Get the free Automatic Investing Payroll Deduction Plan

Show details

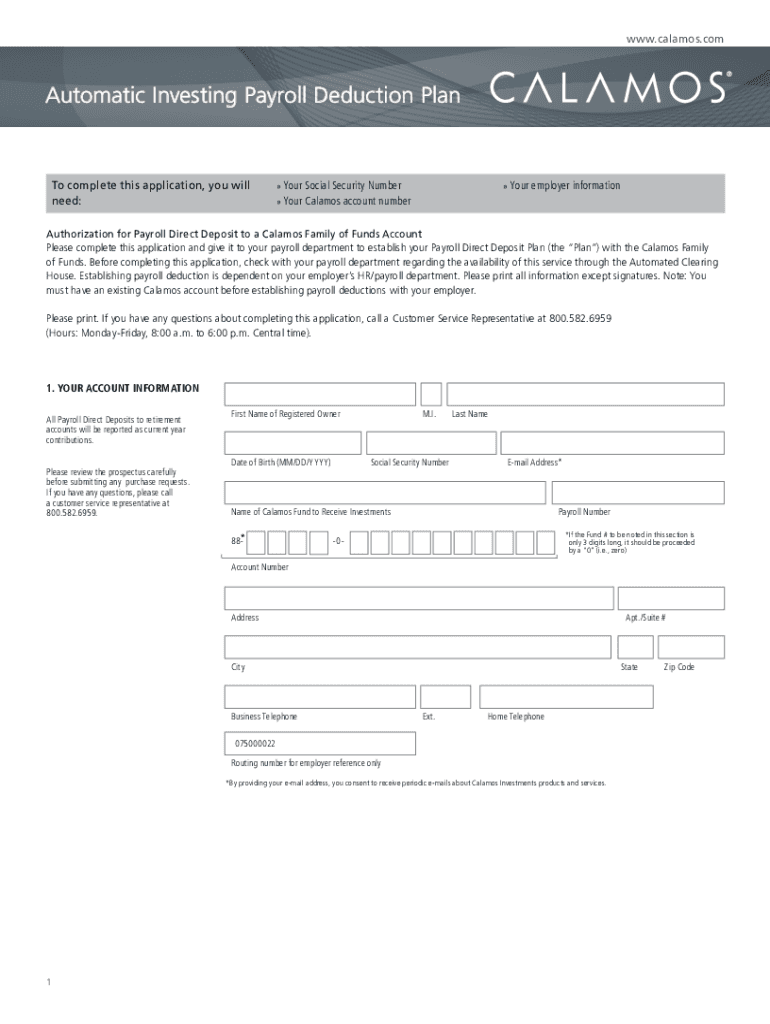

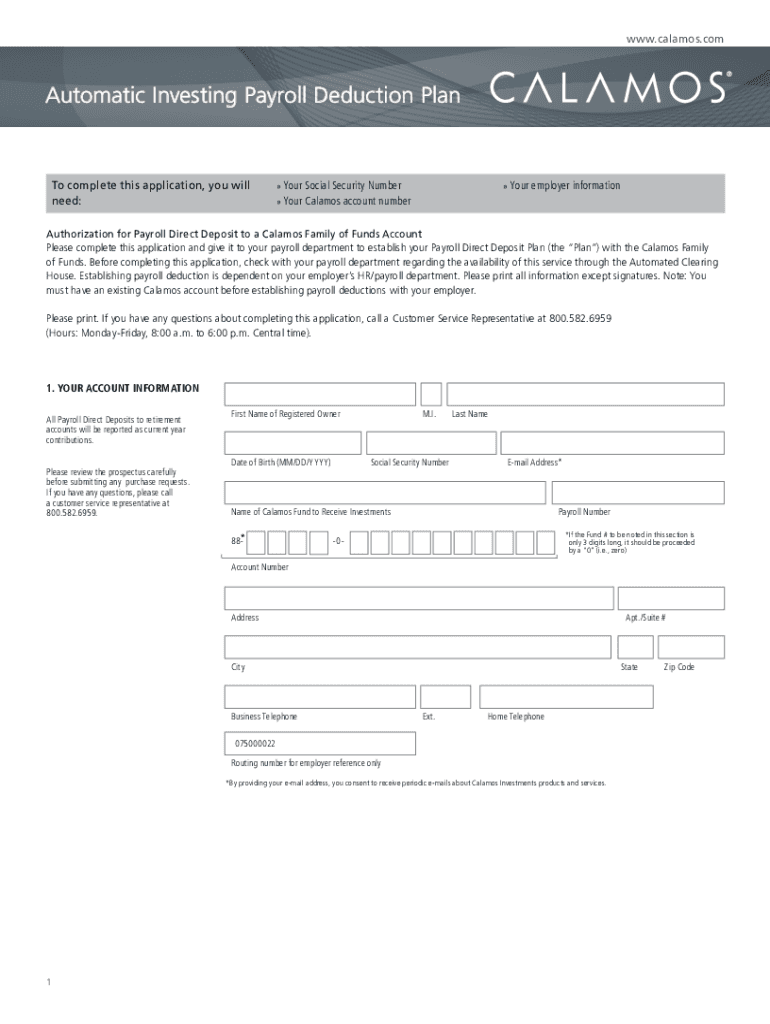

WWW. Calais.automatic Investing Payroll Deduction Plant complete this application, you will

need:

Your Social Security Number

Your Calais account number Your employer informationAuthorization for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automatic investing payroll deduction

Edit your automatic investing payroll deduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automatic investing payroll deduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing automatic investing payroll deduction online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit automatic investing payroll deduction. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automatic investing payroll deduction

How to fill out automatic investing payroll deduction

01

Determine the amount you want to allocate for automatic investing payroll deduction.

02

Contact your employer's human resources department or payroll department to inquire if automatic investing payroll deduction is available and what the process is.

03

If the option is available, fill out the necessary forms provided by your employer. These forms may require information such as your name, employee identification number, desired deduction amount, investment account details, and authorization.

04

Ensure that you have all the required information and documents handy before filling out the forms.

05

Carefully review the information you have provided on the forms to avoid any errors or omissions.

06

Once you have completed the forms, submit them to your employer's human resources or payroll department as instructed.

07

Wait for confirmation from your employer regarding the setup of automatic investing payroll deduction. This may include information about when the deduction will start and how it will appear on your payslip.

08

Monitor your payslips and investment account to ensure that the deductions are being made accurately and according to your instructions.

09

If you have any questions or concerns, contact your employer's human resources or payroll department for assistance.

Who needs automatic investing payroll deduction?

01

Automatic investing payroll deduction can be beneficial for individuals who want to save and invest regularly without having to manually initiate each contribution.

02

Those who prefer a disciplined approach towards investing and want to achieve long-term financial goals can benefit from automatic investing payroll deduction.

03

Employees who have access to this option through their employer can take advantage of the convenience and simplicity it offers.

04

Individuals who struggle with saving or investing consistently can use automatic investing payroll deduction as a tool to develop a habit of regular contributions.

05

