Get the free FAQs - Property Tax Credit ClaimWho can claim the Minnesota Property Tax Credit - M1...

Show details

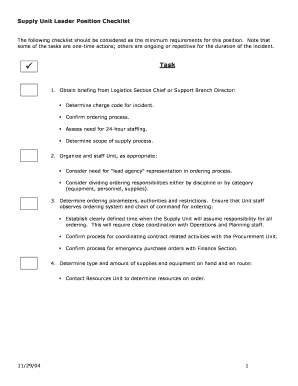

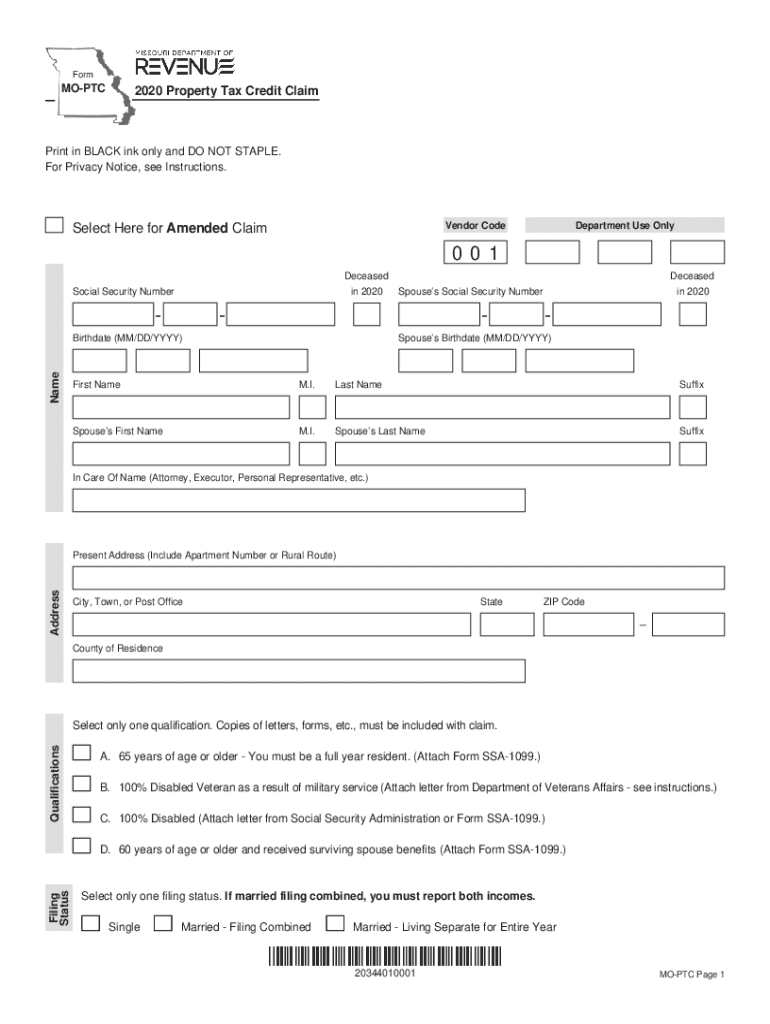

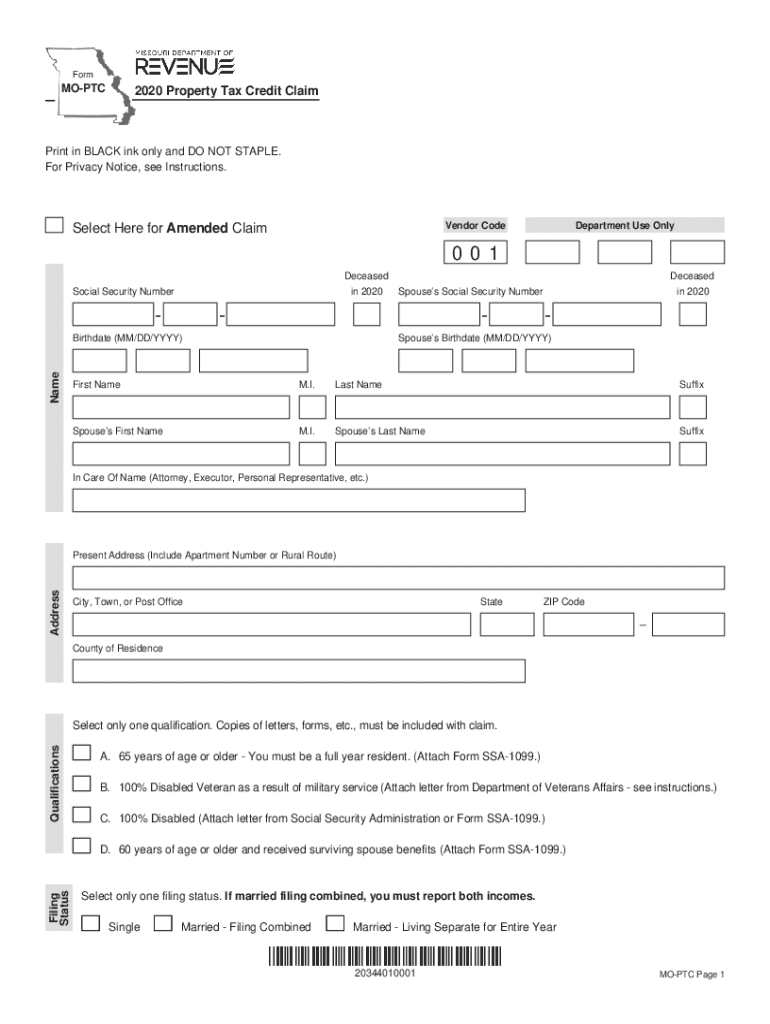

FormMOPTC2020 Property Tax Credit Claiming in BLACK ink only and DO NOT STAPLE.

For Privacy Notice, see Instructions. Vendor Code Select Here for Amended ClaimDepartment Use Only0 0 1

Deceased

in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign faqs - property tax

Edit your faqs - property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your faqs - property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit faqs - property tax online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit faqs - property tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out faqs - property tax

How to fill out faqs - property tax

01

Start by gathering all the necessary information about the property tax FAQs. This may include the most frequently asked questions by property owners, relevant tax regulations and laws, and any specific instructions provided by the tax authority.

02

Clearly define the structure and format of the FAQs. Decide on the categories or topics you want to cover and arrange them in a logical order.

03

Write each FAQ point by point, ensuring that the questions are clear, concise, and easy to understand. Use simple language and avoid technical jargon.

04

Provide accurate and up-to-date answers for each FAQ. Conduct thorough research and consult with experts if needed to ensure the correctness of the information provided.

05

Organize the FAQs in a visually appealing manner. Consider using bullet points or numbered lists for better readability.

06

Review and revise the FAQs to eliminate any errors or ambiguities. Ensure that the FAQs are consistent with the relevant tax laws and regulations.

07

Test the FAQs by sharing them with a small group of property owners or colleagues. Gather feedback and make necessary improvements based on their suggestions.

08

Publish the FAQs on the appropriate platform or medium. This could be a website, a printed booklet, or a digital document. Ensure that the FAQs are easily accessible to the target audience.

09

