Get the free Opening BalancesInitial Audit Engagements, Including ...Financial Audit ChecklistPro...

Show details

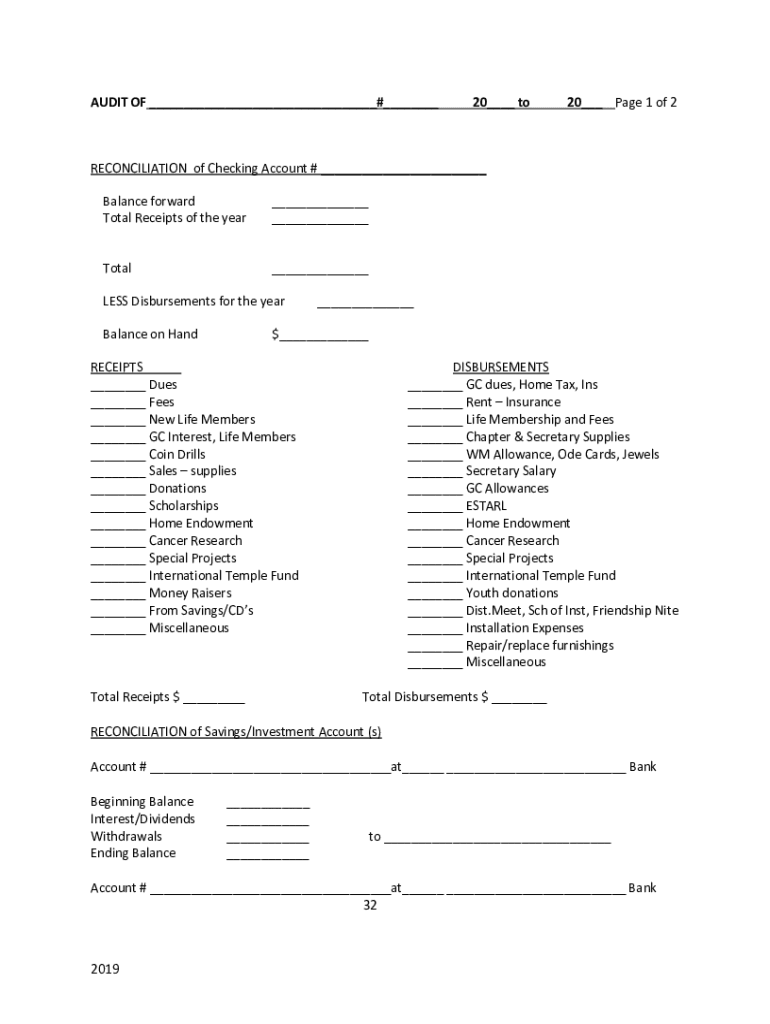

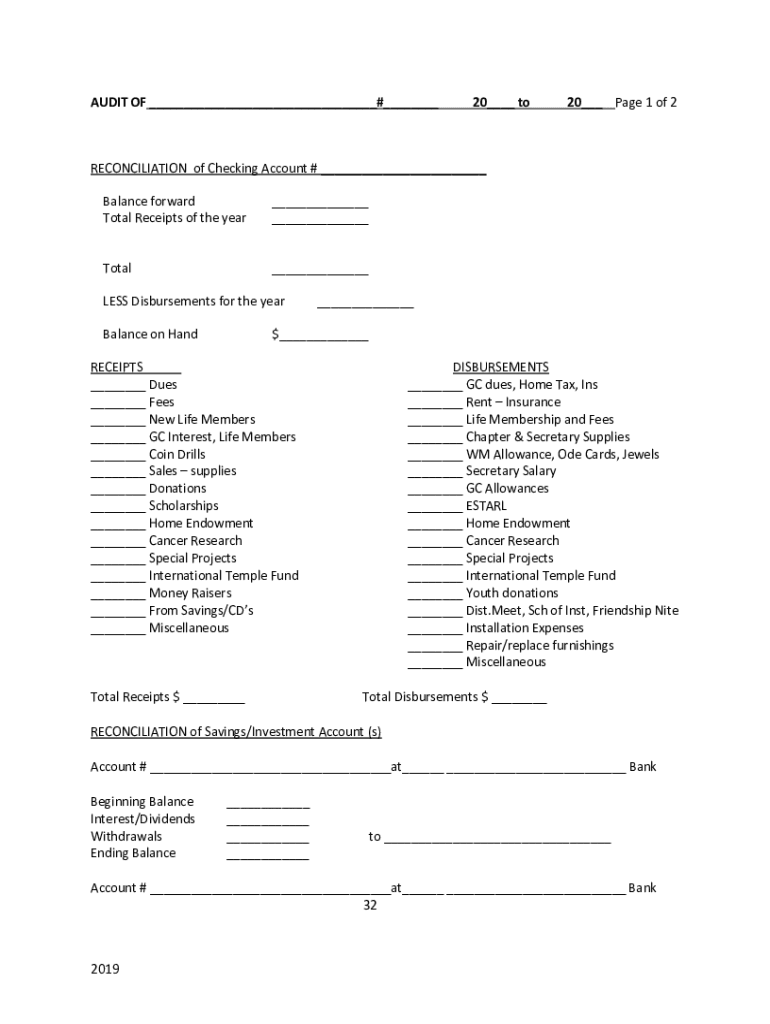

AUDIT OF # 20 to20 Page 1 of 2RECONCILIATION of Checking Account # Balance forward Total Receipts of the year Total LESS Disbursements for the year Balance on Hand $ RECEIPTS Dues Fees New Life Members

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign opening balancesinitial audit engagements

Edit your opening balancesinitial audit engagements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your opening balancesinitial audit engagements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit opening balancesinitial audit engagements online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit opening balancesinitial audit engagements. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out opening balancesinitial audit engagements

How to fill out opening balancesinitial audit engagements

01

To fill out opening balances in initial audit engagements, follow these steps:

02

Collect all relevant financial statements from the previous accounting period.

03

Review the balance sheet, profit and loss statement, and cash flow statement to identify the opening balances for each account.

04

Verify the accuracy of the opening balances by comparing them with supporting documents and records.

05

Record the opening balances in the appropriate accounts in the new accounting system.

06

Reconcile the opening balances with the closing balances from the previous accounting period to ensure consistency.

07

Prepare a summary of the opening balances and include it in the audit documentation for reference.

08

Conduct a thorough audit of the opening balances to identify any discrepancies or errors.

09

Make necessary adjustments or corrections based on the audit findings.

10

Communicate the finalized opening balances to relevant stakeholders and ensure they are properly reflected in financial reports.

11

Document the entire process and findings in the audit report.

Who needs opening balancesinitial audit engagements?

01

Opening balances in initial audit engagements are needed by auditors, accounting firms, and organizations undergoing an audit or financial review.

02

Auditors rely on opening balances to establish the starting point for their audit procedures and to ensure the accuracy of financial statements.

03

