Get the free Consumer Financial Protection Bureau - Wikipedia

Show details

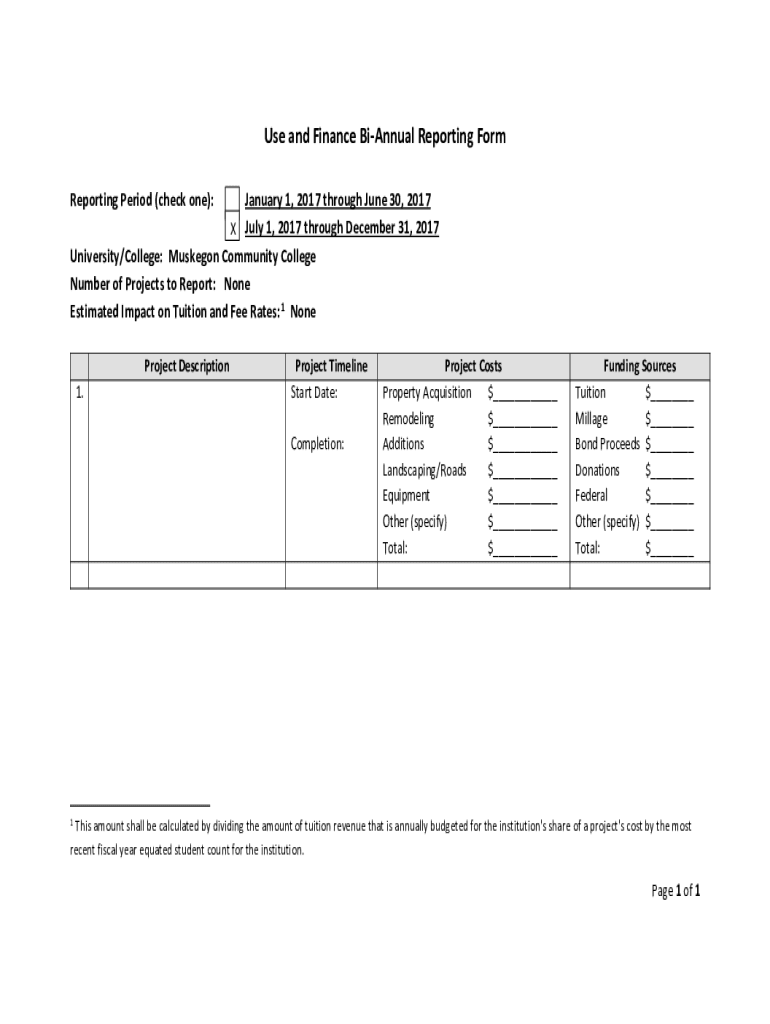

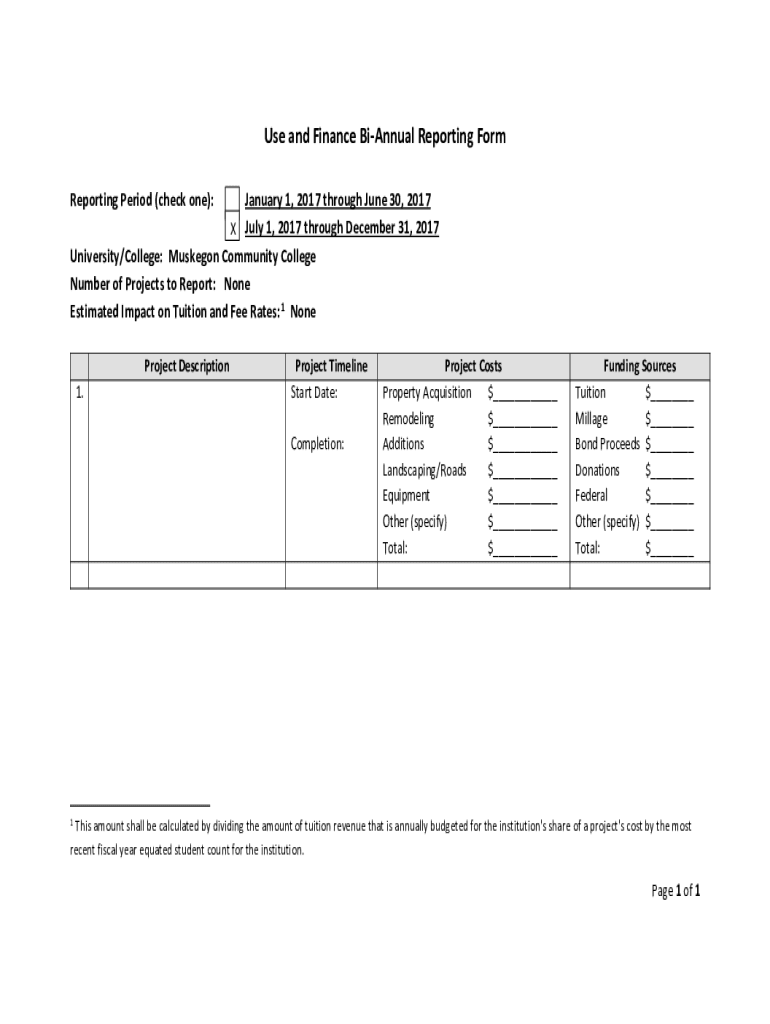

Use and Finance Biannual Reporting Form Reporting Period (check one):January 1, 2017, through June 30, 2017, X July 1, 2017, through December 31, 2017, University/College: Muskegon Community College

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer financial protection bureau

Edit your consumer financial protection bureau form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer financial protection bureau form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit consumer financial protection bureau online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit consumer financial protection bureau. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer financial protection bureau

How to fill out consumer financial protection bureau

01

To fill out the Consumer Financial Protection Bureau, follow these steps:

02

Start by visiting the official website of the Consumer Financial Protection Bureau.

03

Look for the form or application you need to fill out. The website provides various forms for different purposes, such as submitting a complaint, requesting information, etc.

04

Read the instructions carefully before filling out the form. Make sure you understand the requirements and provide accurate information.

05

Gather all the necessary documents and information that may be required to complete the form. This may include personal identification, financial statements, supporting documentation, etc.

06

Begin filling out the form, entering all the required information accurately. Double-check the entered information before proceeding.

07

If there are any specific sections or fields that you don't understand, refer to the provided instructions or contact the Consumer Financial Protection Bureau for clarification.

08

Review the completed form to ensure all the information is accurate and nothing is missing.

09

Sign and date the form where necessary.

10

If applicable, submit the form electronically through the provided online submission portal. Alternatively, you may need to print and mail the completed form to the designated address.

11

Keep a copy of the filled-out form and any supporting documents for your records.

12

In case of any questions or issues during the process, contact the Consumer Financial Protection Bureau for assistance.

Who needs consumer financial protection bureau?

01

The Consumer Financial Protection Bureau is designed to assist and protect consumers in the financial marketplace. Therefore, anyone who engages in financial transactions or uses financial services can benefit from the services provided by the bureau.

02

This includes but is not limited to:

03

- Individuals who have concerns or complaints regarding loans, mortgages, credit cards, or other financial products.

04

