Get the free Retirement, Investments, and InsurancePrincipalMedicare Secondary PayerCMSHow to Nav...

Show details

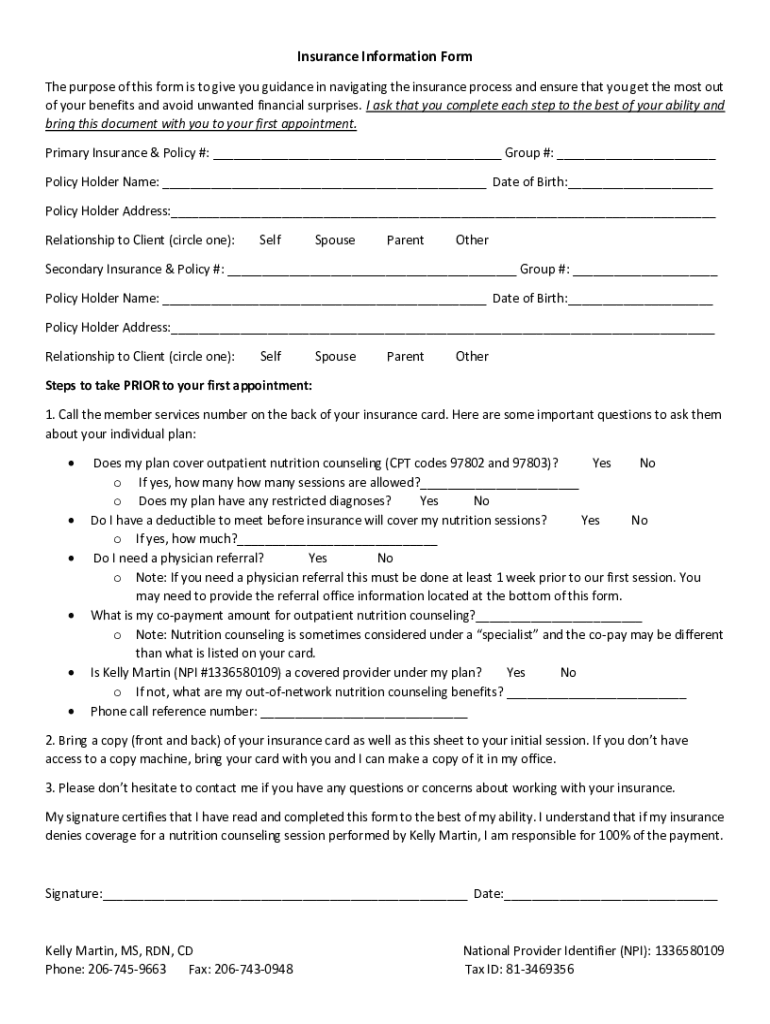

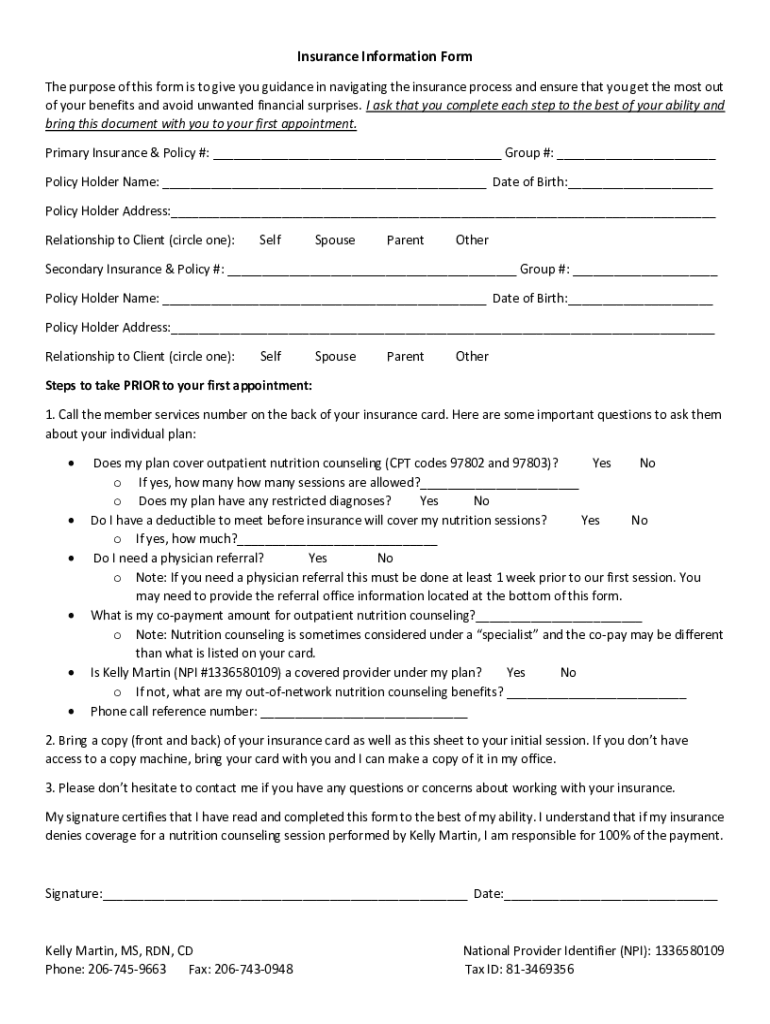

Insurance Information Form The purpose of this form is to give you guidance in navigating the insurance process and ensure that you get the most out of your benefits and avoid unwanted financial surprises.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement investments and insuranceprincipalmedicare

