Get the free S&D2019 Gift in-Kind Donation Form - give cedars

Show details

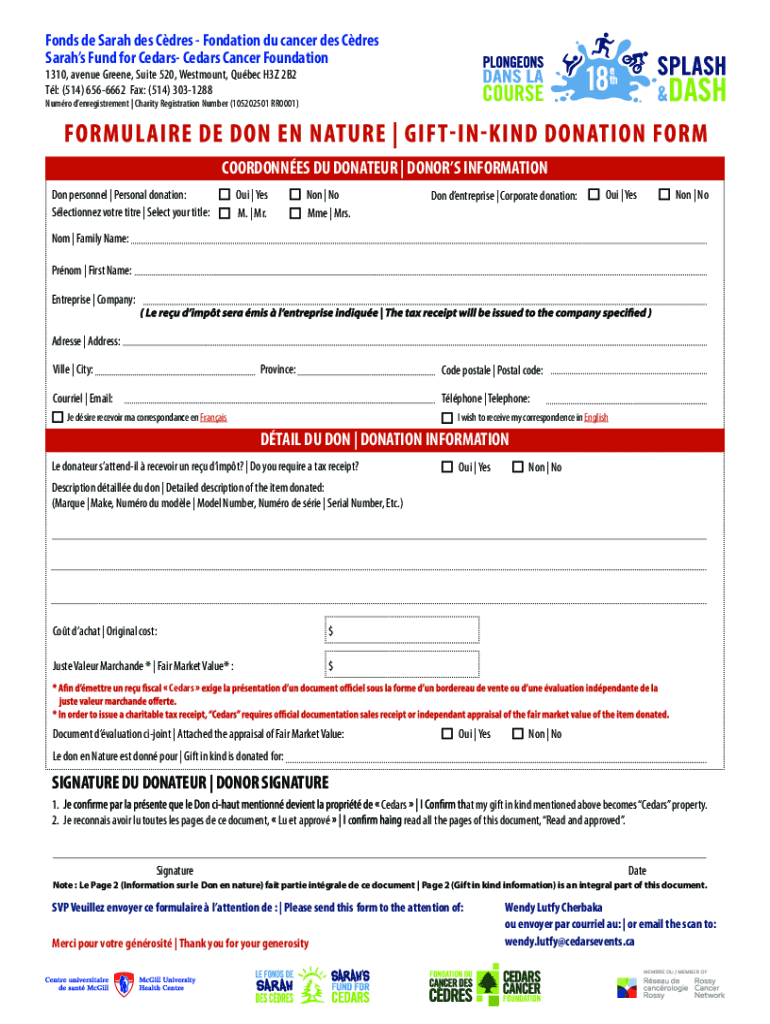

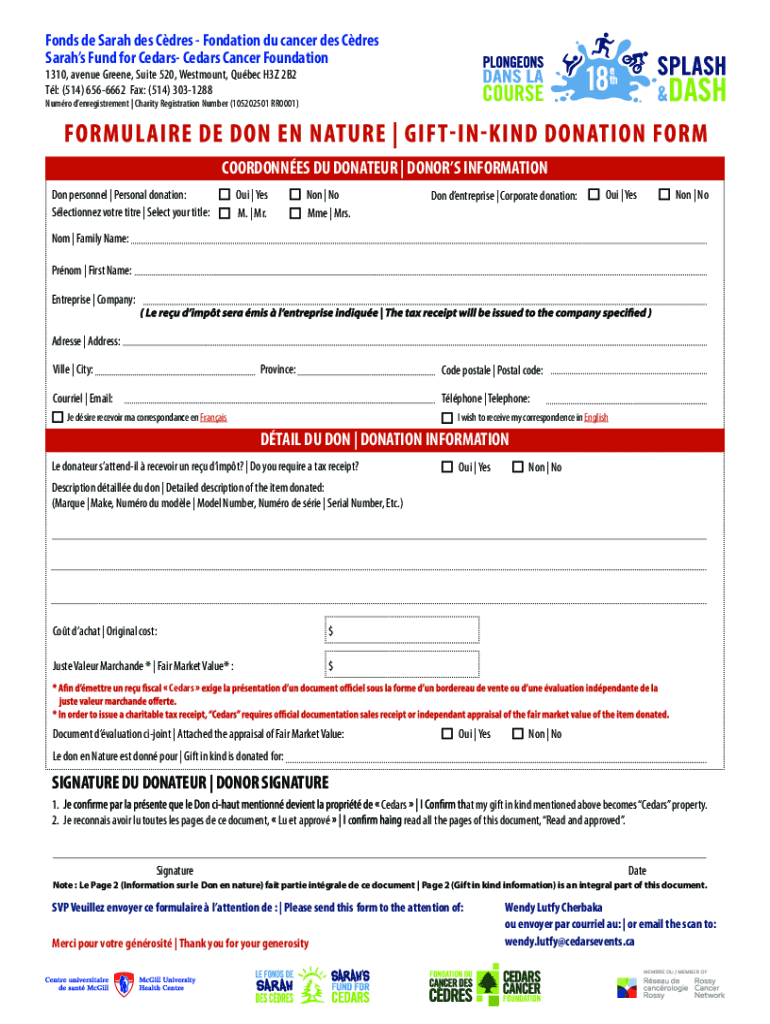

Finds de Sarah DES Cores Foundation Du cancer DES Cores Sarah's Fund for Cedars Cancer Foundation181310, avenue Greene, Suite 520, West mount, Quebec H3Z 2B2 Tl: (514) 6566662 Fax: (514) 3031288Numro

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sampampd2019 gift in-kind donation

Edit your sampampd2019 gift in-kind donation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sampampd2019 gift in-kind donation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sampampd2019 gift in-kind donation online

To use the professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sampampd2019 gift in-kind donation. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sampampd2019 gift in-kind donation

How to fill out sampampd2019 gift in-kind donation

01

Gather all the necessary information about the gift in-kind donation, such as description, quantity, and value of each item.

02

Fill out the sampampd2019 gift in-kind donation form, providing your personal details as well as the details of the donation.

03

Make sure to accurately describe each item and its value. You may need to attach invoices or proofs of value for certain items.

04

Indicate if you would like a tax receipt for your donation.

05

Submit the completed sampampd2019 gift in-kind donation form to the designated organization or charity.

06

If required, arrange for the delivery or pickup of the donated items.

07

Keep a copy of the completed form and any supporting documents for your records.

Who needs sampampd2019 gift in-kind donation?

01

sampampd2019 gift in-kind donation can be beneficial for various individuals or organizations in need such as:

02

- Non-profit organizations or charities that rely on donated items to support their mission.

03

- Individuals or families affected by natural disasters or facing financial hardships.

04

- Schools or educational institutions that can use the donated items for educational purposes.

05

- Medical facilities or hospitals in need of medical supplies or equipment.

06

