Get the free WILLIE 0 BURR TRUST FBO LARRABEE FUND

Show details

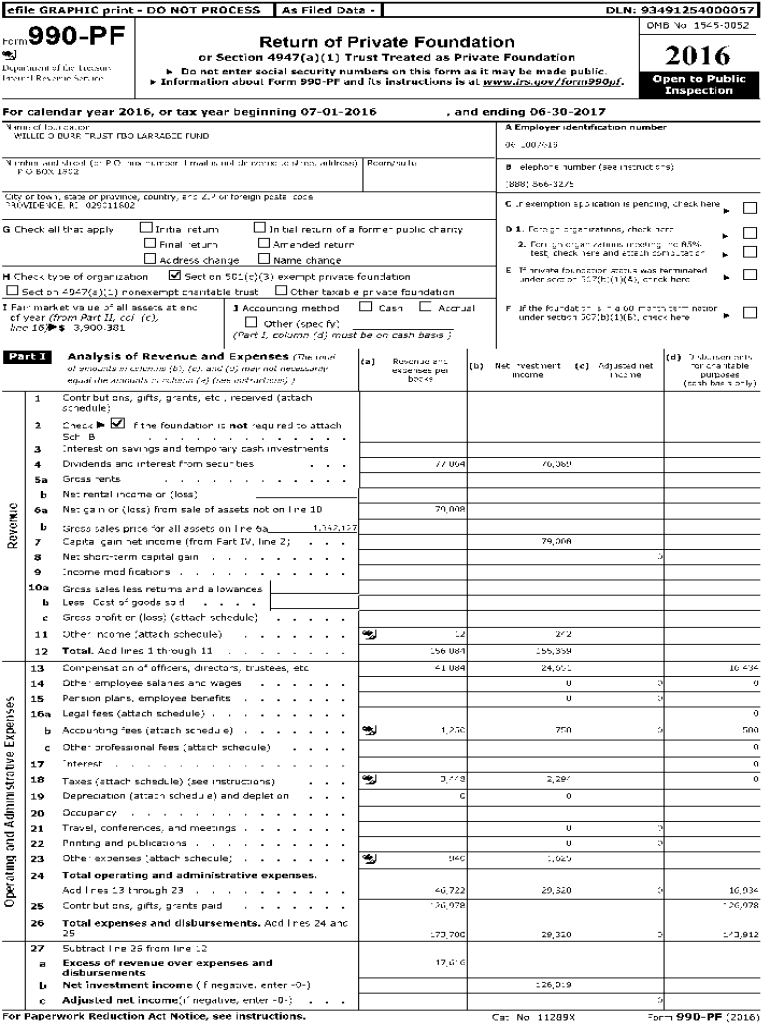

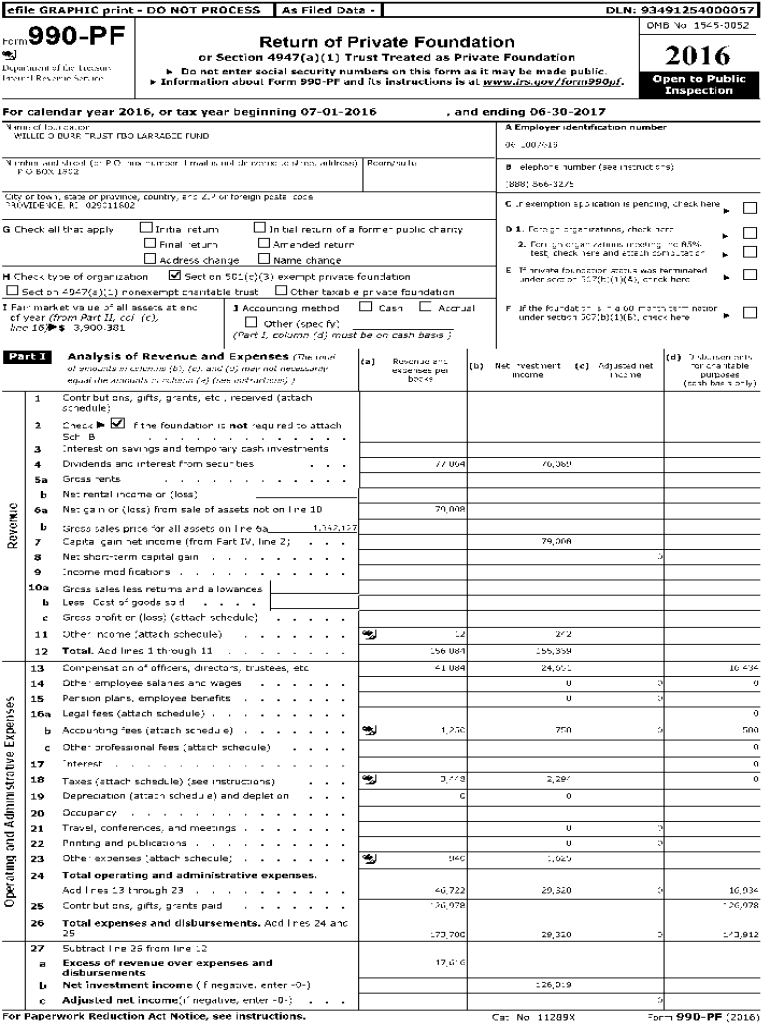

Le file GRAPHIC print DO NOT PROCESS Format Filed Data DAN:93491254000057 OMB No 15450052990PFReturn of Private Foundation2016or Section 4947(a)(1) Trust Treated as Private Foundation Department of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign willie 0 burr trust

Edit your willie 0 burr trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your willie 0 burr trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing willie 0 burr trust online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit willie 0 burr trust. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out willie 0 burr trust

How to fill out willie 0 burr trust

01

To fill out the Willie 0 Burr Trust, follow these steps:

02

Start by gathering all the necessary information and documents, such as the trust's purpose, beneficiaries, assets, and trustees.

03

Create a trust document that clearly states the intentions and provisions of the trust. This document should outline how the trust will be administered, distributed, and managed.

04

Identify the trustee(s) who will be responsible for the management and protection of the trust's assets and beneficiaries' interests. Consider selecting someone with significant financial knowledge and trust administration experience.

05

Specify the beneficiaries of the trust, ensuring their names and relationship to the grantor are clearly mentioned.

06

List all assets that will be placed in the trust, including but not limited to properties, finances, investments, and personal belongings. Provide detailed descriptions and valuations where applicable.

07

Determine any conditions, restrictions, or special instructions regarding the trust's administration, such as when distributions can be made to beneficiaries or under what circumstances the trust can be modified or terminated.

08

Review the trust document thoroughly to ensure accuracy and legality. Seek legal advice if needed.

09

Once satisfied with the trust document, execute it by signing it in the presence of a notary public or witnesses, as per the applicable legal requirements.

10

Store copies of the executed trust document in a safe and accessible location, and inform the trustee(s) and beneficiaries about its existence and location.

11

It's crucial to seek professional legal advice while filling out the Willie 0 Burr Trust to ensure compliance with relevant laws and to address any specific circumstances or concerns.

