Get the free Anti Money Laundering Obligations Trust AML Form We ...

Show details

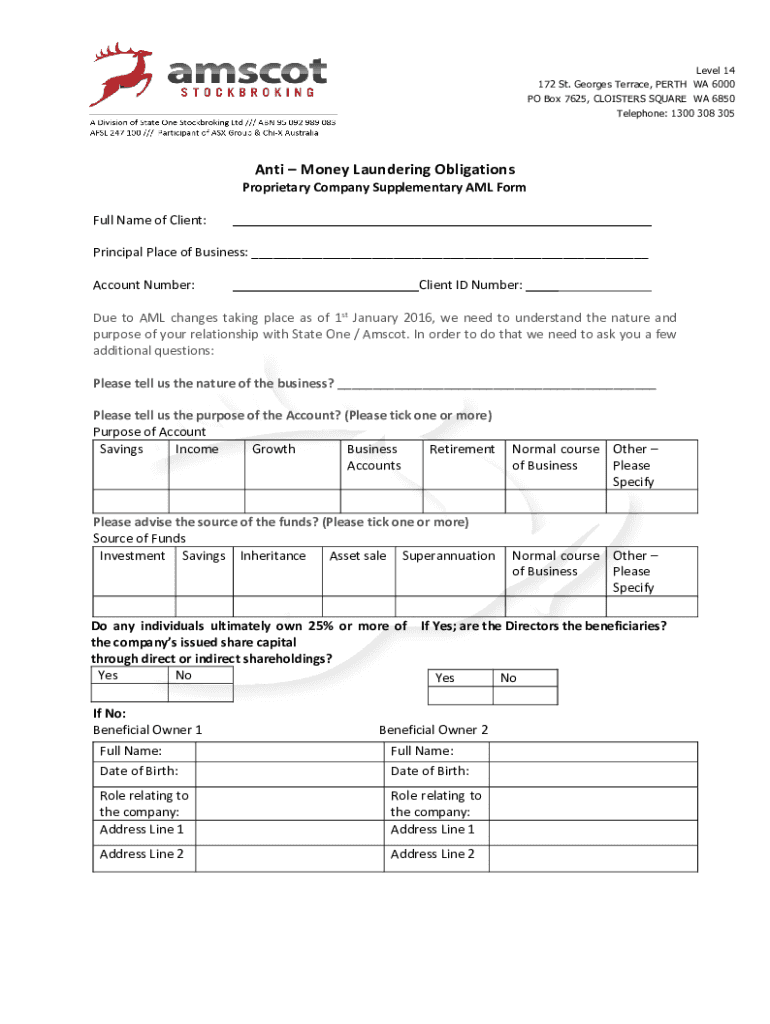

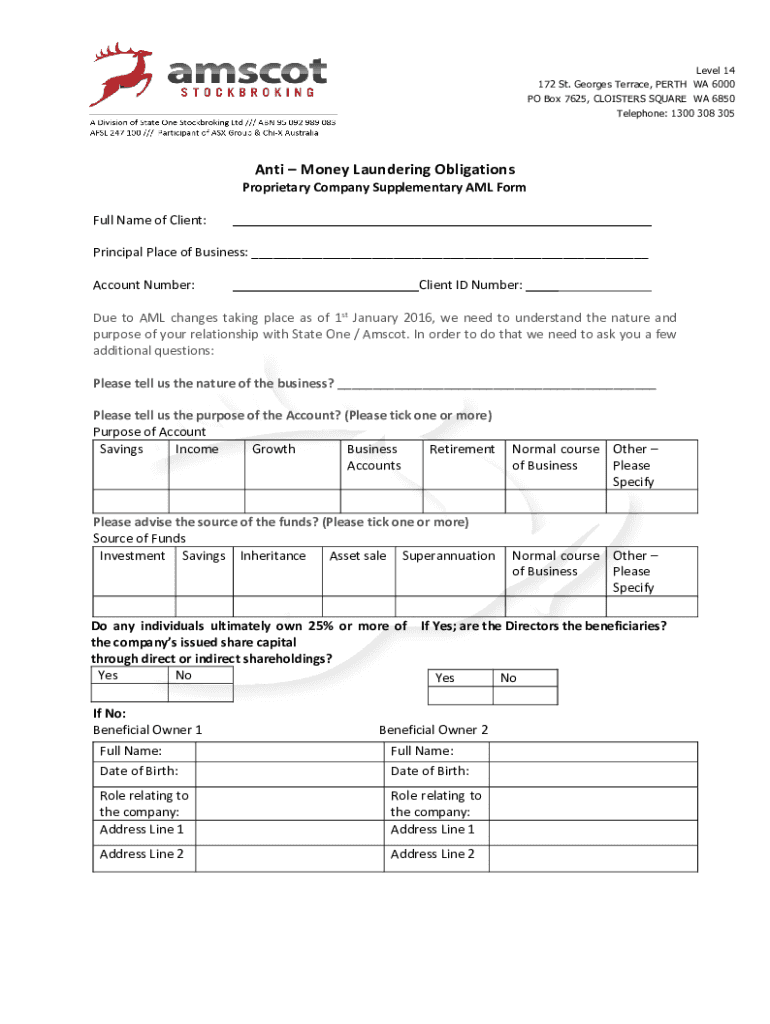

Level 14 172 St. Georges Terrace, PERTH WA 6000 PO Box 7625, CLOISTERS SQUARE WA 6850 Telephone: 1300 308 305Anti Money Laundering ObligationsProprietary Company Supplementary AML Form Full Name of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign anti money laundering obligations

Edit your anti money laundering obligations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your anti money laundering obligations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit anti money laundering obligations online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit anti money laundering obligations. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out anti money laundering obligations

How to fill out anti money laundering obligations

01

To fill out anti-money laundering obligations, follow these steps:

02

Understand the laws and regulations surrounding anti-money laundering (AML) obligations in your jurisdiction.

03

Identify and verify the customer's identity using reliable and valid identification documents.

04

Conduct thorough due diligence on customers and determine the source of their funds.

05

Implement an effective and risk-based AML compliance program within your organization.

06

Develop and maintain comprehensive record-keeping procedures to track transactions and customer information.

07

Train your employees on AML regulations, detection techniques, and reporting obligations.

08

Monitor and report any suspicious activities, transactions, or behaviors that may indicate money laundering.

09

Continuously assess and update your AML policies and procedures to ensure compliance with changing regulations.

10

Cooperate with regulatory authorities and provide necessary documentation or information when requested.

11

Regularly review and audit your AML compliance program to identify areas for improvement and address any deficiencies.

Who needs anti money laundering obligations?

01

Anti-money laundering obligations are necessary for various entities, including:

02

- Financial institutions, such as banks, credit unions, and insurance companies.

03

- Money service businesses, including money transmitters, currency exchanges, and check cashing services.

04

- Securities dealers, brokers, and investment firms.

05

- Casinos and gaming establishments.

06

- Real estate professionals, such as real estate agents, brokers, and developers.

