Get the free IRA Transfer of Assets Form - Fund ServicesUltimus

Show details

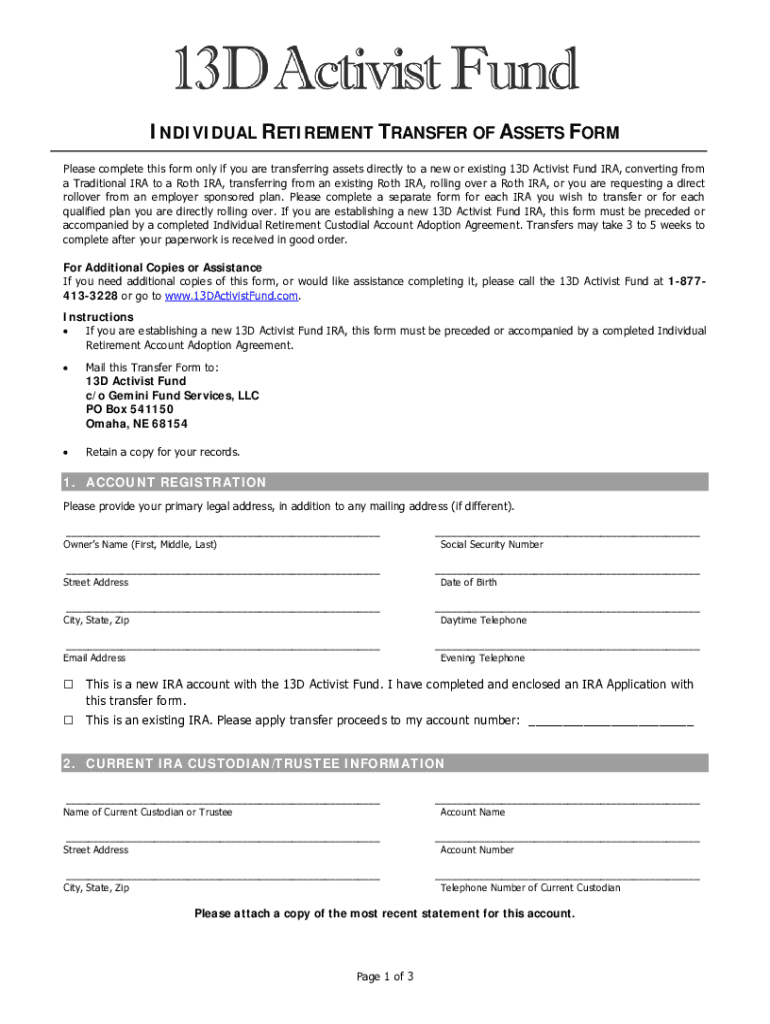

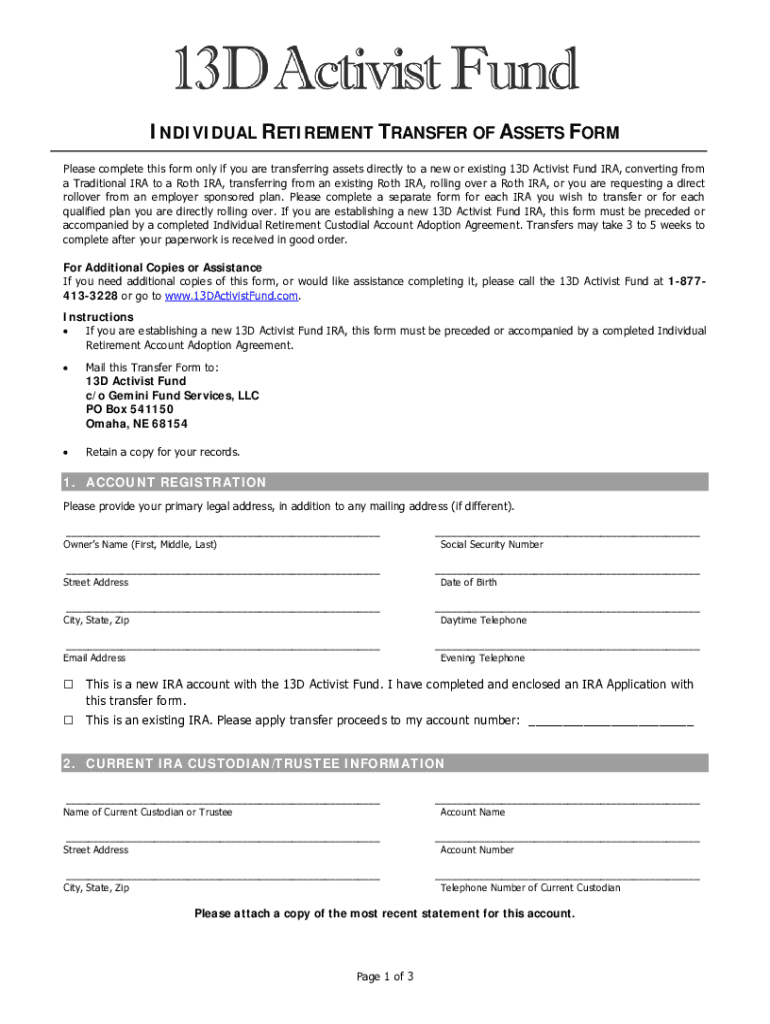

INDIVIDUAL RETIREMENT TRANSFER OF ASSETS FORM

Please complete this form only if you are transferring assets directly to a new or existing 13D Activist Fund IRA, converting from

a Traditional IRA to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira transfer of assets

Edit your ira transfer of assets form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira transfer of assets form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ira transfer of assets online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ira transfer of assets. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira transfer of assets

How to fill out ira transfer of assets

01

To fill out an IRA transfer of assets, follow these steps:

02

Obtain the appropriate transfer of assets form from your IRA custodian or financial institution.

03

Fill out your personal information, including your name, address, and Social Security number.

04

Provide the necessary details about your existing IRA account, such as the account number and the custodian's name and address.

05

Specify the type of transfer you wish to make, whether it is a direct transfer or a rollover to another IRA.

06

Indicate the assets you want to transfer, including any specific investments or cash amounts.

07

If you're transferring to a new IRA account, provide the details of the receiving custodian, including their name and address.

08

Sign and date the transfer of assets form, certifying the accuracy of the information provided.

09

Submit the completed form to your current IRA custodian, who will initiate the transfer process.

10

Keep a copy of the form for your records.

11

Note: It's always a good idea to consult with a financial advisor or tax professional when considering an IRA transfer of assets to ensure compliance with IRS regulations and maximize the potential benefits.

Who needs ira transfer of assets?

01

Individuals who have an existing IRA account and want to move their retirement savings to a different IRA custodian or investment firm may need to initiate an IRA transfer of assets.

02

Common scenarios where individuals may need an IRA transfer of assets include:

03

- Changing financial institutions or custodians

04

- Consolidating multiple IRA accounts into a single account

05

- Seeking better investment options or lower fees with a different IRA provider

06

- Transitioning from an employer-sponsored retirement plan, such as a 401(k), to an individual IRA

07

