Get the free Charity Contributions, Gifts As Tax Deduction - eFile.com

Show details

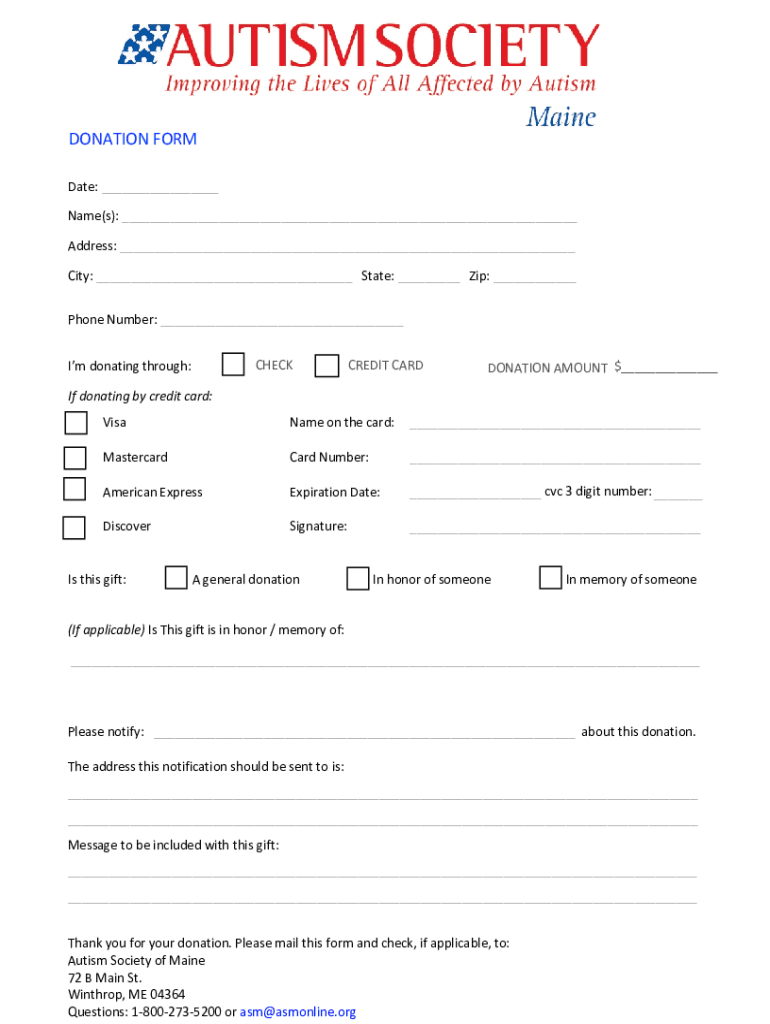

DONATION FORM Date: Name(s): Address: City: State: Zip: Phone Number: I'm donating through:CHECKERED CARBONATION AMOUNT $ If donating by credit card:Misname on the card: MastercardCard Number: American

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charity contributions gifts as

Edit your charity contributions gifts as form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charity contributions gifts as form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charity contributions gifts as online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit charity contributions gifts as. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charity contributions gifts as

How to fill out charity contributions gifts as

01

To fill out charity contributions gifts, follow these steps:

02

Begin by gathering all the necessary information, including the name and contact details of the organization you are making the contribution to, as well as the amount of the gift.

03

Visit the organization's website or contact them directly to determine the preferred method of accepting charity contributions gifts.

04

If donating online, navigate to the organization's donation page and provide the required information, such as your name, address, and payment details.

05

If donating by check, write the organization's name on the payee line, write the gift amount in numbers and words on the appropriate lines, and sign the check.

06

If donating by cash, ensure you have a receipt or acknowledgement from the organization to keep for your records.

07

After completing the donation, consider whether you want to receive a tax deduction for your contribution. If so, be sure to obtain a receipt or acknowledgement from the organization that specifies the tax-exempt status.

08

Finally, keep a record of the contribution for your own reference and tax purposes.

Who needs charity contributions gifts as?

01

Charity contributions gifts are needed by various individuals, organizations, and causes. Some potential recipients of charity contributions gifts include:

02

- Non-profit organizations that rely on contributions to support their programs and initiatives.

03

- Individuals or families experiencing financial hardships, who may benefit from assistance for basic necessities such as food, shelter, or healthcare.

04

- Students or educational institutions in need of funding for scholarships, educational resources, or infrastructure improvements.

05

- Community development programs aimed at improving living conditions, empowering marginalized groups, or fostering social and economic growth.

06

- Research organizations or medical facilities seeking support for innovative research, clinical trials, or patient care.

07

- Environmental conservation initiatives dedicated to preserving natural resources, protecting endangered species, or promoting sustainable practices.

08

In summary, charity contributions gifts are important and necessary for a wide range of individuals, groups, and causes striving to make a positive impact in their respective areas of focus.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in charity contributions gifts as?

With pdfFiller, it's easy to make changes. Open your charity contributions gifts as in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the charity contributions gifts as electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your charity contributions gifts as in minutes.

Can I create an eSignature for the charity contributions gifts as in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your charity contributions gifts as and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is charity contributions gifts as?

Charity contributions gifts refer to donations made to nonprofit organizations that are recognized as tax-exempt under the Internal Revenue Code. These contributions can be in the form of cash, property, or services and may be deductible for tax purposes.

Who is required to file charity contributions gifts as?

Individuals who make charitable contributions and wish to claim a tax deduction on their annual tax return are required to file charity contributions gifts as. Furthermore, organizations that receive these donations may also need to report them.

How to fill out charity contributions gifts as?

To fill out charity contributions gifts, taxpayers generally complete Schedule A (Form 1040) if they itemize deductions, detailing the amount and type of contributions made, as well as the names of the charities.

What is the purpose of charity contributions gifts as?

The purpose of charity contributions gifts is to allow taxpayers to receive tax benefits for their generous donations to qualified charitable organizations, thereby encouraging philanthropy and support for community initiatives.

What information must be reported on charity contributions gifts as?

Taxpayers must report the total amount of charitable contributions, the names of the organizations to which they donated, and may need to provide additional details for contributions exceeding certain thresholds, such as the date and description of the donated property.

Fill out your charity contributions gifts as online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charity Contributions Gifts As is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.