Get the free Mortgage - Principal & Interest

Show details

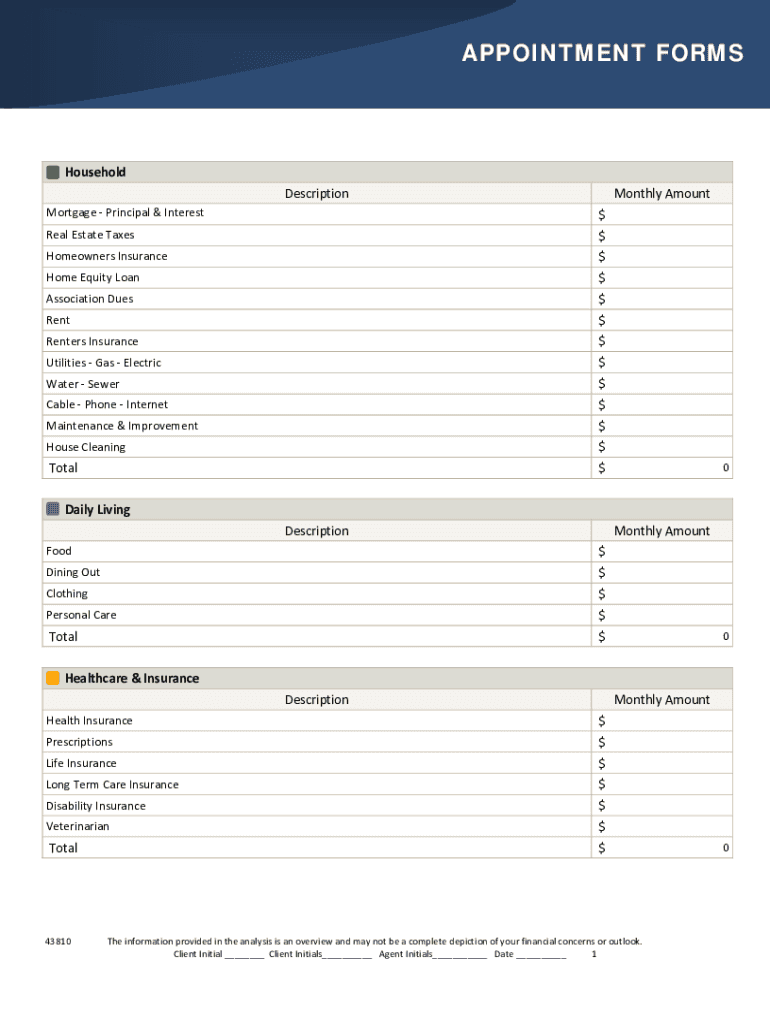

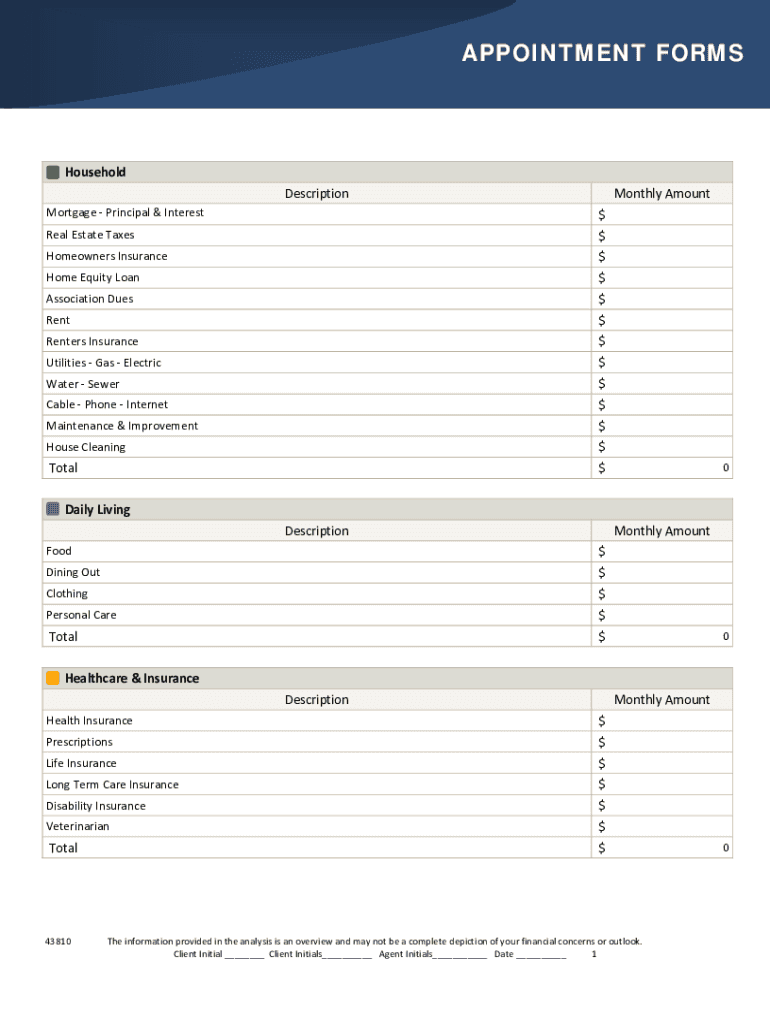

APPOINTMENT FORMSHousehold Mortgage Principal & InterestDescription $ $ $ $ $ $ $ $ $ $ $ $ real Estate TaxesHomeowners Insurance Home Equity Loan Association Descent Renters Insurance Utilities Gas

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage - principal amp

Edit your mortgage - principal amp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage - principal amp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage - principal amp online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mortgage - principal amp. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage - principal amp

How to fill out mortgage - principal amp

01

Gather all the necessary financial documents, such as your income statements, bank statements, and tax returns.

02

Research and compare different lenders and mortgage options to find the best fit for your financial situation.

03

Calculate your budget and determine how much you can afford to borrow and repay each month.

04

Fill out the mortgage application form with accurate and detailed information about your personal finances, employment history, and property details.

05

Submit your application along with the required documents to the lender for review.

06

Cooperate with the lender and provide any additional information or documentation they may request.

07

Wait for the lender to process your application and conduct a thorough evaluation of your financial background and creditworthiness.

08

Review and sign the mortgage agreement if your application is approved.

09

Arrange for a professional appraisal and inspection of the property you wish to purchase.

10

Coordinate with the lender, real estate agents, and other involved parties to complete the necessary paperwork and finalize the mortgage.

11

Fulfill any closing requirements, such as making a down payment and purchasing homeowners insurance.

12

Attend the closing appointment to sign all the final documents and officially take ownership of the property.

13

Maintain regular communication with the lender and fulfill your mortgage repayments on time to avoid any penalties or complications.

Who needs mortgage - principal amp?

01

Mortgage - principal amp is needed by individuals or families who are interested in purchasing a property but do not have sufficient funds to pay for it in full upfront.

