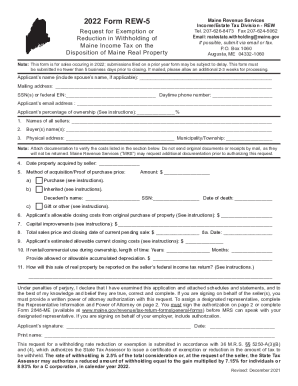

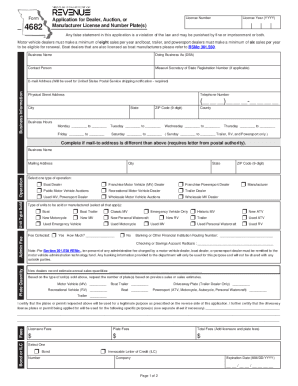

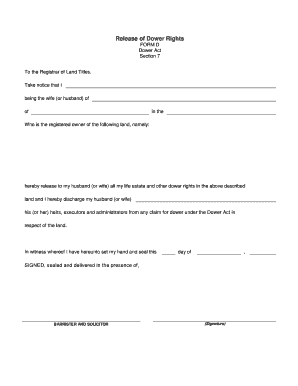

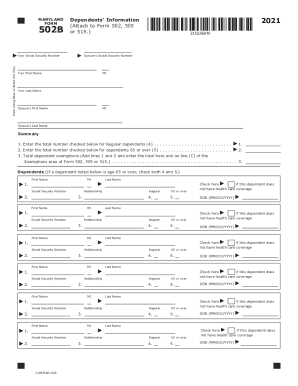

IA DoR W-4 2022 free printable template

Get, Create, Make and Sign IA DoR W-4

How to edit IA DoR W-4 online

Uncompromising security for your PDF editing and eSignature needs

IA DoR W-4 Form Versions

How to fill out IA DoR W-4

How to fill out IA DoR W-4

Who needs IA DoR W-4?

Instructions and Help about IA DoR W-4

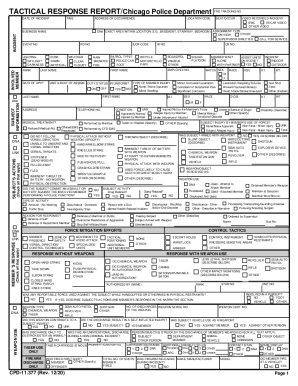

Today we're going to talk about the W-4for the 2018 version just came out first I'm going to go through the pa perversion, and then we're going to go through the online version so whichever one you want to do just follow along today's going to cover a single codependents possibly a new job or just want to update your w-4 this is the video for you my name is Travis sickle certified financial planner with sickle on her financial advisors first we're going to go through the paper version I'going to jump right in and as soon as we're done we're going to go right into the online version it doesn't matter which version you do you should get identical answers so here we go this is the w-4 2018 version, and I'm going to leave a link down at the bottom, so you can get it yourself, although the link is right here it's an IRS gov a Form w-4 the purpose of thew-4 is to complete form w-4 so that your employer can withhold the correct federal income tax from your pay it's right here purpose complete w-4 so that your employer can withhold the correct federal income tax from your pay the top section of the form w-4 for 2018 all the directions are right here at the top I'gonna point out a couple of things right now if we look right here note that if you have too much tax without you receive a refund when you file your tax return if you have too little tax withheld you will attack when you file your tax return, and you might owe a penalty, so I'm going to go ahead and highlight that because that is important to understand so what does that mean that means that the w-4 is only estimating how many taxes you're going to have to pay on the amount of income that you're earning but rather than paying at all at the end of the year you're paying it throughout the year so what this is saying is if you are estimating your withholding to be too high you're going to get back this large refund or a refund that's all your money anyways, so you want to make it as accurate as possible, so you're not paying too much in advance think of itlike giving the government a tax-free loan and if you estimate in the wrong direction, and you have to pay too much you're going to get hit with a penalty soil's important to estimate correctly this is the bottom of the first page of the w-4 we're going to come back to if it's going to have all your basic information, and we're just going to go ahead and jump right to the next page this is going to be the bottom of the w-4 the things that you're gonna fill out here is going to be your name your last name your social security number we're going to come backhand fill out the rest of this I just wanted to show you in page order what we're looking at let's jump to the next page more directions we're gonna Godhead and skip over those because I'm going to go through this with you so we'redoing to start right up here right at line a, so that's going to enter one for yourself, so you're going to put a 1 right next to an on line B enter one if you will...

People Also Ask about

Do I need to file an Iowa income tax return?

Who must file an Iowa non resident tax return?

What is a form IA 1040?

What is the state income tax in Iowa?

Does Iowa have a state income tax form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IA DoR W-4 to be eSigned by others?

Can I create an electronic signature for the IA DoR W-4 in Chrome?

How can I fill out IA DoR W-4 on an iOS device?

What is IA DoR W-4?

Who is required to file IA DoR W-4?

How to fill out IA DoR W-4?

What is the purpose of IA DoR W-4?

What information must be reported on IA DoR W-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.