Get the free Annual CPA Firm Report & Registration - the Nevada State Board of ...

Show details

NEVADA STATE BOARD OF ACCOUNTANCY 1325 Air motive Way, Ste. 220 * Reno, NV 89502 *Phone (775) 786-0231 * Fax (775) 786-0234 *Email CPA nvaccountancy.com ANNUAL CPA FIRM REPORT AND REGISTRATION January

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual cpa firm report

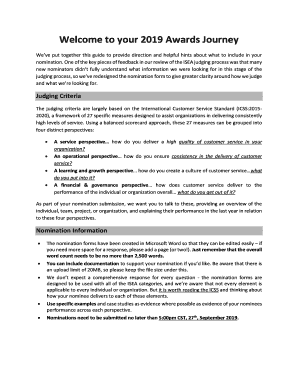

Edit your annual cpa firm report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual cpa firm report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual cpa firm report online

To use our professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit annual cpa firm report. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual cpa firm report

How to fill out an annual CPA firm report?

01

Gather all relevant financial documents: Start by gathering all the necessary financial documents, such as income statements, balance sheets, cash flow statements, and tax returns. These documents will provide the foundation for completing the report accurately.

02

Review the previous year's report: Take the time to review the previous year's report to understand the format and ensure consistency. This will also help identify any areas that need improvement or updates.

03

Organize the information: Organize the financial information in a systematic manner. Properly categorize and label each item and ensure accuracy in all calculations.

04

Prepare financial statements: Use the gathered financial information to prepare the necessary financial statements required for the report, including the income statement, balance sheet, and cash flow statement. These statements should accurately reflect the financial position and performance of the CPA firm.

05

Obtain supporting documents: Include supporting documents that provide evidence for the figures mentioned in the financial statements. This can include receipts, invoices, contracts, bank statements, and any other relevant documents.

06

Analyze the financial data: Review the financial statements and analyze the data to identify any trends, patterns, or anomalies. This analysis will help in providing insights into the firm's financial health and inform decision-making processes.

07

Disclose any significant events or changes: Apart from the financial data, disclose any significant events or changes that have occurred during the reporting period. This can include mergers, acquisitions, changes in management, or any other material events.

08

Provide explanatory notes: Include explanatory notes to provide additional context and clarity for the financial statements. These notes can explain accounting policies, significant accounting estimates, and other relevant information.

09

Review and ensure accuracy: Once all the necessary information is gathered, organized, and prepared, thoroughly review the report to ensure accuracy. Double-check all calculations and confirm that all required information has been included.

10

Consult with professionals: If needed, consult with professionals such as accountants or auditors to ensure compliance with relevant accounting standards and regulations.

Who needs an annual CPA firm report?

01

Businesses and corporations: Businesses and corporations that have employed a CPA firm to handle their accounting and financial matters require an annual CPA firm report. This report provides crucial information on the financial health and performance of the company.

02

Investors and shareholders: Investors and shareholders who have invested in a company often request an annual CPA firm report to assess the financial stability and profitability of the business. This report helps them make informed investment decisions.

03

Regulatory authorities and government agencies: Regulatory authorities and government agencies rely on annual CPA firm reports to monitor and regulate businesses effectively. These reports ensure compliance with accounting standards, tax regulations, and other legal requirements.

04

Lenders and creditors: Lenders and creditors, such as banks and financial institutions, may require an annual CPA firm report before extending credit or loans to businesses. This report helps assess the creditworthiness and financial standing of the borrowing entity.

05

Internal stakeholders: Internal stakeholders, including company management and board of directors, rely on annual CPA firm reports to evaluate the financial performance of the company. This information aids in strategic decision-making and planning for the future.

In conclusion, filling out an annual CPA firm report requires gathering and organizing financial information, preparing financial statements, analyzing data, and ensuring accuracy. This report is essential for businesses, investors, regulatory authorities, lenders, and internal stakeholders to assess financial performance and make informed decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit annual cpa firm report from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like annual cpa firm report, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit annual cpa firm report in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your annual cpa firm report, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out the annual cpa firm report form on my smartphone?

Use the pdfFiller mobile app to complete and sign annual cpa firm report on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

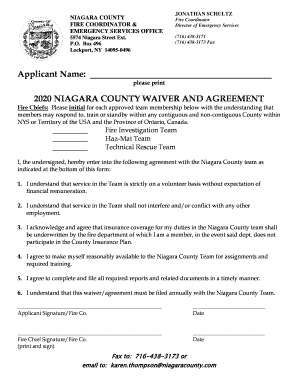

What is annual cpa firm report?

Annual CPA firm report is a document that provides detailed information about the financial status and performance of a CPA firm for a specific period.

Who is required to file annual cpa firm report?

CPA firms are required to file annual CPA firm reports as per regulatory requirements.

How to fill out annual cpa firm report?

To fill out an annual CPA firm report, detailed financial information and other relevant data about the firm must be gathered and accurately reported in the designated forms.

What is the purpose of annual cpa firm report?

The purpose of an annual CPA firm report is to provide transparency and accountability regarding the financial status and performance of the firm to regulatory authorities, stakeholders, and the public.

What information must be reported on annual cpa firm report?

The annual CPA firm report must include financial statements, income statements, balance sheets, cash flow statements, notes to the financial statements, and other relevant information.

Fill out your annual cpa firm report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Cpa Firm Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.