Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

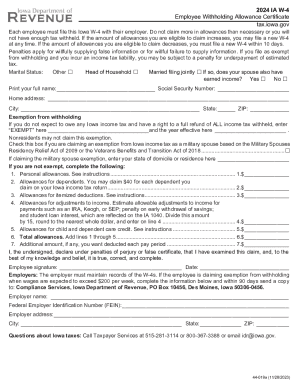

What is forms iowa state tax?

Forms for Iowa state tax include:

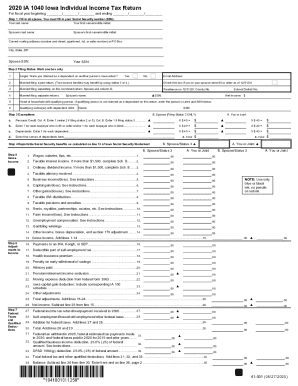

1. Iowa Form IA 1040: Individual Income Tax Return

2. Iowa Form IA 1040V: Payment Voucher for Individual Income Tax

3. Iowa Form IA 1040X: Amended Individual Income Tax Return

4. Iowa Form IA 1040ES: Estimated Tax Voucher for Individuals

5. Iowa Form IA 1040C: Composite Return for Nonresident Individuals

6. Iowa Form IA 1041: Fiduciary Return

7. Iowa Form IA 1065: Iowa Partnership Return

8. Iowa Form IA 1120: Iowa Corporation Income Tax Return

9. Iowa Form IA 1120F: Iowa Corporation Income Tax Return for Foreign Corporations

10. Iowa Form IA 1120S: Iowa S Corporation Return

11. Iowa Form IA 1120V: Iowa Corporation Income Tax Payment Voucher

12. Iowa Form IA 1120X: Amended Corporation Income Tax Return

It is important to note that these are just a few examples of the various forms available for Iowa state tax. The specific forms required will depend on the individual or business's tax situation.

Who is required to file forms iowa state tax?

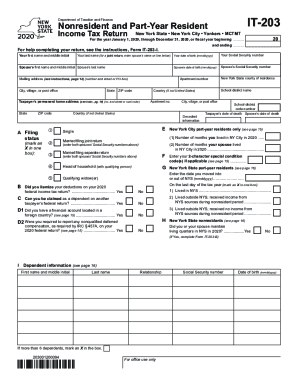

The residents of Iowa who have an income that exceeds certain thresholds, non-residents who have earned income in Iowa, and part-year residents are required to file forms for Iowa state tax. However, specific filing requirements may vary depending on individual circumstances, such as income level, age, and filing status. It is recommended to consult the Iowa Department of Revenue or a tax professional for precise information regarding your situation.

How to fill out forms iowa state tax?

To fill out Iowa state tax forms, follow these steps:

1. Gather all necessary documents: Collect your W-2 forms, 1099 forms, and any other relevant tax documents such as receipts, deductions, and credits.

2. Obtain the necessary forms: Visit the Iowa Department of Revenue website (tax.iowa.gov) to download the appropriate forms.

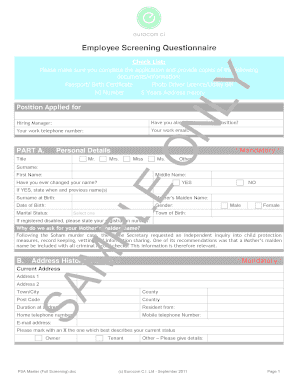

3. Provide personal information: Begin filling out the form by entering your personal information, including your name, Social Security number, and address.

4. Report income: Enter all sources of income on the appropriate line(s), such as wages, salaries, dividends, interest, and self-employment income. Attach additional forms or schedules if needed.

5. Claim deductions and credits: Iowa allows various deductions and credits. Fill out the relevant sections to claim deductions such as student loan interest, tuition and fees, medical expenses, or mortgage interest, and any tax credits you may be eligible for.

6. Calculate taxes: Use the Iowa Tax Table provided in the instructions to calculate your Iowa tax liability based on your income and filing status.

7. Make payments: If you owe any tax, include a check or money order payable to the "Iowa Department of Revenue" with your completed tax form. Alternatively, you can pay electronically through the Iowa Department of Revenue's website.

8. Double-check and sign: Review your completed form for accuracy, ensuring you have answered all questions and entered the correct information. Sign and date the form.

9. Submit your tax return: Mail your completed Iowa state tax form to the Iowa Department of Revenue at the address provided on the form. Alternatively, if you are filing electronically, follow the instructions on the Iowa Department of Revenue website.

It is recommended to consult the official Iowa Department of Revenue website and refer to the instructions accompanying the tax forms for specific guidance based on your circumstances. You may also seek assistance from a tax professional if needed.

What is the purpose of forms iowa state tax?

The purpose of the forms for Iowa State tax is to enable individuals and businesses in Iowa to report their income, deductions, credits, and other relevant details to calculate and pay the correct amount of state taxes owed. These forms provide a standardized format for taxpayers to accurately and efficiently report their financial information to the Iowa Department of Revenue. The information provided in these forms is used by the state government to assess and collect taxes according to the applicable tax laws and regulations.

What information must be reported on forms iowa state tax?

When filing Iowa state taxes, taxpayers must report several types of information. The specific details required may vary depending on the individual's circumstances, but some common information to be reported on Iowa state tax forms includes:

1. Personal Information: This includes the taxpayer's full name, social security number, filing status (such as single, married filing jointly, or head of household), and contact information.

2. Income Information: All sources of income should be reported, including wages, salaries, tips, self-employment income, rental income, dividends, interest, and any other taxable income.

3. Deductions: Taxpayers can claim various deductions on their Iowa state tax forms, including itemized deductions or the standard deduction. Itemized deductions may include expenses related to mortgage interest, property taxes, qualified medical expenses, charitable donations, and certain other expenses allowed by Iowa law.

4. Credits: Iowa offers various tax credits that could be claimed, such as child and dependent care credit, earned income credit, education credits, adoption credit, etc. Taxpayers need to provide necessary information related to eligible credits.

5. Payments and Withholding: Information regarding any tax withheld from wages, estimated tax payments made, and any other credits or payments applied towards the tax liability should be reported.

6. Iowa State Taxes Paid: If the taxpayer paid any taxes to other states, it may need to be reported on the Iowa tax forms as well.

7. Additional supporting documents: Depending on the specific deductions or credits claimed, taxpayers may need to attach additional supporting documents, such as W-2 forms, 1099 forms, receipts, or other relevant paperwork.

It is important to note that the guidelines for reporting information on Iowa state tax forms may change annually, so it's advisable to consult the latest version of the Iowa tax forms or seek professional tax advice.

When is the deadline to file forms iowa state tax in 2023?

The deadline to file Iowa state tax forms in 2023 is typically April 30th. However, please note that tax deadlines can change, so it is always recommended to check with the Iowa Department of Revenue or a tax professional for the most up-to-date information.

What is the penalty for the late filing of forms iowa state tax?

In Iowa, if you file your state tax forms late or fail to file them at all, you may be subject to penalties and interest charges. The penalty for late filing is usually 10% of the tax amount owed, with a minimum penalty of $10. Additionally, interest is charged daily on any unpaid taxes at a rate of 4%. It is important to note that penalties and interest can quickly accumulate, so it is best to file your forms and pay any taxes owed on time to avoid additional charges.

How can I get forms iowa state tax?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific iowa withholding w form and other forms. Find the template you need and change it using powerful tools.

How do I edit iowa withholding employee in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing ia w 4 2021 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I edit iowa w4 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing print an iowa w 4 form for me right away.