02

It is also useful for those who prefer to spread out the payments over a longer period of time, making homeownership more affordable and manageable.

03

Moreover, people who want to take advantage of tax benefits related to mortgage interest payments may choose to get a mortgage - principal amp.

04

However, it is important to note that mortgage - principal amp is a significant financial commitment, and individuals or families should carefully consider their financial stability and capability to repay the loan before taking this step.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mortgage - principal amp?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the mortgage - principal amp. Open it immediately and start altering it with sophisticated capabilities.

Can I sign the mortgage - principal amp electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your mortgage - principal amp in minutes.

How do I complete mortgage - principal amp on an Android device?

Complete your mortgage - principal amp and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is mortgage - principal amp?

A mortgage - principal amp is a financial document that reports the principal amount of a loan secured by real property, detailing the borrower's obligation to repay the loan.

Who is required to file mortgage - principal amp?

Typically, lenders or financial institutions that offer mortgage loans are required to file the mortgage - principal amp to report the details of the loan and its principal balance.

How to fill out mortgage - principal amp?

To fill out a mortgage - principal amp, gather the required information such as the borrower's details, loan amount, property description, and terms of the mortgage, then input this information into the appropriate sections of the form.

What is the purpose of mortgage - principal amp?

The purpose of mortgage - principal amp is to provide a formal record of the mortgage loan, including the principal due, which facilitates accurate tracking of repayment progress and financial reporting.

What information must be reported on mortgage - principal amp?

The information reported typically includes the borrower’s name and contact details, loan amount, property address, interest rate, term of the loan, and payment schedule.

Fill out your mortgage - principal amp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage - Principal Amp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.