07

- Lawyers, accountants, and other professionals engaged in financial or legal services.

08

- Non-profit organizations involved in high-value transactions or international funding.

09

- Any business or individual involved in cash-intensive or high-risk activities.

10

- Government agencies and regulatory bodies responsible for overseeing financial transactions and combating money laundering.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit anti money laundering obligations in Chrome?

Install the pdfFiller Google Chrome Extension to edit anti money laundering obligations and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for the anti money laundering obligations in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out anti money laundering obligations on an Android device?

On an Android device, use the pdfFiller mobile app to finish your anti money laundering obligations. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is anti money laundering obligations?

Anti-money laundering obligations are legal requirements imposed on financial institutions and other entities to prevent, detect, and report money laundering activities.

Who is required to file anti money laundering obligations?

Entities such as banks, credit unions, insurance companies, brokers, and other financial institutions, as well as certain businesses like casinos and real estate firms, are required to file anti-money laundering obligations.

How to fill out anti money laundering obligations?

To fill out anti-money laundering obligations, entities must collect and report specific information regarding suspicious transactions, customer identification, and compliance with regulatory requirements using designated forms or systems.

What is the purpose of anti money laundering obligations?

The purpose of anti-money laundering obligations is to prevent the use of the financial system for illicit purposes, to protect the integrity of the financial system, and to assist in the detection and prosecution of money laundering activities.

What information must be reported on anti money laundering obligations?

Information that must be reported includes details about suspicious transactions, customer identities, transaction amounts, dates, and any relevant documentation supporting the report.

Fill out your anti money laundering obligations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Anti Money Laundering Obligations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.