Get the free LivestockDepreciate? Inventory? Sell?Tax Rules for Farmers

Show details

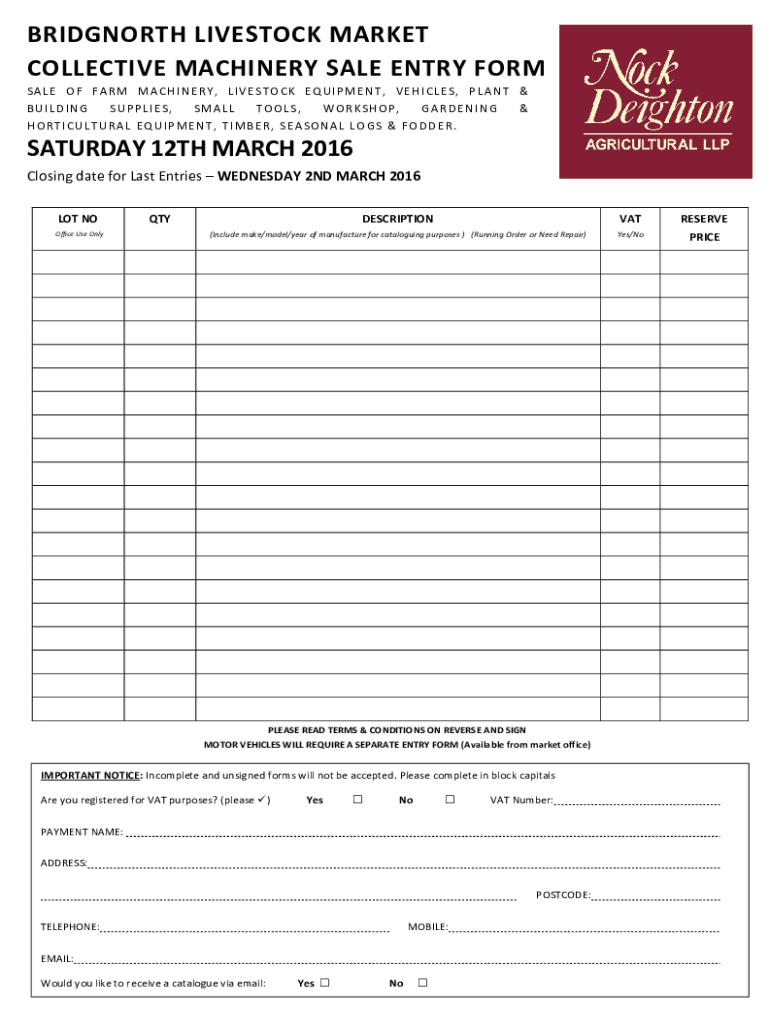

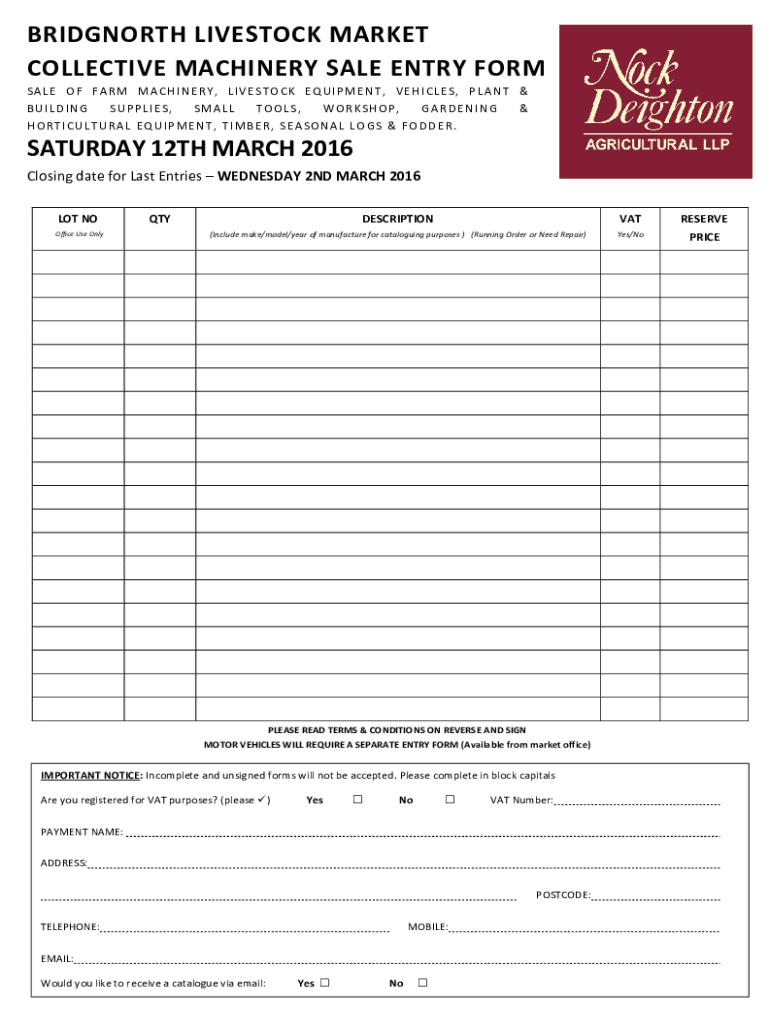

BRIDGNORTH LIVESTOCK MARKET COLLECTIVE MACHINERY SALE ENTRY FORM SA LE OF F A RM M A CH I N E R Y, LI VE S T O CK E Q UI PME N T, VE H I CL E S, PL A N T & BU IL DIN G SU PP LIE S, SM ALL T OO LS,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign livestockdepreciate inventory selltax rules

Edit your livestockdepreciate inventory selltax rules form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your livestockdepreciate inventory selltax rules form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit livestockdepreciate inventory selltax rules online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit livestockdepreciate inventory selltax rules. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out livestockdepreciate inventory selltax rules

How to fill out livestockdepreciate inventory selltax rules

01

To fill out livestock depreciation inventory sell tax rules, follow these steps:

02

Gather all the necessary information about your livestock inventory, such as the number of animals, their purchase date, and their purchase cost.

03

Determine the depreciation method you will use. You can choose between straight-line depreciation or accelerated depreciation.

04

Calculate the depreciation expense for each animal based on the chosen depreciation method and the useful life of the animal. The useful life can vary depending on the type of livestock.

05

Keep a record of the depreciated value of each animal throughout its useful life. This includes updating the value annually or as specified by tax regulations.

06

Determine the selling price of any livestock sold during the tax year.

07

Calculate the gain or loss on the sale by subtracting the depreciated value of the sold animal from the selling price.

08

Report the gain or loss on your tax return according to the applicable tax rules and regulations.

09

Keep accurate records of all calculations and supporting documentation in case of an audit or to provide evidence if required.

Who needs livestockdepreciate inventory selltax rules?

01

Livestock owners and businesses involved in the buying and selling of livestock are the ones who need livestock depreciation inventory sell tax rules.

02

This can include individual farmers, ranchers, livestock traders, and agricultural businesses.

03