12

Note: The provided steps are a general guide and may vary depending on individual circumstances and legal jurisdictions.

Who needs willie 0 burr trust?

01

The Willie 0 Burr Trust may be suitable for individuals or families who:

02

- Wish to protect and manage their assets for the benefit of their beneficiaries after their demise

03

- Prefer to have a trusted third-party oversee the administration and distribution of their assets

04

- Want to minimize potential probate complications and costs

05

- Desire to maintain privacy and confidentiality regarding their estate plan

06

- Have complex financial or personal situations that require specialized trust arrangements

07

- Intend to support charitable causes or organizations through their assets

08

It's important to consult with a legal professional to evaluate individual circumstances and determine whether the Willie 0 Burr Trust is appropriate for specific needs and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send willie 0 burr trust to be eSigned by others?

Once your willie 0 burr trust is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make edits in willie 0 burr trust without leaving Chrome?

willie 0 burr trust can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the willie 0 burr trust in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your willie 0 burr trust.

What is willie 0 burr trust?

The Willie 0 Burr Trust is a type of irrevocable trust that is often utilized for estate planning, asset protection, and tax strategies.

Who is required to file willie 0 burr trust?

Typically, the trustee of the Willie 0 Burr Trust is required to file any necessary tax forms, while the grantor should be aware of the reporting obligations.

How to fill out willie 0 burr trust?

Filling out the Willie 0 Burr Trust usually involves completing the trust document with pertinent information about the trust assets, beneficiaries, and the terms of management.

What is the purpose of willie 0 burr trust?

The purpose of the Willie 0 Burr Trust is to manage and protect assets, provide for beneficiaries, avoid probate, and potentially reduce estate taxes.

What information must be reported on willie 0 burr trust?

Information typically reported includes the trust's income, expenses, distributions to beneficiaries, and details about trust assets.

Fill out your willie 0 burr trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Willie 0 Burr Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.