Get the free Taxes for Endowments: How It Works - InvestopediaWhat You Need to Know About Endowme...

Show details

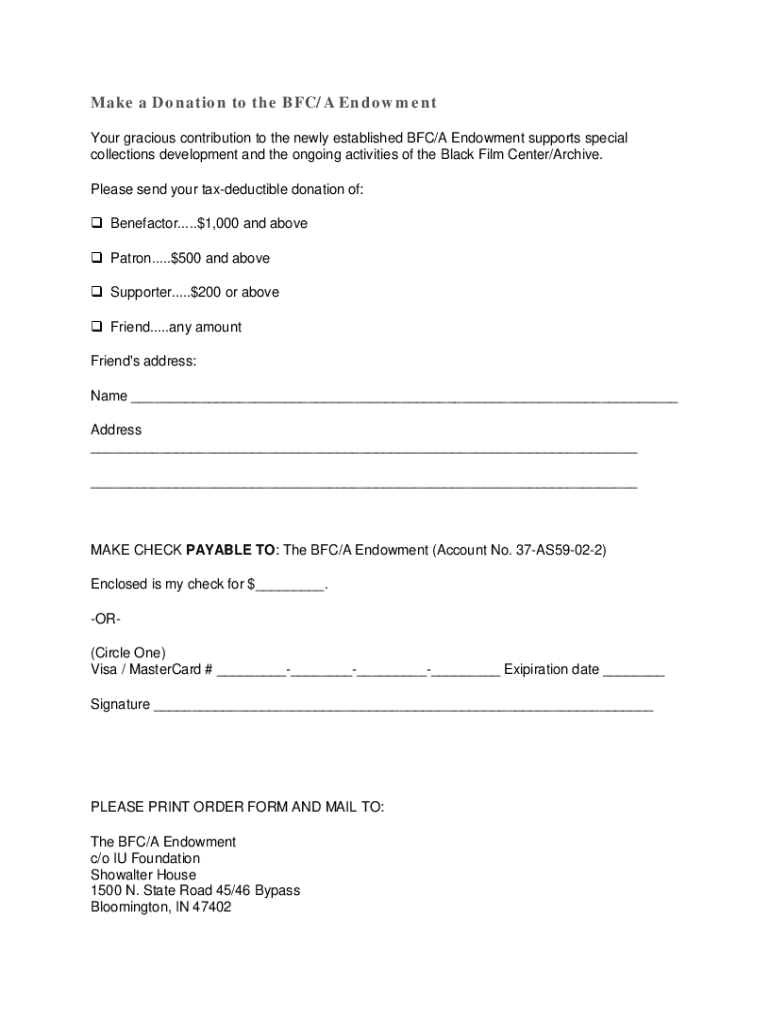

Make a Donation to the BFC/A Endowment Your gracious contribution to the newly established BFC/A Endowment supports special collections development and the ongoing activities of the Black Film Center/Archive.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxes for endowments how

Edit your taxes for endowments how form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxes for endowments how form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing taxes for endowments how online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit taxes for endowments how. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxes for endowments how

How to fill out taxes for endowments how

01

To fill out taxes for endowments, follow these steps:

02

Gather all relevant financial documents related to the endowments, such as income statements, expense reports, and investment records.

03

Determine the type of tax return form you need to file for endowments, which may vary depending on the organization's tax-exempt status and the size of the endowment.

04

Consult with a tax professional or use tax software to correctly fill out the tax return form. Provide accurate information about the endowment's income, expenses, and any applicable deductions.

05

Pay close attention to any specific tax regulations or requirements related to endowments, such as reporting guidelines for restricted funds or special treatments for investment income.

06

Calculate the endowment's taxable income and determine any tax liability. This may involve applying tax rates and deductions according to relevant tax laws.

07

Double-check all entries and calculations on the tax return form to ensure accuracy and completeness.

08

File the completed tax return form with the appropriate tax authority, following their submission instructions and deadlines.

09

Keep copies of all relevant documents and tax filings related to the endowment for future reference and record-keeping purposes.

10

Consider seeking professional tax advice or assistance if you encounter complex tax situations or have specific questions about filing taxes for endowments.

11

Regularly review and update your understanding of tax laws and regulations to stay compliant with any changes that may affect endowment taxation.

Who needs taxes for endowments how?

01

Taxes for endowments are typically needed by organizations or institutions that have established endowment funds. This includes:

02

- Non-profit organizations, such as universities, colleges, or religious institutions, that rely on endowments to fund various activities, scholarships, or operations.

03

- Foundations or charitable organizations that manage endowments to support specific causes or initiatives.

04

- Cultural institutions, museums, or art organizations that use endowments to preserve and promote cultural heritage or artistic endeavors.

05

- Healthcare organizations or hospitals that have endowment funds to finance medical research, patient care, or facility maintenance.

06

- Community foundations that gather and distribute funds through endowments to address local needs and support social welfare programs.

07

These are just a few examples, and various other entities may also have endowments requiring tax reporting and compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send taxes for endowments how to be eSigned by others?

Once you are ready to share your taxes for endowments how, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for signing my taxes for endowments how in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your taxes for endowments how right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit taxes for endowments how on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign taxes for endowments how. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is taxes for endowments how?

Taxes for endowments refer to the tax obligations that apply to income generated from an endowment fund. Endowments are typically established to provide ongoing support for an organization, such as a nonprofit or educational institution, and the income generated may be subject to various forms of taxation depending on the type of organization and the nature of the income.

Who is required to file taxes for endowments how?

Generally, the organization managing the endowment is required to file taxes for the income generated by the endowment. This includes non-profit organizations, universities, and other entities holding endowments that realize taxable income.

How to fill out taxes for endowments how?

Filling out taxes for endowments typically involves completing the appropriate tax forms, such as Form 990 for non-profits or other relevant forms based on the organization's tax status. It's important to report all income generated from the endowment as well as any applicable deductions or credits.

What is the purpose of taxes for endowments how?

The purpose of taxes for endowments is to ensure that income generated from the invested endowment funds is reported and taxed accordingly, contributing to governmental revenue and ensuring compliance with tax laws.

What information must be reported on taxes for endowments how?

Organizations must report the total income generated from the endowment, expenses related to managing the endowment, and any distributions made from the endowment, along with supporting documentation to justify these figures.

Fill out your taxes for endowments how online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxes For Endowments How is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.