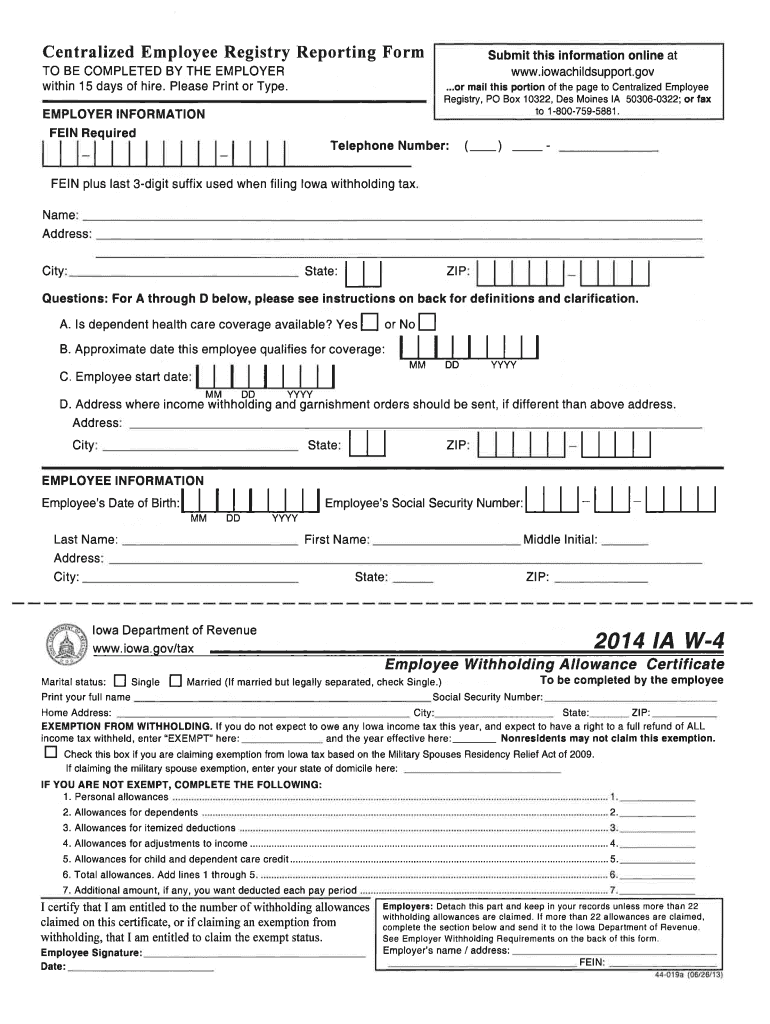

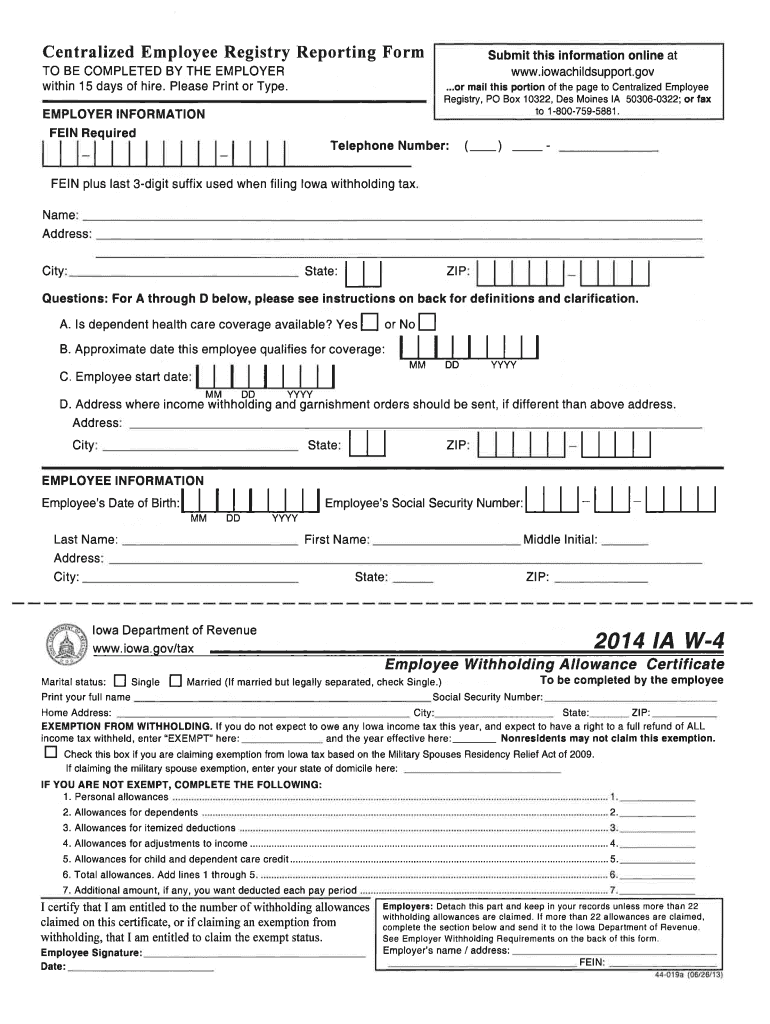

IA DoR W-4 2014 free printable template

Show details

2014 Iowa Rent Reimbursement Claim ... from Social Security Administration, Veterans Administration, your doctor, or Form ... Did you live in Iowa during 2014

?

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IA DoR W-4

Edit your IA DoR W-4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IA DoR W-4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IA DoR W-4 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IA DoR W-4. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IA DoR W-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IA DoR W-4

How to fill out IA DoR W-4

01

Obtain a copy of the IA DoR W-4 form from the Iowa Department of Revenue website or your employer.

02

Fill out your personal information in the designated sections, including your name, address, and Social Security number.

03

Indicate your filing status (Single, Married, etc.) by checking the appropriate box.

04

Claim allowances by completing the allowance worksheet, which is usually provided with the form.

05

If you have multiple jobs or your spouse works, you may need to use the calculations provided in the form to adjust your allowances.

06

Review any additional adjustments for deductions or additional withholding amounts, if applicable.

07

Sign and date the form before submitting it to your employer.

Who needs IA DoR W-4?

01

Any employee working in Iowa who wants to adjust their state income tax withholding amount.

02

Individuals who have a change in personal circumstances, such as marriage or additional jobs.

03

Anyone who anticipates claiming deductions or credits that may affect their withholding.

Instructions and Help about IA DoR W-4

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file an Iowa income tax return?

Almost everyone must file a state income tax return in Iowa, including: Residents with at least $9,000 in net income for individuals or $13,500 for married taxpayers.

Who must file an Iowa non resident tax return?

You were a nonresident or part-year resident and your net income from Iowa sources [line 26, IA 126 (pdf)] was $1,000 or more, unless below the income thresholds above.