- Inheriting an IRA and wanting to transfer the assets to a new account

08

It is important to note that IRA transfers should be done in compliance with IRS rules and guidelines to avoid penalties or tax consequences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ira transfer of assets online?

With pdfFiller, the editing process is straightforward. Open your ira transfer of assets in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an eSignature for the ira transfer of assets in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your ira transfer of assets right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out the ira transfer of assets form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign ira transfer of assets and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is ira transfer of assets?

An IRA transfer of assets refers to the process of moving funds or assets from one Individual Retirement Account (IRA) to another without incurring tax penalties. This can happen through a direct transfer (trustee-to-trustee) or a rollover, where the account holder withdraws the funds and then deposits them into a new IRA within a specified time frame.

Who is required to file ira transfer of assets?

Individuals who initiate a transfer of assets between IRAs, particularly if the transfer is not directly made between institutions, may be required to file certain forms. Additionally, financial institutions facilitating the transfer may have reporting obligations.

How to fill out ira transfer of assets?

Filling out an IRA transfer of assets typically involves completing a transfer request form provided by the receiving financial institution. This form may require account details, the amount to be transferred, and signatures. Some institutions may assist in this process to ensure all necessary information is included.

What is the purpose of ira transfer of assets?

The purpose of an IRA transfer of assets is to allow individuals to move their retirement savings between different IRA accounts without facing immediate tax liabilities. This can help consolidate accounts, take advantage of better investment options, or switch to a financial institution that offers lower fees or better services.

What information must be reported on ira transfer of assets?

Information that must be reported on an IRA transfer of assets typically includes the account holder's name, Social Security number, details of both the old and new IRA accounts, the amount transferred, and any relevant transaction dates.

Fill out your ira transfer of assets online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Transfer Of Assets is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.