TX Comptroller 50-132 2012 free printable template

Show details

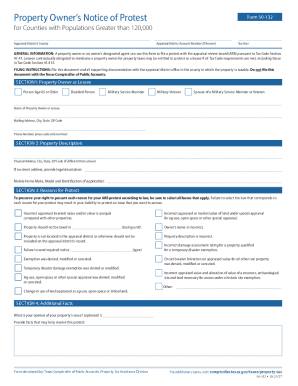

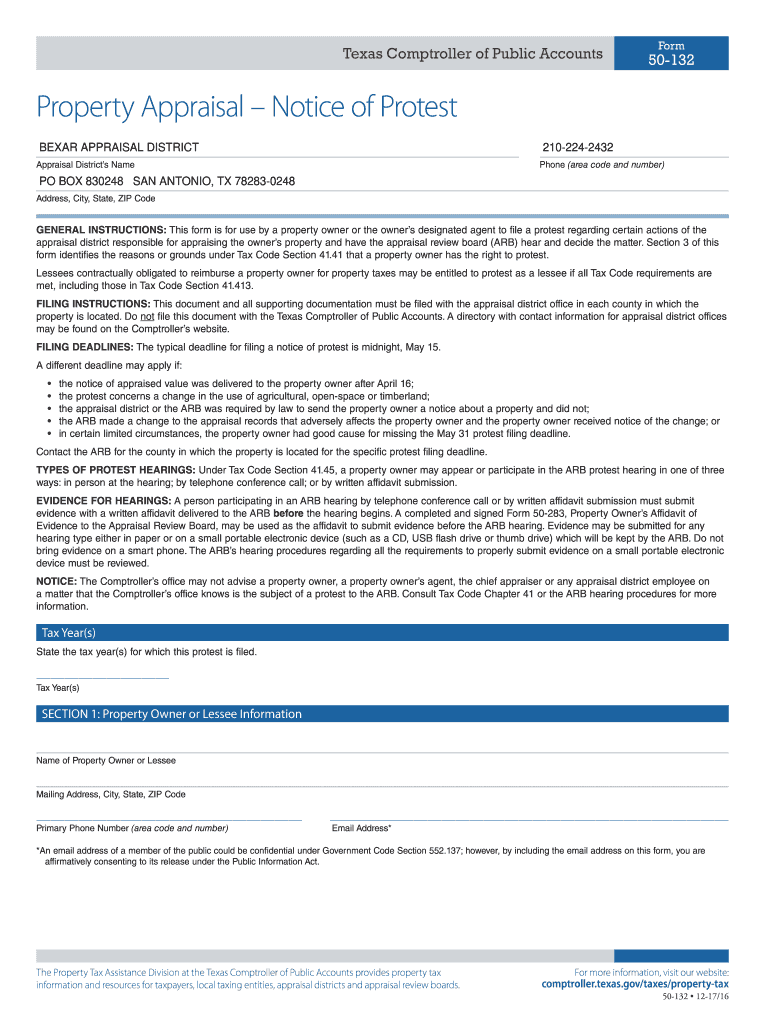

P r o p e r t y Ta x Property Appraisal Notice of Protest Form 50-132 BEXAR APPRAISAL DISTRICT 210 224-2432 Appraisal District s Name Phone area code and number PO BOX 830248 SAN ANTONIO TX 78283-0248 Address This document must be filed with the appraisal review board ARB for the appraisal district that took the action s you want to protest. It must not be filed with the office of the Texas Comptroller of Public Accounts. GENERAL INSTRUCTIONS Pursuant to Tax Code Section 41. 41 a property...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 50-132

Edit your TX Comptroller 50-132 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 50-132 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX Comptroller 50-132 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX Comptroller 50-132. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-132 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 50-132

How to fill out TX Comptroller 50-132

01

Begin by downloading the TX Comptroller Form 50-132 from the official state website.

02

In the top section, provide the name of the property owner or entity.

03

Fill in the property address, including the city, county, and zip code.

04

Indicate the type of exemption you are applying for by checking the appropriate box.

05

Include the legal description of the property, which can typically be found on your tax statement.

06

Provide the appraised value of the property as assessed by the local appraisal district.

07

If applicable, list all other exemptions currently claimed on the property.

08

Sign and date the form at the bottom to certify that the information is true and correct.

09

Submit the completed form to the local appraisal district office before the deadline.

Who needs TX Comptroller 50-132?

01

Individuals or organizations that own property and are seeking tax exemption in Texas.

02

Property owners who meet specific criteria for exemptions such as charity, religious, or educational purposes.

03

People who want to qualify for local property tax reductions based on specific state exemptions.

Fill

form

: Try Risk Free

People Also Ask about

How much is the residence homestead exemption in Texas?

For the $40,000 general residence homestead exemption, you may submit an Application for Residential Homestead Exemption (PDF) and supporting documentation, with the appraisal district where the property is located.

What is the appraisal limit for homestead exemption in Texas?

Homestead Assessed Value Maximum Technically, a Texas homestead's assessed value is limited to the lesser of either its market value or the sum of the market value of any new improvements and 110% of the appraised value of the preceding year.

How to qualify for homestead exemption in Texas residency?

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.

Can I file Texas homestead exemption online?

Our online Homestead application can be used for the following exemptions, and offers the following benefits: Exemptions: General Residence Homestead Exemption. Over 65 Exemption.

Can I file my homestead exemption online Bexar County?

The Online Services Portal is available to ALL owners that would like to conduct business with the Appraisal District electronically. This service includes filing an exemption on your residential homestead property, submitting a Notice of Protest, and receiving important notices and other information online.

How do I file my homestead exemption in Bexar County?

To apply for an exemption, call the Bexar Appraisal District at 210-224-2432. You may also contact their agency directly by email or visit their website to obtain the necessary forms. The exemption will be forwarded to the tax office as soon as the Appraisal District updates their records.

How do I submit my homestead exemption to Bexar County?

To apply for an exemption, call the Bexar Appraisal District at 210-224-2432. You may also contact their agency directly by email or visit their website to obtain the necessary forms. The exemption will be forwarded to the tax office as soon as the Appraisal District updates their records.

Where do I submit my homestead exemption Texas?

You must apply with your county appraisal district to apply for a homestead exemption. Applying is free and only needs to be filed once. The application can be found on your appraisal district website or using Texas Comptroller Form 50-114.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify TX Comptroller 50-132 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your TX Comptroller 50-132 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make edits in TX Comptroller 50-132 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit TX Comptroller 50-132 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit TX Comptroller 50-132 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign TX Comptroller 50-132 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is TX Comptroller 50-132?

TX Comptroller 50-132 is a form used in Texas for reporting information related to the exemption from property taxes for certain properties that are owned by charitable organizations or other qualifying entities.

Who is required to file TX Comptroller 50-132?

Organizations that claim a property tax exemption under the Texas Property Tax Code are required to file TX Comptroller 50-132.

How to fill out TX Comptroller 50-132?

To fill out TX Comptroller 50-132, organizations need to provide necessary details such as their name, address, the type of exemption claimed, and information specific to the property in question.

What is the purpose of TX Comptroller 50-132?

The purpose of TX Comptroller 50-132 is to formally request property tax exemptions for qualifying charitable organizations and ensure compliance with Texas tax laws.

What information must be reported on TX Comptroller 50-132?

The information that must be reported includes the organization's name, contact information, property details, the type of exempt use, and any other relevant data required by the form.

Fill out your TX Comptroller 50-132 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 50-132 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.