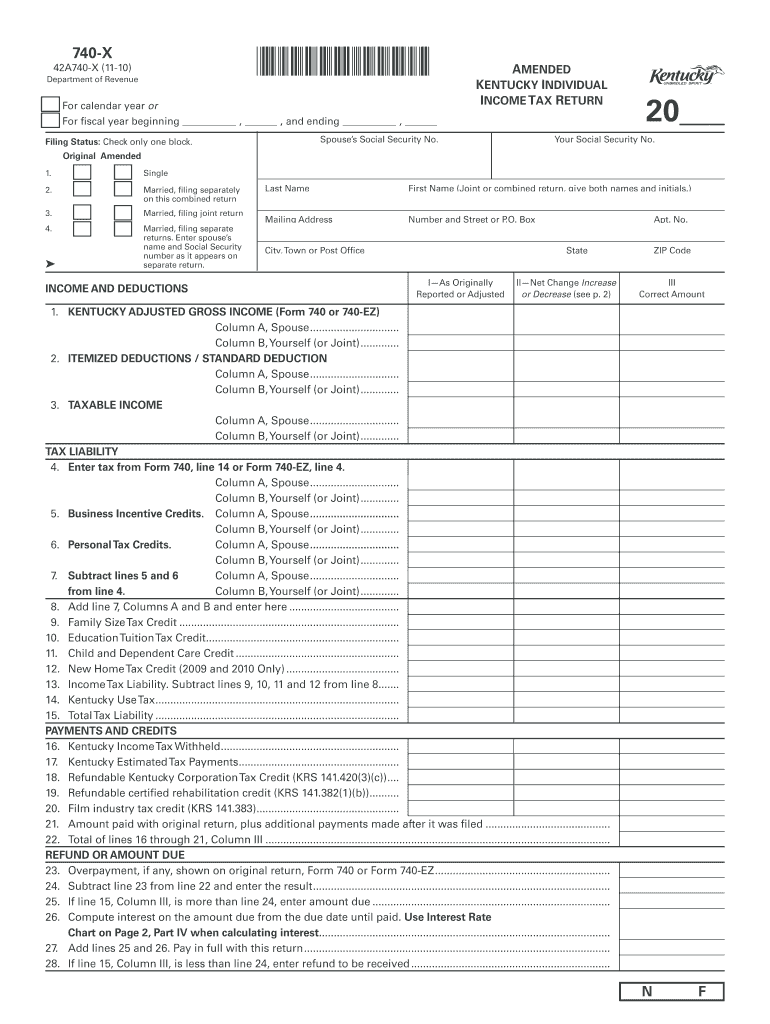

Get the free kentucky form 740x 2010

Instructions and Help about KY DoR 740-X

How to edit KY DoR 740-X

How to fill out KY DoR 740-X

About KY DoR 740-X 2010 previous version

What is KY DoR 740-X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about kentucky form 740x 2010

What steps should I take if I realize I've made an error after submitting kentucky form 740x 2010?

If you've made a mistake on your submitted kentucky form 740x 2010, you will need to file an amended return. Use the same form, marking it as amended, and provide the correct information. Ensure that you attach a written explanation of the changes and submit it according to the filing instructions.

How can I verify the status of my kentucky form 740x 2010 after submission?

To verify the status of your kentucky form 740x 2010, visit the Kentucky Department of Revenue's website. Look for the 'Check the Status of Your Return' section, where you can enter your information to check if your submission has been received and processed.

Are there specific common mistakes I should be aware of to avoid issues with kentucky form 740x 2010?

Some common errors include incorrect social security numbers, not signing the form, and miscalculating tax liabilities. Carefully review the form and double-check all entries to ensure accuracy and completeness before submission to avoid potential problems with your kentucky form 740x 2010.

What should I do if my electronic submission of kentucky form 740x 2010 is rejected?

If your e-filing of kentucky form 740x 2010 is rejected, review the rejection code provided, which typically indicates the reason for the rejection. Correct the noted error and resubmit your form promptly to ensure timely processing of your tax return.

How long should I retain records related to my kentucky form 740x 2010 filing?

It is advisable to retain records related to your kentucky form 740x 2010 for at least three years from the date you filed it. This period allows for adequate preparation in case of an audit or request for documentation by the Kentucky Department of Revenue.