- Animal shelters or rescue organizations that require donations for the well-being of animals.

07

- Local community centers or programs that aim to support underprivileged community members.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find sampampd2019 gift in-kind donation?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific sampampd2019 gift in-kind donation and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I edit sampampd2019 gift in-kind donation on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing sampampd2019 gift in-kind donation.

How do I fill out sampampd2019 gift in-kind donation using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign sampampd2019 gift in-kind donation and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is sampampd2019 gift in-kind donation?

The sampampd2019 gift in-kind donation refers to a specific form of reporting for non-cash contributions made to a charitable organization, detailing items or services donated rather than monetary gifts.

Who is required to file sampampd2019 gift in-kind donation?

Individuals or organizations that make non-cash contributions to a charitable entity are required to file the sampampd2019 gift in-kind donation.

How to fill out sampampd2019 gift in-kind donation?

To fill out the sampampd2019 gift in-kind donation form, you must provide details such as the description of the gift, its fair market value, the date of donation, and any relevant recipient information.

What is the purpose of sampampd2019 gift in-kind donation?

The purpose of the sampampd2019 gift in-kind donation is to ensure accurate reporting of non-cash donations for tax purposes and to provide transparency about the contributions made to charitable organizations.

What information must be reported on sampampd2019 gift in-kind donation?

The information that must be reported includes the item description, fair market value, date of donation, recipient's details, and the donor's contact information.

Fill out your sampampd2019 gift in-kind donation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

sampampd2019 Gift In-Kind Donation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.