IA DoR W-4 2015 free printable template

Show details

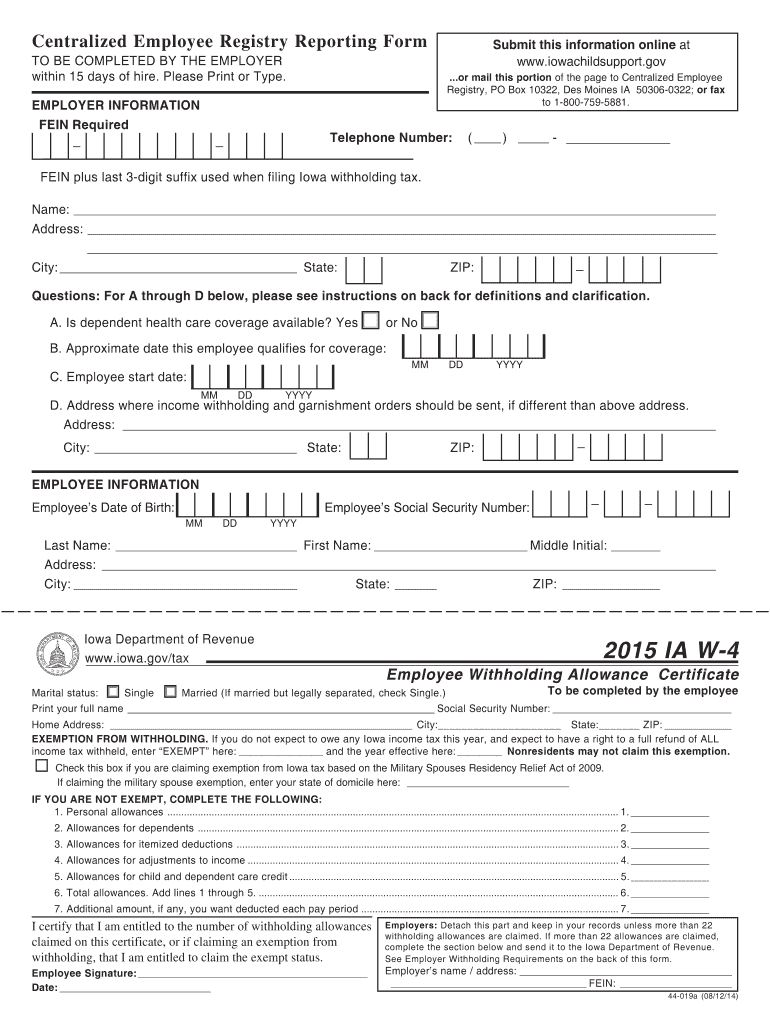

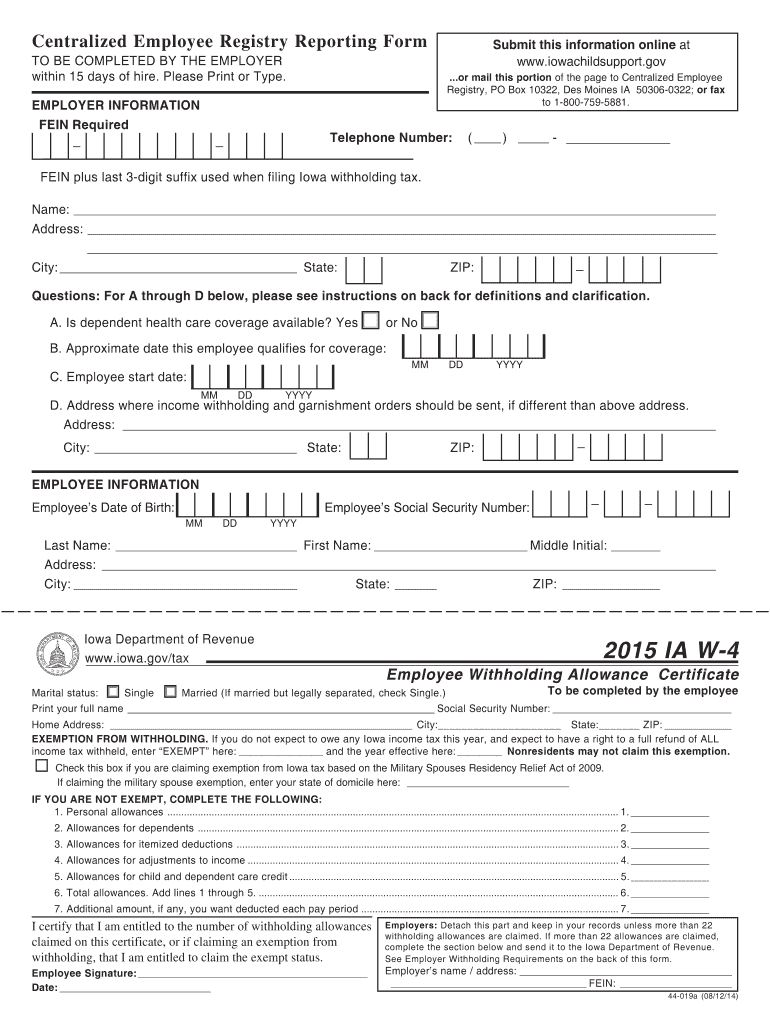

Of savings alimony paid moving expense deduction from federal form 3903 and student loan interest which are reflected on the Iowa 1040 form. Divide this amount by 600 round to the nearest whole number and enter on line 4 of the IA W-4. Centralized Employee Registry Reporting Form Submit this information online at www. iowachildsupport. gov TO BE COMPLETED BY THE EMPLOYER within 15 days of hire. Please Print or Type. EMPLOYER INFORMATION FEIN Required. or mail this portion of the page to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IA DoR W-4

Edit your IA DoR W-4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IA DoR W-4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IA DoR W-4 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IA DoR W-4. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IA DoR W-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IA DoR W-4

How to fill out IA DoR W-4

01

Obtain a copy of the IA DoR W-4 form from the Iowa Department of Revenue website or your employer.

02

Fill in your personal information at the top of the form, including your name, address, Social Security number, and filing status.

03

Indicate any adjustments you want to make for state withholding, such as additional allowances.

04

If applicable, provide information about any other income or deductions that may affect your withholding.

05

Review the completed form for any errors, ensuring all information is accurate.

06

Sign and date the form.

07

Submit the completed IA DoR W-4 to your employer’s payroll department.

Who needs IA DoR W-4?

01

Any employee working in Iowa who wants to ensure proper state tax withholding from their paycheck.

02

Individuals who have changed their filing status or have had changes in their personal or financial situation that could impact withholding.

03

New employees in Iowa who need to establish their tax withholding preferences.

Instructions and Help about IA DoR W-4

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file an Iowa income tax return?

Almost everyone must file a state income tax return in Iowa, including: Residents with at least $9,000 in net income for individuals or $13,500 for married taxpayers.

Who must file an Iowa non resident tax return?

