Get the free Credit Card Application - RBC Bank

Show details

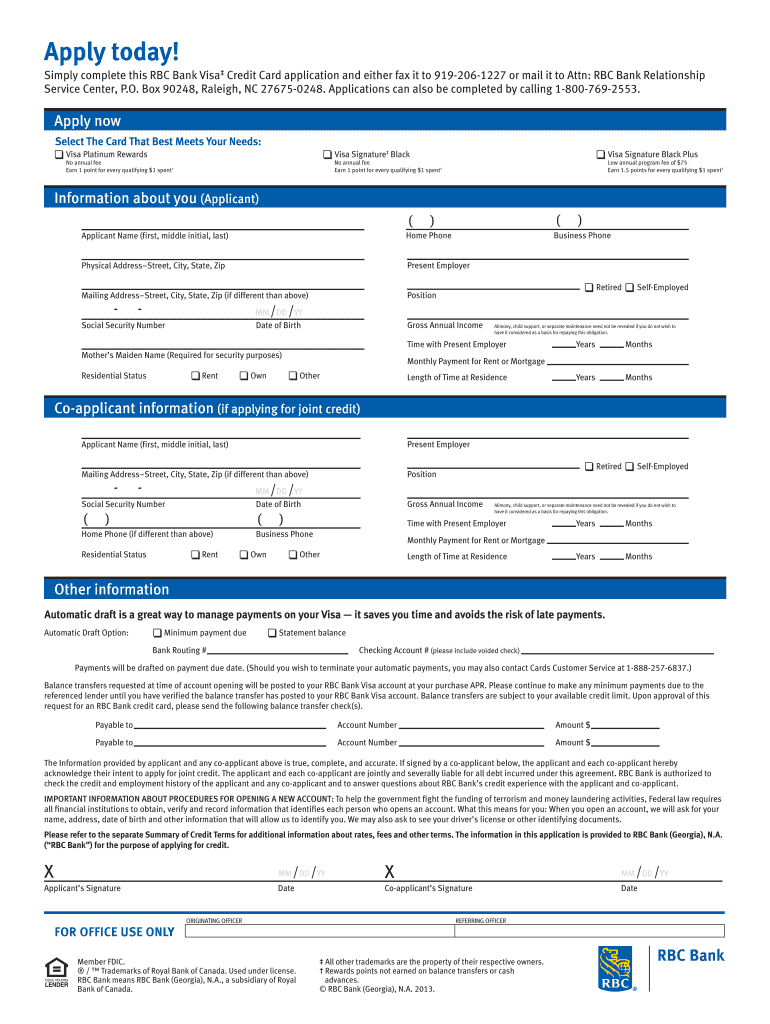

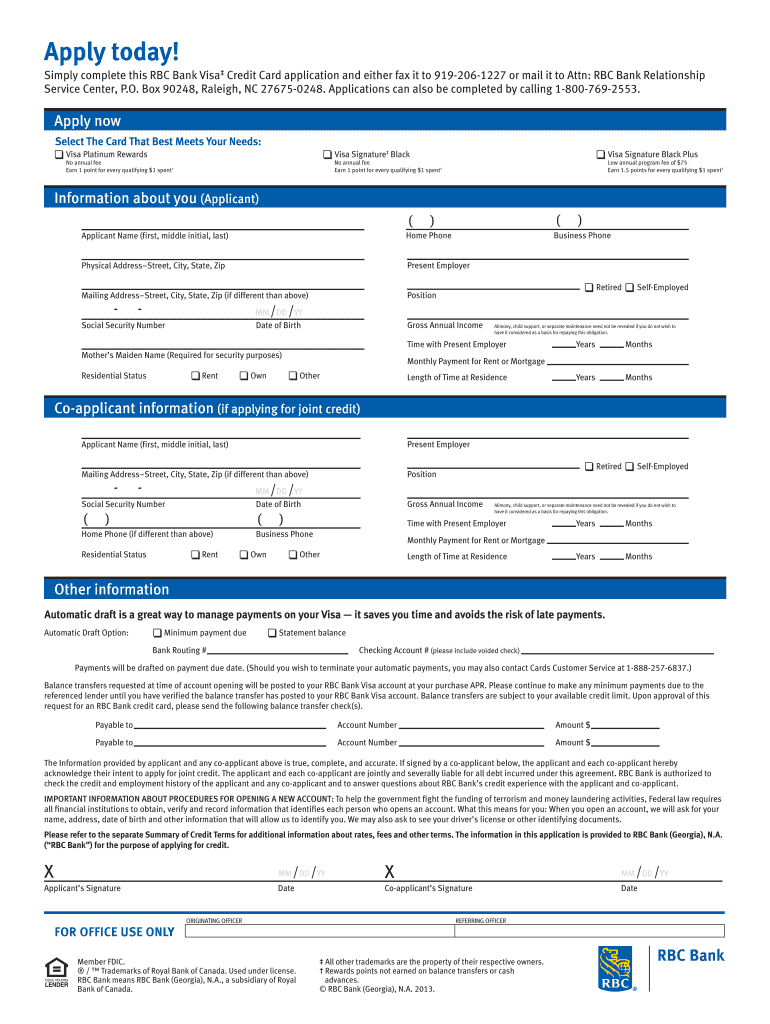

Summary of Credit Terms INTEREST RATES AND INTEREST CHARGES Visa Platinum Rewards Annual Percentage Rate (APR) for Purchases and Balance Transfers Visa Signature Black Plus Visa Signature Black 0%

