Get the free Deduct $200 on orders

Show details

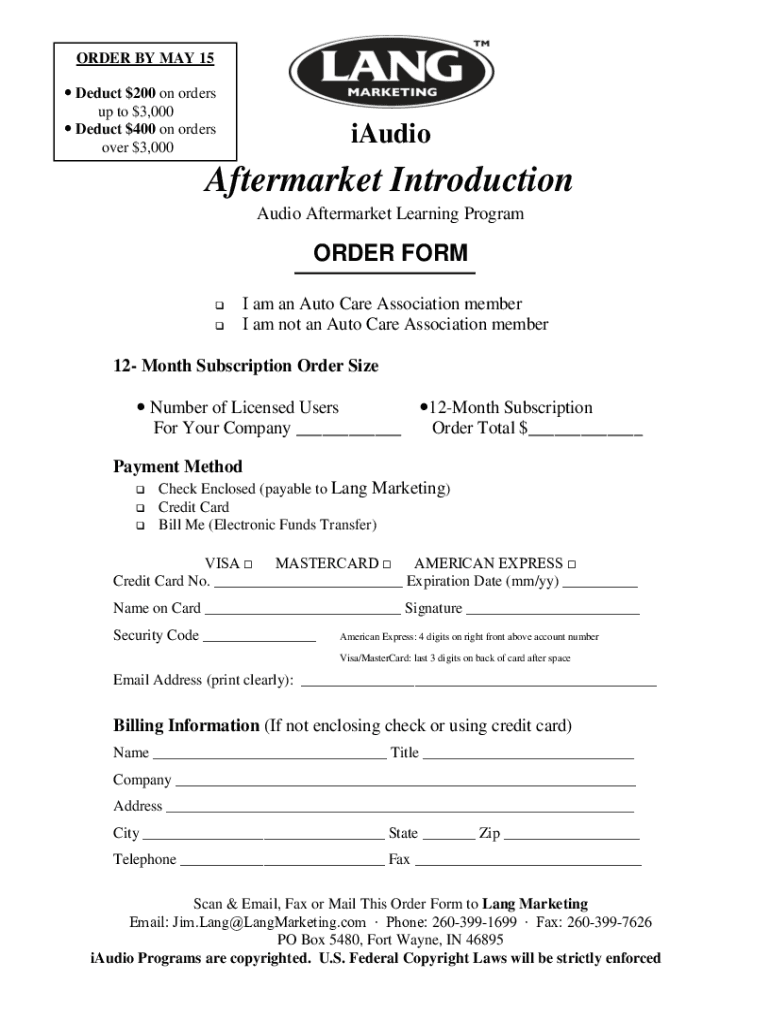

ORDER BY MAY 15 Deduct $200 on orders up to $3,000 Deduct $400 on orders over $3,000iAudioAftermarket Introduction Audio Aftermarket Learning Programmer FORM I am an Auto Care Association member I

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deduct 200 on orders

Edit your deduct 200 on orders form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deduct 200 on orders form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deduct 200 on orders online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit deduct 200 on orders. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deduct 200 on orders

How to fill out deduct 200 on orders

01

To fill out deduct 200 on orders, follow these steps:

02

Open the order form or invoice where you need to deduct 200.

03

Locate the field or column where the deduction amount can be entered.

04

Enter the amount 200 in the deduction field.

05

Make sure to indicate the reason or purpose for the deduction, if required.

06

Save the changes or submit the form to complete the deduction process.

Who needs deduct 200 on orders?

01

Deducting 200 on orders may be needed by various individuals or entities, including:

02

- Businesses that offer discounts or promotions where a specific amount needs to be deducted from the total order value.

03

- Service providers who offer refunds or reimbursements and need to deduct a specified amount from the original payment.

04

- Suppliers or vendors who apply deductions for late deliveries or damaged goods.

05

- Tax authorities or financial institutions that require specific deductions to be made for compliance or accounting purposes.

06

- Any individual or organization that has agreed upon deducting 200 on orders as part of a contractual arrangement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete deduct 200 on orders online?

pdfFiller has made it easy to fill out and sign deduct 200 on orders. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for the deduct 200 on orders in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your deduct 200 on orders and you'll be done in minutes.

How do I edit deduct 200 on orders straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing deduct 200 on orders, you need to install and log in to the app.

What is deduct 200 on orders?

Deduct 200 on orders refers to a specific tax form or deduction applied to certain types of orders that allows a business or individual to reduce their taxable income by a deduction of 200 units.

Who is required to file deduct 200 on orders?

Businesses and individuals who engage in qualifying transactions that meet the criteria for deducting 200 on orders are generally required to file this deduction.

How to fill out deduct 200 on orders?

To fill out deduct 200 on orders, you need to follow the guidelines provided by the taxing authority, usually involving completing the designated form with relevant financial information, including the transaction details.

What is the purpose of deduct 200 on orders?

The purpose of deduct 200 on orders is to provide financial relief to taxpayers by allowing them to reduce their overall taxable income, thus lowering the tax burden.

What information must be reported on deduct 200 on orders?

Typically, the information that must be reported includes the order details, amounts involved, and any other relevant financial data that supports the claim for the deduction.

Fill out your deduct 200 on orders online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deduct 200 On Orders is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.