The rules are important for accurately reporting the financial transactions related to livestock inventory and ensuring compliance with tax laws and regulations.

04

By following these rules, livestock owners and businesses can properly calculate the depreciation of their livestock inventory and report any gains or losses on sales in an accurate and legal manner.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my livestockdepreciate inventory selltax rules directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your livestockdepreciate inventory selltax rules and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I edit livestockdepreciate inventory selltax rules on an iOS device?

Use the pdfFiller mobile app to create, edit, and share livestockdepreciate inventory selltax rules from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How can I fill out livestockdepreciate inventory selltax rules on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your livestockdepreciate inventory selltax rules, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is livestock depreciate inventory sell tax rules?

Livestock depreciate inventory sell tax rules refer to the regulations governing how livestock is classified for depreciation and how sales of such inventory may be taxed according to state and federal tax laws.

Who is required to file livestock depreciate inventory sell tax rules?

Farmers and ranchers who buy, sell, or maintain livestock as part of their business operations are generally required to file under these rules.

How to fill out livestock depreciate inventory sell tax rules?

To fill out the livestock depreciate inventory sell tax rules, individuals should complete the designated forms provided by the IRS or their state's revenue department, ensuring they accurately report livestock values, sales, and applicable depreciation.

What is the purpose of livestock depreciate inventory sell tax rules?

The purpose of these rules is to establish clear guidelines for the reporting and taxation of livestock as business assets, allowing for fair depreciation and tax calculation.

What information must be reported on livestock depreciate inventory sell tax rules?

Information that must be reported includes the type of livestock, acquisition costs, sale prices, quantities, and any depreciation claimed on the livestock.

Fill out your livestockdepreciate inventory selltax rules online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Livestockdepreciate Inventory Selltax Rules is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.