Get the free How FDIC Insurance Coverage Is CalculatedNolo

Show details

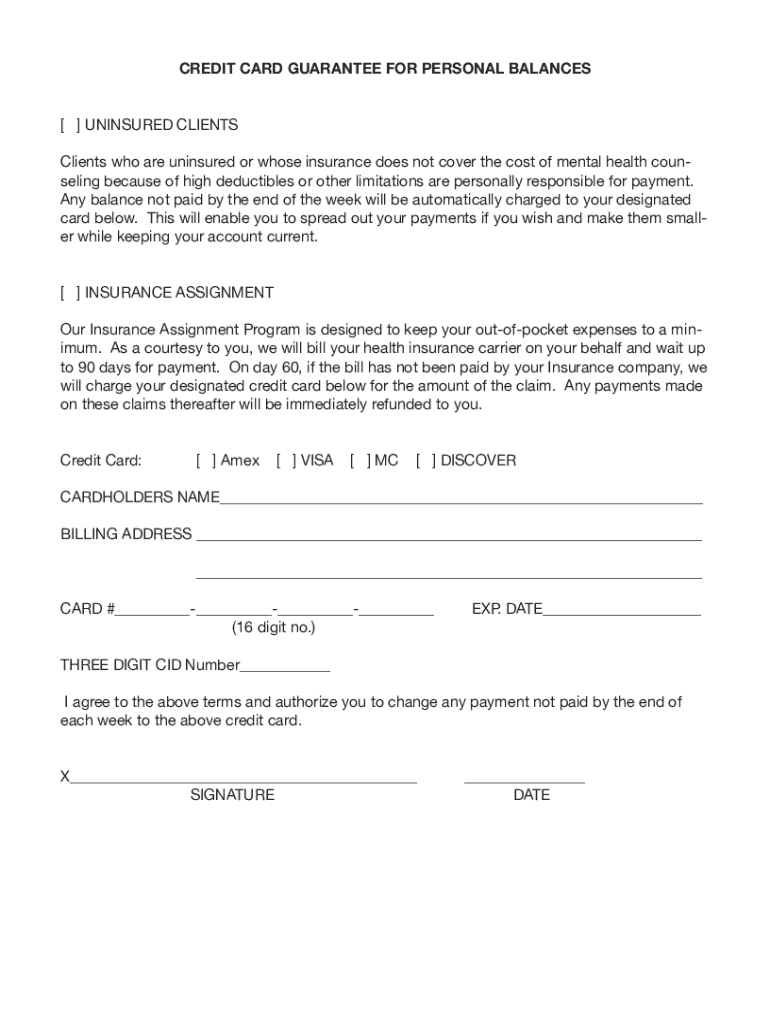

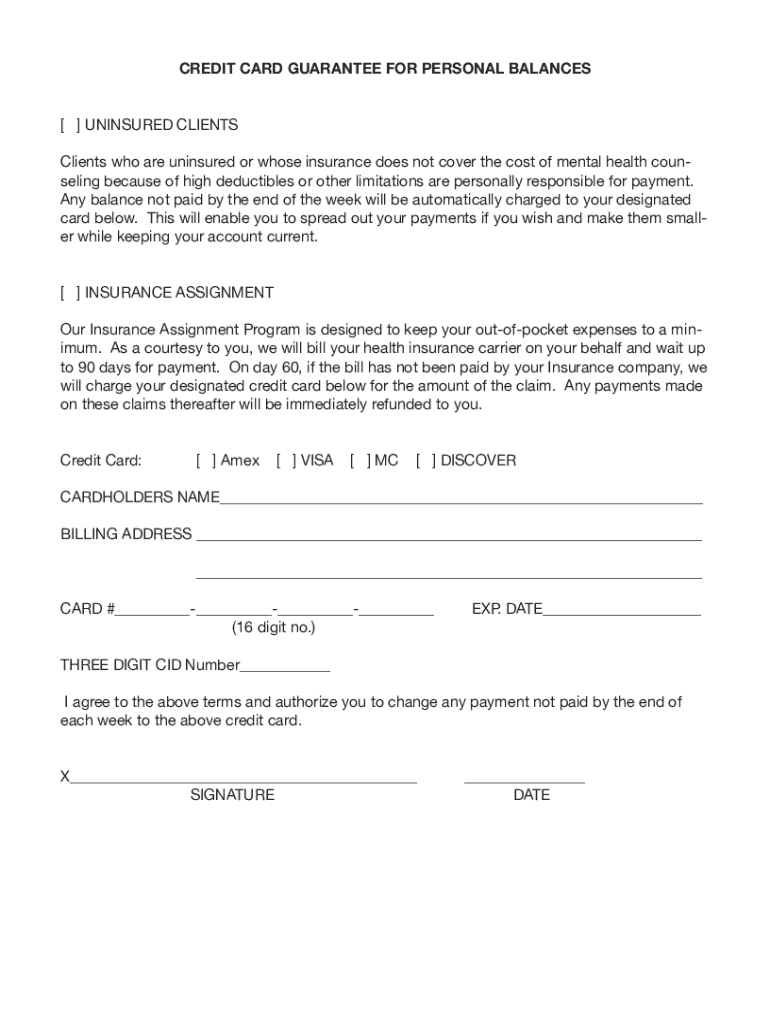

CREDIT CARD GUARANTEE FOR PERSONAL BALANCES UNINSURED CLIENTS who are uninsured or whose insurance does not cover the cost of mental health counseling because of high deductibles or other limitations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how fdic insurance coverage

Edit your how fdic insurance coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how fdic insurance coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how fdic insurance coverage online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit how fdic insurance coverage. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how fdic insurance coverage

How to fill out how fdic insurance coverage

01

To fill out FDIC insurance coverage, follow the steps below:

02

Start by determining your account type: FDIC coverage applies to deposits held in checking accounts, savings accounts, money market deposit accounts, and certificates of deposit (CDs).

03

Check the FDIC website for the current insurance limit: The coverage limit may vary over time, so it's important to know the maximum amount of coverage you can receive.

04

Understand how joint accounts are covered: If you have joint accounts, the coverage may be different. Each co-owner may be eligible for separate coverage.

05

Consider opening accounts at different financial institutions: If you have large deposits or want to ensure maximum coverage, spreading your money across multiple banks can be an option.

06

Keep track of your account balances: It's crucial to monitor your balances to ensure they stay within the FDIC insurance limits.

07

Consult with a financial advisor: If you have more complex banking needs or substantial deposits, seeking professional advice can help optimize your FDIC coverage.

08

Review your accounts periodically: Regularly review your accounts to ensure they are still FDIC-insured and that you comply with any changes in coverage limits or regulations.

09

Remember, FDIC insurance does not cover losses from investments, such as stocks, bonds, or mutual funds.

Who needs how fdic insurance coverage?

01

Anyone who holds deposits in FDIC-insured institutions needs FDIC insurance coverage.