Regularly update the FAQs to reflect any changes in tax laws or regulations. Monitor feedback from users and address any new or frequently asked questions that arise.

10

Promote the availability of the FAQs to property owners by utilizing various communication channels such as emails, social media, or newsletters.

Who needs faqs - property tax?

01

Property owners who are subject to property tax need FAQs - property tax.

02

Tax consultants or professionals who assist property owners with tax matters can also benefit from these FAQs.

03

Individuals or organizations responsible for managing property tax systems and providing information to property owners can use FAQs as a resource.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit faqs - property tax on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share faqs - property tax from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete faqs - property tax on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your faqs - property tax. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I edit faqs - property tax on an Android device?

You can make any changes to PDF files, like faqs - property tax, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is faqs - property tax?

FAQs - property tax refers to the frequently asked questions regarding property tax, covering topics such as assessment, payment, exemptions, and filing procedures.

Who is required to file faqs - property tax?

Property owners and individuals who hold real property are typically required to file and address FAQs related to property tax.

How to fill out faqs - property tax?

To fill out FAQs - property tax, individuals should carefully read each question, provide detailed and accurate answers, and submit any required documents to the relevant tax authority.

What is the purpose of faqs - property tax?

The purpose of FAQs - property tax is to provide clear and accessible information to property owners about their tax obligations, rights, and procedures.

What information must be reported on faqs - property tax?

Information that must be reported typically includes property details, ownership information, assessed value, exemptions claimed, and payment history.

Fill out your faqs - property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Faqs - Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.