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card application

Edit your credit card application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit card application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit card application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card application

How to fill out a credit card application:

01

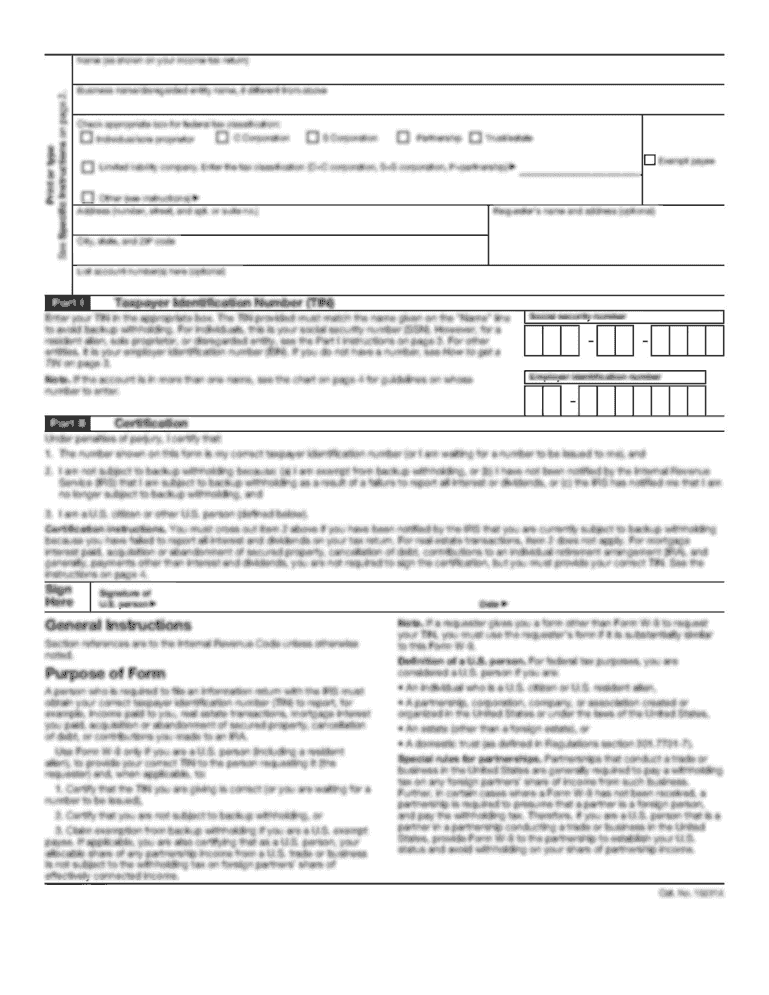

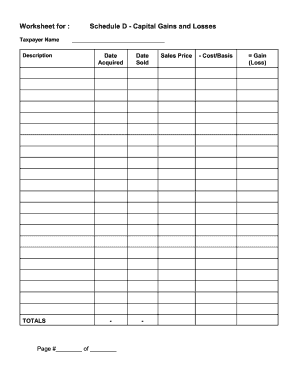

Start by gathering all the necessary information. This includes your personal details such as your full name, date of birth, address, contact information, and social security number.

02

Read through the application form carefully, making sure you understand all the terms and conditions, fees, and interest rates associated with the credit card you are applying for.

03

Provide accurate and honest information. Fill in all the required fields, including your employment details, annual income, and any other financial information requested.

04

If you are applying online, double-check your entries for any errors before submitting the application. If you're filling out a physical form, ensure your handwriting is clear and legible.

05

Consider adding an authorized user if applicable. Some credit card applications allow you to add an authorized user to your account, typically a family member or spouse.

06

Read and sign the authorization and consent section, acknowledging that you understand the terms of the credit card agreement and granting permission for the issuer to access your credit information.

07

Review your application one final time to ensure accuracy and completion. Submit the application either electronically or by mail, following the instructions provided.

08

Remember to keep a copy of the application for your records in case there are any discrepancies or issues in the future.

Who needs a credit card application?

01

Individuals who want to establish a credit history: Credit card applications are useful for individuals who have not yet established credit but are interested in building a credit history to secure loans or favorable interest rates in the future.

02

Those looking to manage their finances: Credit cards offer convenience and a way to track expenses. Applying for a credit card might be beneficial for individuals who want to budget their expenses effectively and track their spending habits.

03

People who want to earn rewards: Many credit cards offer rewards programs that allow cardholders to earn points, cashback, or travel rewards based on their spending. Those who want to take advantage of these rewards might consider filling out a credit card application.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card application to be eSigned by others?

When you're ready to share your credit card application, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Where do I find credit card application?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific credit card application and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out credit card application on an Android device?

Use the pdfFiller Android app to finish your credit card application and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is credit card application?

Credit card application is a request made by an individual to a financial institution for a credit card.

Who is required to file credit card application?

Anyone who wishes to obtain a credit card from a financial institution is required to file a credit card application.

How to fill out credit card application?

To fill out a credit card application, one must provide personal information such as name, address, employment information, and financial details.

What is the purpose of credit card application?

The purpose of a credit card application is to apply for a credit card from a financial institution in order to make purchases and payments.

What information must be reported on credit card application?

Information such as name, address, employment details, income, and other financial information must be reported on a credit card application.

Fill out your credit card application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.