What is a form IA 1040?

IA 1040 Individual Income Tax Return, 41-001.

What is the state income tax in Iowa?

How does Iowa's tax code compare? Iowa has a graduated individual income tax, with rates ranging from 4.40 percent to 6.00 percent. There are also jurisdictions that collect local income taxes. Iowa has a 5.50 percent to 8.40 percent corporate income tax rate.

Does Iowa have a state income tax form?

Prepare your full-year resident Iowa state tax return alongside your federal tax return for your convenience. The regular deadline to file an Iowa state income tax return is April 30. Find additional information about Iowa state tax forms, Iowa state tax filing instructions, and government information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute IA DoR W-4 online?

Filling out and eSigning IA DoR W-4 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the IA DoR W-4 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit IA DoR W-4 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing IA DoR W-4 right away.

What is IA DoR W-4?

IA DoR W-4 is a form used in Iowa for employees to indicate their tax withholding preferences to their employer based on state income tax regulations.

Who is required to file IA DoR W-4?

Any employee in Iowa who wishes to have state income tax withheld from their paycheck is required to file the IA DoR W-4 form.

How to fill out IA DoR W-4?

To fill out the IA DoR W-4, an employee needs to provide their personal information, such as name, address, and Social Security number, and indicate the number of allowances they are claiming for withholding purposes.

What is the purpose of IA DoR W-4?

The purpose of the IA DoR W-4 is to determine the correct amount of state income tax to withhold from an employee's wages throughout the year.

What information must be reported on IA DoR W-4?

The IA DoR W-4 requires reporting personal information such as the employee's name, address, Social Security number, and the number of allowances claimed for withholding.

Fill out your IA DoR W-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IA DoR W-4 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.