Accounting firms require opening balances to initiate the accounting process for a new client and to establish a foundation for further recordkeeping.

04

Organizations undergoing an audit or financial review need to provide opening balances as part of their financial statements and disclosures.

05

These opening balances serve as the basis for comparative analysis and help identify any significant changes or discrepancies in financial performance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send opening balancesinitial audit engagements to be eSigned by others?

When your opening balancesinitial audit engagements is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I edit opening balancesinitial audit engagements on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing opening balancesinitial audit engagements.

How can I fill out opening balancesinitial audit engagements on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your opening balancesinitial audit engagements, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is opening balancesinitial audit engagements?

Opening balances in initial audit engagements refer to the financial position of a company at the start of the audit period, which includes assets, liabilities, and equity as reported in the company's financial statements.

Who is required to file opening balancesinitial audit engagements?

Entities that are undergoing their first audit or have recently transitioned from one accounting framework to another are required to file opening balances in initial audit engagements.

How to fill out opening balancesinitial audit engagements?

To fill out opening balances in initial audit engagements, auditors must obtain the prior period financial statements, verify the amounts with supporting documents, and ensure they comply with the relevant accounting standards.

What is the purpose of opening balancesinitial audit engagements?

The purpose of opening balances in initial audit engagements is to ensure that the financial statements are consistent and correctly reflect the company's financial position at the start of the audit period.

What information must be reported on opening balancesinitial audit engagements?

The information that must be reported includes the total amounts of assets, liabilities, and equity, as well as any adjustments made to the previous period's financial statements.

Fill out your opening balancesinitial audit engagements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Opening Balancesinitial Audit Engagements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.