AU The Victorian Independent Schools Superannuation Fund Withdrawal Form 2020-2025 free printable template

Show details

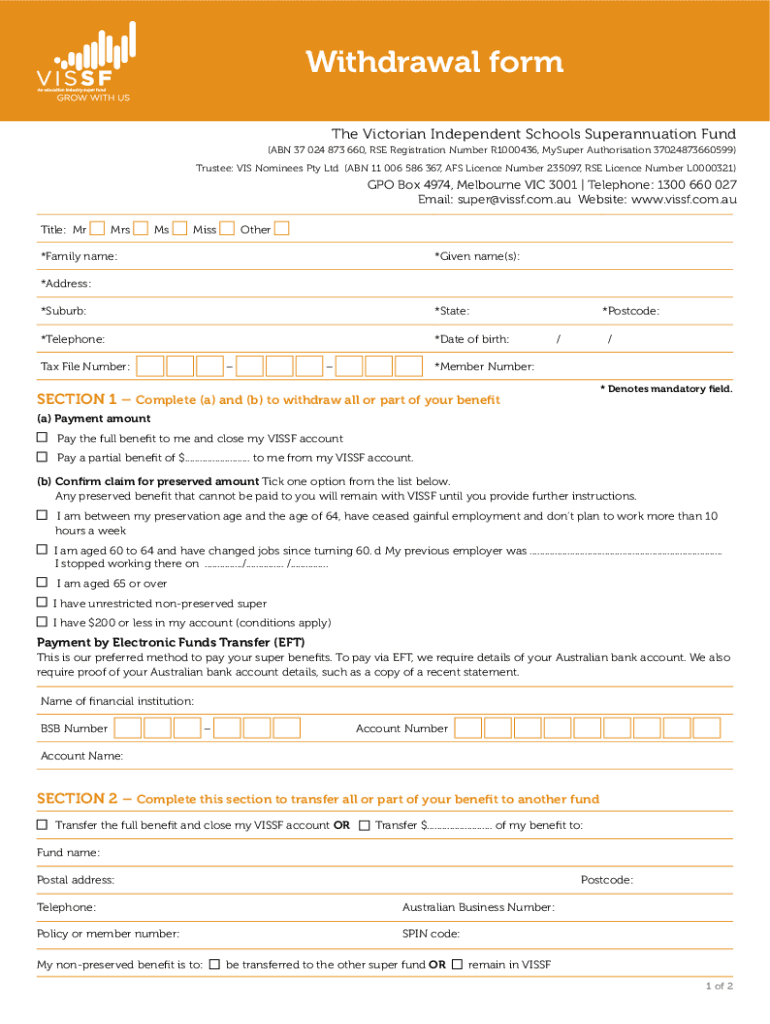

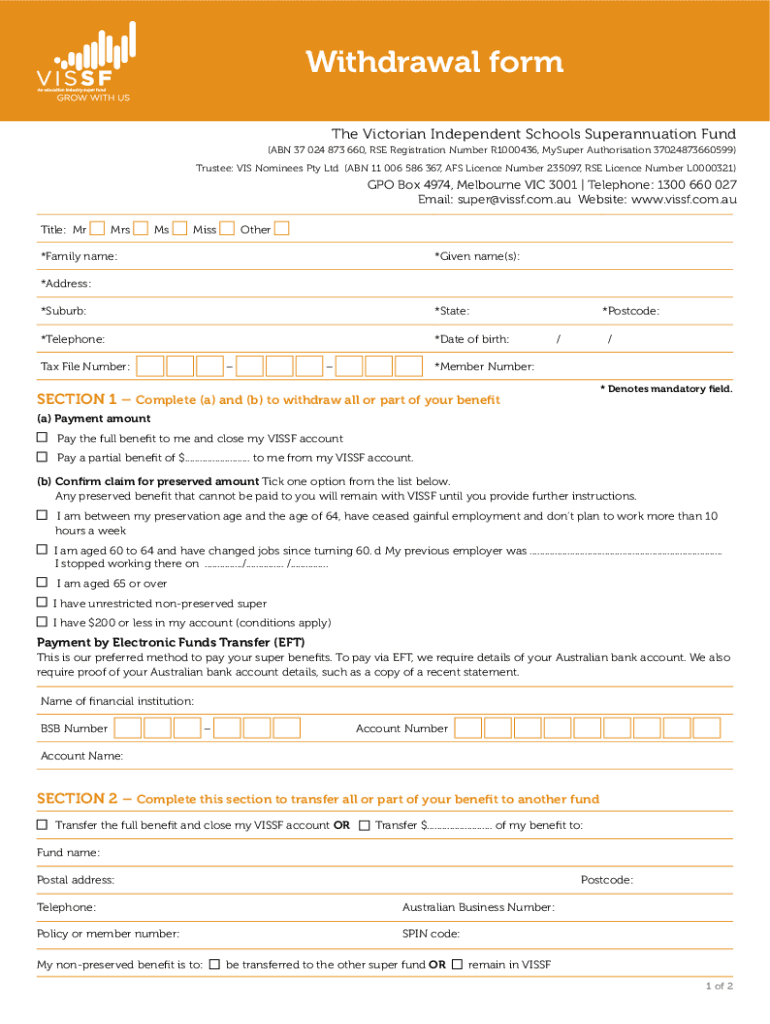

Withdrawal forms The Victorian Independent Schools Superannuation Fund (ABN 37 024 873 660, RSE Registration Number R1000436, Super Authorization 37024873660599) Trustee: IS Nominees Pty Ltd (ABN