This option may also be suitable for individuals who wish to take advantage of employer-sponsored retirement plans or investment opportunities.

06

Overall, anyone who wants to automate their investment contributions and make consistent progress towards their financial objectives can benefit from automatic investing payroll deduction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my automatic investing payroll deduction in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your automatic investing payroll deduction and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I create an electronic signature for the automatic investing payroll deduction in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your automatic investing payroll deduction and you'll be done in minutes.

How do I fill out automatic investing payroll deduction on an Android device?

On Android, use the pdfFiller mobile app to finish your automatic investing payroll deduction. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is automatic investing payroll deduction?

Automatic investing payroll deduction is a financial arrangement where an employee's pay is automatically reduced by a specified amount and directed towards a designated investment account or plan. This system simplifies the process of saving and investing by allowing employees to contribute to their investments without manual transfers.

Who is required to file automatic investing payroll deduction?

Typically, any employee who wishes to participate in an automatic investing payroll deduction program must file the necessary forms through their employer. Employers may also be responsible for maintaining records and filing relevant documentation with tax authorities.

How to fill out automatic investing payroll deduction?

To fill out automatic investing payroll deduction, employees usually need to complete a form provided by their employer or investment plan administrator. This form typically includes personal information, the amount to be deducted, the frequency of deductions, and the details of the investment account.

What is the purpose of automatic investing payroll deduction?

The purpose of automatic investing payroll deduction is to promote savings and investment habits by making the process easier and more consistent. It helps employees to systematically allocate a portion of their earnings towards future financial goals, such as retirement or building wealth.

What information must be reported on automatic investing payroll deduction?

Information that must be reported includes the employee's name, social security number or tax identification number, the amount to be deducted, the frequency of deductions, and the destination of the funds (such as the investment account).

Fill out your automatic investing payroll deduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automatic Investing Payroll Deduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.