- Consumers facing unfair or deceptive practices by financial institutions or companies.

05

- Borrowers who want to understand their rights and responsibilities when dealing with lenders.

06

- People looking for information and resources to make informed financial decisions.

07

- Individuals who want to stay updated on financial regulations and consumer protection laws.

08

- Victims of identity theft or fraud in the financial sector.

09

- Consumers seeking guidance on managing debt, improving credit scores, or avoiding financial scams.

10

In summary, the Consumer Financial Protection Bureau is useful for anyone who wants to ensure fair practices and protection in their financial transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete consumer financial protection bureau online?

pdfFiller has made it easy to fill out and sign consumer financial protection bureau. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out the consumer financial protection bureau form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign consumer financial protection bureau and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How can I fill out consumer financial protection bureau on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your consumer financial protection bureau from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is the Consumer Financial Protection Bureau?

The Consumer Financial Protection Bureau (CFPB) is a U.S. government agency that supervises financial institutions and enforces federal consumer financial laws to ensure that consumers are treated fairly in the financial marketplace.

Who is required to file with the Consumer Financial Protection Bureau?

Financial institutions and other businesses that provide consumer financial products or services, such as banks, credit unions, mortgage companies, and payday lenders, are required to file with the CFPB.

How to fill out the Consumer Financial Protection Bureau?

To fill out the Consumer Financial Protection Bureau forms, ensure you have the necessary information regarding your financial products or services, complete the required sections accurately, and submit it according to the guidelines provided by the CFPB.

What is the purpose of the Consumer Financial Protection Bureau?

The purpose of the CFPB is to protect consumers from unfair, deceptive, or abusive practices in the financial sector, and to promote transparency and fairness in the consumer financial marketplace.

What information must be reported to the Consumer Financial Protection Bureau?

Entities must report data related to consumer financial products and services, including loan details, interest rates, fees, and any complaints or issues arising from consumer interactions.

Fill out your consumer financial protection bureau online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Financial Protection Bureau is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.