You were a nonresident or part-year resident and your net income from Iowa sources [line 26, IA 126 (pdf)] was $1,000 or more, unless below the income thresholds above.

What is a form IA 1040?

IA 1040 Individual Income Tax Return, 41-001.

What is the state income tax in Iowa?

How does Iowa's tax code compare? Iowa has a graduated individual income tax, with rates ranging from 4.40 percent to 6.00 percent. There are also jurisdictions that collect local income taxes. Iowa has a 5.50 percent to 8.40 percent corporate income tax rate.

Does Iowa have a state income tax form?

Prepare your full-year resident Iowa state tax return alongside your federal tax return for your convenience. The regular deadline to file an Iowa state income tax return is April 30. Find additional information about Iowa state tax forms, Iowa state tax filing instructions, and government information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IA DoR W-4 for eSignature?

When your IA DoR W-4 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find IA DoR W-4?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific IA DoR W-4 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an eSignature for the IA DoR W-4 in Gmail?

Create your eSignature using pdfFiller and then eSign your IA DoR W-4 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is IA DoR W-4?

IA DoR W-4 is a form used for Iowa state income tax withholding, allowing employees to indicate their withholding preferences for state taxes.

Who is required to file IA DoR W-4?

Any employee in Iowa who wants to have state income taxes withheld from their wages is required to file the IA DoR W-4 form.

How to fill out IA DoR W-4?

To fill out the IA DoR W-4, employees need to provide personal information such as their name, address, and Social Security number, select their filing status, and claim allowances.

What is the purpose of IA DoR W-4?

The purpose of IA DoR W-4 is to determine the amount of Iowa state income tax that should be withheld from an employee's paycheck.

What information must be reported on IA DoR W-4?

The IA DoR W-4 requires reporting personal information including name, address, Social Security number, filing status, and the number of allowances or exemptions.

Fill out your IA DoR W-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IA DoR W-4 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.