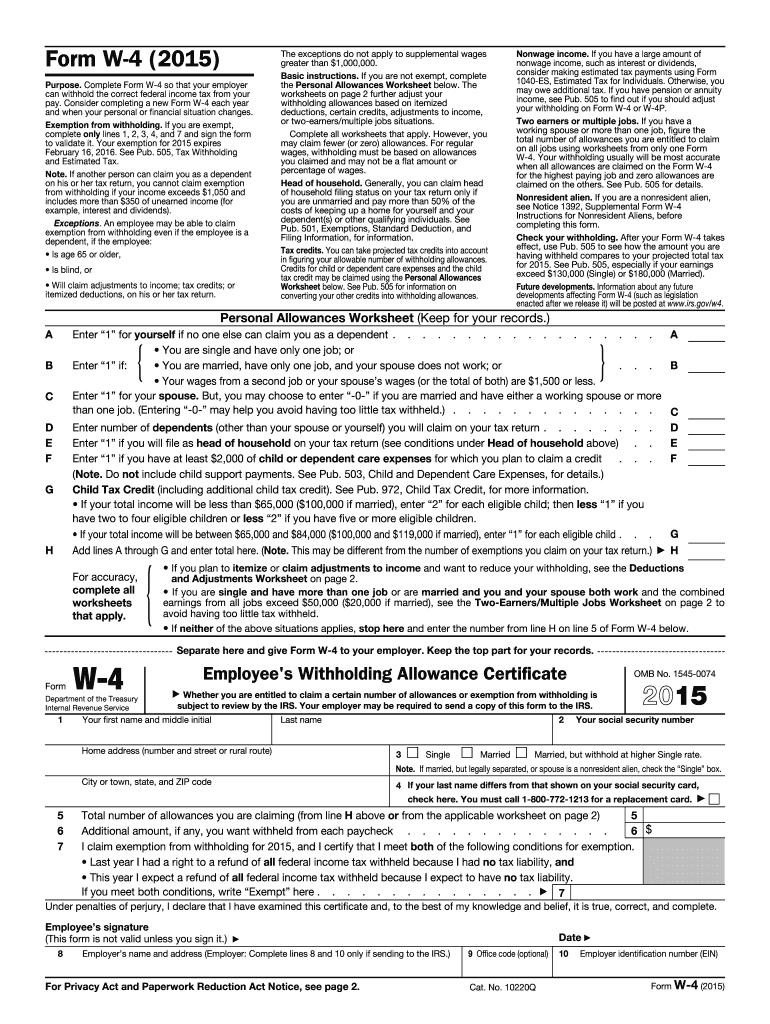

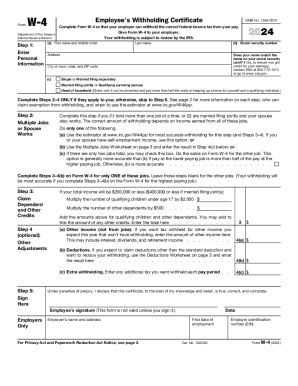

What is form W-4?

IRS Form W4 helps employers withhold the correct amount of federal income tax from their employees' paychecks. The withheld funds are released to the IRS at the end of the tax year. Then, depending on your individual tax return information to the IRS, you will either receive a refund from the IRS or have the opportunity to pay any extra taxes.

Who should fill out form W-4?

Employees need to complete a form W-4 and provide it to their employers, who must calculate and withhold the right amount of federal income tax for them. You need to get a printable form W4 and fill it out if you're a new employee to your current employer or if your personal or financial situation has recently changed. For example, you need to provide a new Employee Withholding Certificate if married, divorced, got a child, or an additional paid job. Married taxpayers can each complete a separate form W4 or prepare a joint certificate with a spouse.

What information do you need to provide in form W-4?

When completing your W-4 form, you need to provide the following information:

- your personal data (full name, address, SSN, marital status)

- whether you hold more than one job or your spouse also works, and you file jointly

- whether you have extra income, not from jobs (dividends, interests, etc.)

- the number of children and other dependents

- the amount of deductions you expect to claim

- any additional tax to be withheld

- your employer's details (name, address, EIN) and your first date of employment

How do I fill out a printable form W-4?

An up-to-date printable form W-4 sample is available on our website and the IRS web source. You can complete it electronically with our online editor and then furnish a printed form w-4 to your employer.

Employee Withholding Certificate completion depends on whether you prepare it for yourself or jointly file with your spouse. The IRS provides instructions on how to complete your certificate correctly on page 2 in the document. You’ll also find an accurate table of lower and higher-paying job annual taxable wage and salary provided on page 4 to simplify your calculations.

Follow the steps below to prepare your Employee Withholding Certificate:

- Click on the Get Form button to open a printable form W-4 template in the editor.

- Fill out the fields with your name, SSN, address, and marital status.

- Scroll to page 2 and read the instructions on how to complete steps 2-4 of your sample.

- Use the provided by IRS to make accurate calculations of your income tax withholding.

- Give your employer's details and your first date of employment in Step 5.

- Click on the Signature field to add an electronic signature to the document or print and sign it manually.

- Fill out page 3 of the sample and keep it for your records if you have more than one job.

- Click Done when your document is ready and choose whether to print form W-4 or email a printable copy to your employee right from the editor.

If you require assistance filling out your form w-4, you can usually ask your company's HR department. Be careful that you have double-checked all of your information is correct and complete on the document. Otherwise, you may end up owing additional income tax at the end of the year.

Is form W-4 accompanied by other forms?

There are only exceptional cases where you need to fill out additional documents. For example, if you have any interest or dividends, you may want to fill out a 1040-ES template to estimate your taxes.

When is form W-4 due?

There's no particular due date for preparing Employee's Withholding Certificate. You should fill out the printable form W-4 when a company first hires you and every time your tax situation changes. It's not necessary to fill it out every tax year. However, it is a good idea because your tax situation may differ since the last W-4 form completion.

Where do I send my printed form W-4?

Employees should provide a printed form W-4 to their employer, who are no longer required to send these certificates to the IRS. Employers must keep these certificates for each worker on file for at least four years after the employment tax due date or payment. The IRS may request these documents for revision, so make sure original forms W-4 are available for inspection. The IRS may also demand copies of these certificates.

This form is another great candidate for PDFfiller's template tool, which can help your company save time and money onboarding new employees. Want to fill form W4 on your mobile device? We've got an app for that! You can find it in the App Store.