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pensioners entitlement form

Edit your scheme superannuation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payment form agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pensioners annuity pensions online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit contribution superannuation form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU The Victorian Independent Schools Superannuation Fund Withdrawal Form Form Versions

Version

Form Popularity

Fillable & printabley

4.8 Satisfied (171 Votes)

4.3 Satisfied (233 Votes)

How to fill out superannuation pay form

How to fill out AU The Victorian Independent Schools Superannuation Fund Withdrawal

01

Gather your personal details, including your name, address, date of birth, and contact information.

02

Obtain your superannuation account details, including your member number for the Victorian Independent Schools Superannuation Fund.

03

Choose the reason for the withdrawal from the available options (e.g., financial hardship, retirement, etc.).

04

Complete the withdrawal application form by filling in all required fields accurately.

05

Attach any necessary supporting documents, such as identification, proof of hardship, or other relevant evidence.

06

Review your completed application for any errors or missing information.

07

Submit the application either online through the fund’s portal or send it via post to the address provided.

Who needs AU The Victorian Independent Schools Superannuation Fund Withdrawal?

01

Individuals who are members of the Victorian Independent Schools Superannuation Fund and wish to access their superannuation funds for eligible reasons.

02

Employees who have faced financial hardship and need to withdraw funds to alleviate their situation.

03

Members approaching retirement and looking to access their superannuation savings.

Fill

superannuation guarantee fund

: Try Risk Free

People Also Ask about pensioners australians taxation

What are the three main taxes in Australia?

The key taxes affecting businesses are Company (income) Tax, Capital Gains Tax (CGT) and the Goods and Services Tax (GST). These taxes are all set by the Australian Government.

Is Australia a highly taxed country?

Based on 2019 data and including state taxes, we are the eighth-lowest country in the OECD for tax collection relative to our economy's size, with tax revenue at 28% of GDP compared with the OECD average of 33%.

How much tax do you pay in Australia?

Calculate how much tax you'll pay Taxable incomeTax on this income0–$18,200Nil$18,201–$45,00019c for each $1 over $18,200$45,001–$120,000$5,092 plus 32.5c for each $1 over $45,000$120,001–$180,000$29,467 plus 37c for each $1 over $120,0001 more row

Is Australia tax good?

Australia has relatively low average and marginal tax rates at low income levels, but relatively high marginal tax rates at high income levels.

Are taxes higher in the US or Australia?

Taxes paid to Australia generally tend to be higher than US taxes due. The highest Australian tax rate is 45%, whereas the highest US tax rate is 37%.

Is Australia's tax system good?

Australia's individuals' income tax regime is very progressive compared with other countries. Australia has relatively low average and marginal tax rates at low income levels, but relatively high marginal tax rates at high income levels.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send partner pension for eSignature?

scheme superannuation based is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in superannuation guarantee pay?

The editing procedure is simple with pdfFiller. Open your scheme superannuation commonwealth in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out scheme commonwealth employees on an Android device?

On Android, use the pdfFiller mobile app to finish your contributory pensioners australians. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is AU The Victorian Independent Schools Superannuation Fund Withdrawal?

AU The Victorian Independent Schools Superannuation Fund Withdrawal refers to the process through which members of the Victorian Independent Schools Superannuation Fund can access their superannuation benefits, typically in cases of retirement, resignation, or financial hardship.

Who is required to file AU The Victorian Independent Schools Superannuation Fund Withdrawal?

Individuals who are members of the Victorian Independent Schools Superannuation Fund and wish to withdraw their funds due to qualifying circumstances such as retirement, resignation, or specific financial events are required to file the withdrawal.

How to fill out AU The Victorian Independent Schools Superannuation Fund Withdrawal?

To fill out the AU The Victorian Independent Schools Superannuation Fund Withdrawal, members must obtain the appropriate withdrawal form from the fund's website or office, provide personal identification details, specify the reason for withdrawal, and submit necessary documentation as required.

What is the purpose of AU The Victorian Independent Schools Superannuation Fund Withdrawal?

The purpose of the AU The Victorian Independent Schools Superannuation Fund Withdrawal is to allow eligible members to access their superannuation savings when they meet specific criteria, ensuring they can utilize their funds for retirement, personal needs, or emergencies.

What information must be reported on AU The Victorian Independent Schools Superannuation Fund Withdrawal?

The information that must be reported on AU The Victorian Independent Schools Superannuation Fund Withdrawal includes the member's personal details, membership number, amount being withdrawn, reason for withdrawal, and any supporting documents required by the fund.

Fill out your superannuation rate 2020-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Superannuation Based is not the form you're looking for?Search for another form here.

Keywords relevant to rate pay

Related to superannuation rate pay

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.