Get the free Non-profit investigative reporting in American journalism ...

Show details

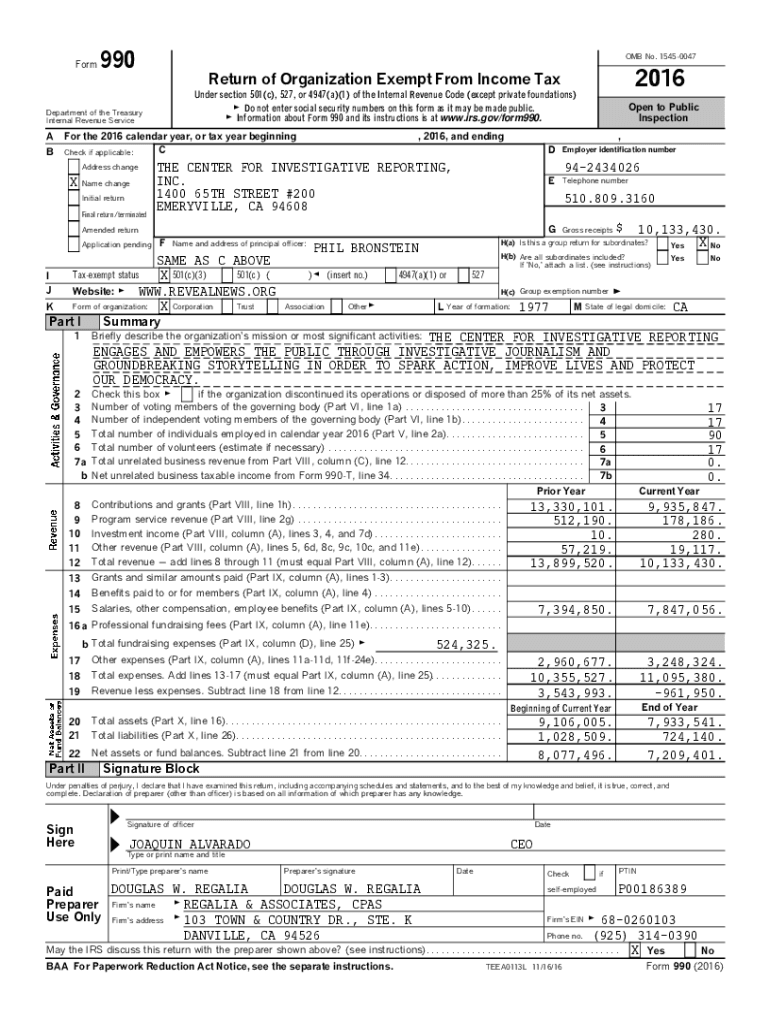

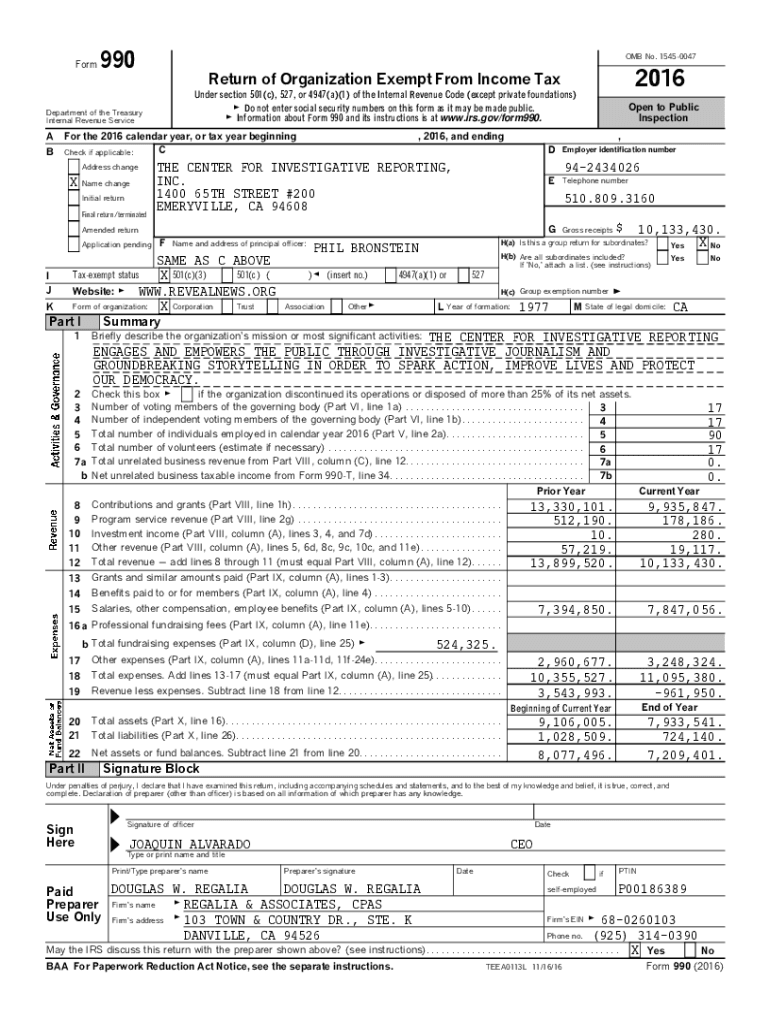

Form990OMB No. 15450047Department of the Treasury

Internal Revenue Service

For the 2016 calendar year, or tax year beginning

C

Check if applicable:

Address changeXName change

Initial return

Final

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-profit investigative reporting in

Edit your non-profit investigative reporting in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-profit investigative reporting in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-profit investigative reporting in online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit non-profit investigative reporting in. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-profit investigative reporting in

How to fill out non-profit investigative reporting in

01

To fill out a non-profit investigative reporting form, follow these steps:

02

Start by gathering all the necessary information and documents related to the investigation.

03

Begin by providing the basic details such as the name of the non-profit organization being investigated and the purpose of the investigation.

04

Proceed to provide a detailed description of the allegations or issues being investigated. Include any evidence or supporting documents that can help in understanding the case.

05

In the form, provide information about the individuals or entities involved in the investigation, including their names, roles, and any relevant background information.

06

If applicable, provide information about any witnesses or sources who can provide further insight into the investigation.

07

Clearly state the goals and objectives of the investigation, including any specific outcomes or remedies sought.

08

Finally, review the completed form for accuracy and completeness before submitting it.

09

Note: The specific layout and sections may vary depending on the non-profit investigative reporting form being used.

Who needs non-profit investigative reporting in?

01

Non-profit investigative reporting is needed by various stakeholders who are interested in transparency, accountability, and exposing potential wrongdoings within non-profit organizations. Some examples of those who may need non-profit investigative reporting include:

02

- Government agencies responsible for overseeing non-profit organizations and ensuring compliance with regulations.

03

- Donors and grantmakers who want to ensure their funds are being utilized appropriately and ethically.

04

- Journalists and media outlets who aim to uncover corruption or misconduct within non-profit organizations.

