Social Security Direct Deposit Card

What is social security direct deposit card?

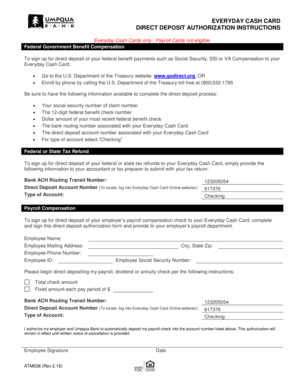

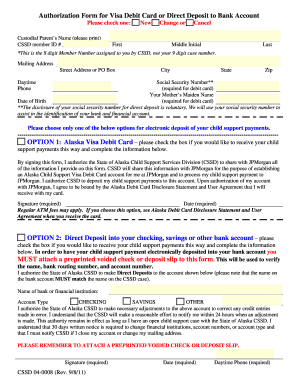

A social security direct deposit card is a prepaid debit card that allows recipients of Social Security benefits, Supplemental Security Income (SSI) payments, and other federal benefits to receive their funds electronically.

What are the types of social security direct deposit card?

There are two types of social security direct deposit cards: the Direct Express Debit Mastercard and the TTW Direct Deposit Card. The Direct Express card is offered by the Treasury Department and is the most widely used option. The TTW Direct Deposit Card, on the other hand, is specifically designed for Ticket to Work program participants.

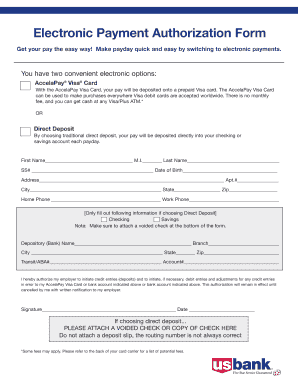

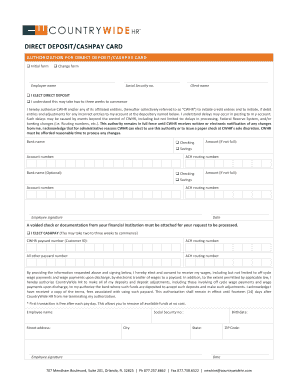

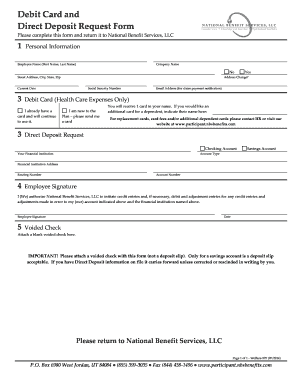

How to complete social security direct deposit card

Completing a social security direct deposit card is a straightforward process. Here are the steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.