02

This includes individuals, families, businesses, and organizations that have funds in checking accounts, savings accounts, money market accounts, or certificates of deposit (CDs).

03

Having FDIC insurance coverage provides protection and peace of mind in the event of a bank failure, as the FDIC guarantees to reimburse eligible deposits up to the coverage limit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send how fdic insurance coverage to be eSigned by others?

Once you are ready to share your how fdic insurance coverage, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit how fdic insurance coverage online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your how fdic insurance coverage to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for signing my how fdic insurance coverage in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your how fdic insurance coverage and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is how fdic insurance coverage?

FDIC insurance coverage protects depositors by insuring their deposits in member banks up to a certain limit, currently $250,000 per depositor, per insured bank, for each account ownership category.

Who is required to file how fdic insurance coverage?

Banks and savings associations that are members of the FDIC are required to comply with and report their insurance coverage. Individual depositors do not file coverage; they are automatically covered within the designated limits.

How to fill out how fdic insurance coverage?

There is no specific form for individuals to fill out for FDIC insurance; coverage is automatic. However, financial institutions may need to report their insurance status through periodic filings with the FDIC.

What is the purpose of how fdic insurance coverage?

The purpose of FDIC insurance coverage is to maintain public confidence in the U.S. financial system by protecting depositors' funds against bank failures.

What information must be reported on how fdic insurance coverage?

FDIC insurance reports typically include information about the institution's financial health, the amount of insured deposits, and compliance with insurance regulations.

Fill out your how fdic insurance coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How Fdic Insurance Coverage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.