05

- Non-profit board members and executives who are committed to maintaining integrity and addressing any issues within their own organizations.

06

- General public and community members who rely on non-profit services and want to ensure their donations or tax dollars are being used effectively and responsibly.

07

By conducting non-profit investigative reporting, it becomes possible to identify potential issues, hold non-profit organizations accountable, and protect the interests of various stakeholders.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my non-profit investigative reporting in directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your non-profit investigative reporting in along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send non-profit investigative reporting in for eSignature?

To distribute your non-profit investigative reporting in, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit non-profit investigative reporting in straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing non-profit investigative reporting in.

What is non-profit investigative reporting?

Non-profit investigative reporting refers to journalistic investigations conducted by non-profit organizations aimed at uncovering truths, holding powerful entities accountable, and informing the public about critical issues.

Who is required to file non-profit investigative reporting?

Non-profit organizations that engage in investigative journalism activities are typically required to file non-profit investigative reporting, especially those that qualify under specific regulations governing their operations and funding.

How to fill out non-profit investigative reporting?

To fill out non-profit investigative reporting, organizations should follow mandated forms provided by regulatory authorities, detailing their financial activities, funding sources, expenditures, and the nature of their investigative work.

What is the purpose of non-profit investigative reporting?

The purpose of non-profit investigative reporting is to promote transparency, protect civil liberties, and ensure accountability by investigating issues of public concern, often involving government, corporations, or societal injustices.

What information must be reported on non-profit investigative reporting?

Organizations must report information such as funding sources, expenses, project descriptions, outcomes of investigations, and any partnerships with other entities relevant to their investigative endeavors.

Fill out your non-profit investigative reporting in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Profit Investigative Reporting In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.