Edit your retirement investments and insuranceprincipalmedicare form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement investments and insuranceprincipalmedicare form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit retirement investments and insuranceprincipalmedicare online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit retirement investments and insuranceprincipalmedicare. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retirement investments and insuranceprincipalmedicare

How to fill out retirement investments and insuranceprincipalmedicare

01

To fill out retirement investments and insuranceprincipalmedicare, follow these steps:

02

Determine your retirement goals and how much income you will need during retirement.

03

Research different retirement investment options such as 401(k), Individual Retirement Accounts (IRAs), and annuities.

04

Consider consulting with a financial advisor to help you understand the investment options and choose the right ones for your needs.

05

Evaluate your risk tolerance and investment timeline to determine the appropriate asset allocation for your investments.

06

Fill out the necessary paperwork to open your retirement investment accounts.

07

Set up automatic contributions or regular deposits into your retirement accounts to ensure consistent savings and growth.

08

Review and adjust your retirement investments periodically to make sure they align with your changing goals and market conditions.

09

To fill out insuranceprincipalmedicare, consider the following:

10

Research different insurance plans that offer coverage for medical expenses, hospitalization, prescription drugs, and other healthcare services.

11

Compare the premiums, deductibles, co-pays, and coverage limits of different insurance plans to find the one that best meets your healthcare needs and budget.

12

Fill out the necessary paperwork to enroll in the chosen insurance plan.

13

Provide accurate information about your personal details, medical history, and any pre-existing conditions to ensure proper coverage.

14

Pay the required premiums to activate your insurance coverage.

15

Familiarize yourself with the terms and conditions of your insurance plan, including the procedures for filing claims and accessing healthcare services.

16

Review your insurance coverage regularly and make adjustments as needed to ensure adequate protection.

17

Always consult with professionals or financial advisors for personalized advice and recommendations based on your specific situation.

Who needs retirement investments and insuranceprincipalmedicare?

01

Retirement investments and insuranceprincipalmedicare are needed by individuals who:

02

- Want to secure their financial future and have a source of income during retirement.

03

- Want to grow their savings and investments over time.

04

- Are planning for retirement and want to take advantage of tax benefits and employer-sponsored retirement plans.

05

- Want to protect themselves and their loved ones from financial risks associated with healthcare expenses.

06

- Want access to quality healthcare services and prescription drugs without incurring significant out-of-pocket costs.

07

- Want to comply with legal requirements and avoid penalties for not having adequate insurance coverage.

08

It is important for individuals to assess their financial and healthcare needs and consult with professionals to determine the right retirement investments and insurance plans for their specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit retirement investments and insuranceprincipalmedicare online?

With pdfFiller, it's easy to make changes. Open your retirement investments and insuranceprincipalmedicare in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the retirement investments and insuranceprincipalmedicare electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I edit retirement investments and insuranceprincipalmedicare on an iOS device?

Use the pdfFiller mobile app to create, edit, and share retirement investments and insuranceprincipalmedicare from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is retirement investments and insuranceprincipalmedicare?

Retirement investments are financial assets set aside for future use after employment ends, aimed at providing income during retirement. Insurance principal refers to the core amount of money in an insurance policy that earns interest or guarantees a return. Medicare is a federal health insurance program for individuals aged 65 and older, and some younger people with disabilities.

Who is required to file retirement investments and insuranceprincipalmedicare?

Individuals who are receiving retirement income and have investments related to retirement, as well as those who qualify for Medicare benefits, must file retirement investments and insurance principal Medicare forms as necessary.

How to fill out retirement investments and insuranceprincipalmedicare?

To fill out the retirement investments and insurance principal Medicare forms, gather all relevant financial documents, report your income and investment information as required, follow the instructions provided on the form carefully, and ensure accuracy before submission.

What is the purpose of retirement investments and insuranceprincipalmedicare?

The purpose is to ensure individuals can plan for financial stability in retirement and to facilitate access to necessary healthcare services as outlined by Medicare, thus safeguarding their health and financial resources.

What information must be reported on retirement investments and insuranceprincipalmedicare?

Required information typically includes personal identification details, income sources, investment values, insurance policy details, and any relevant health care coverage information required by Medicare.

Fill out your retirement investments and insuranceprincipalmedicare online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Investments And Insuranceprincipalmedicare is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.