Get the free Estimated Taxes for IndividualsInternal Revenue Service

Show details

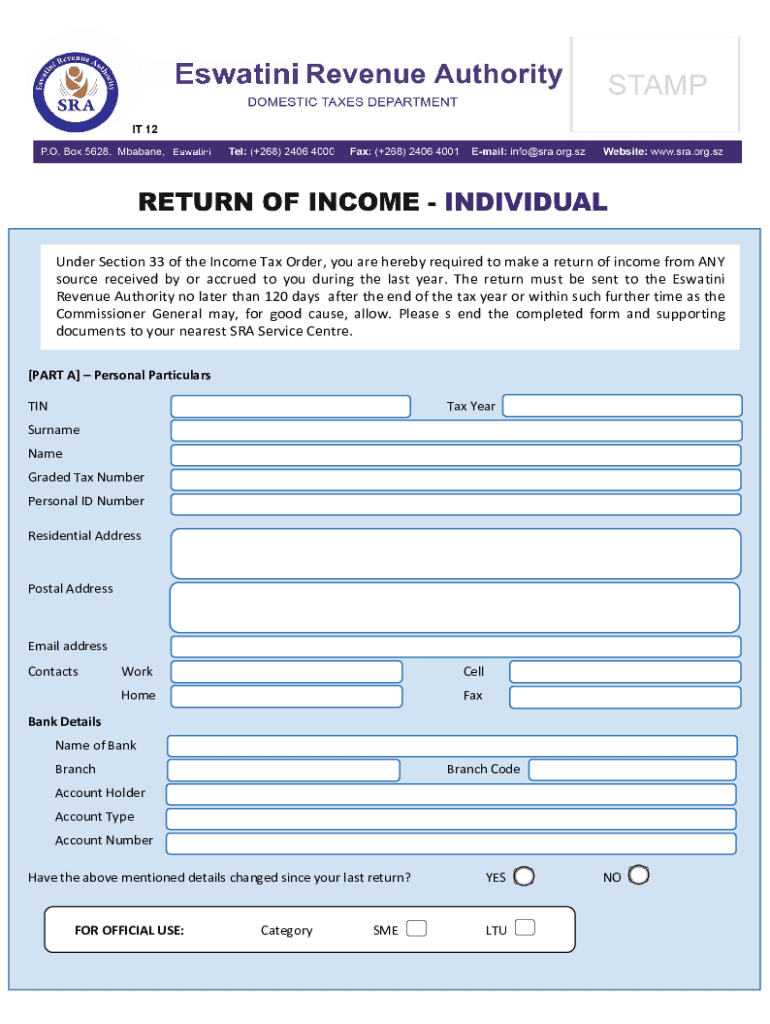

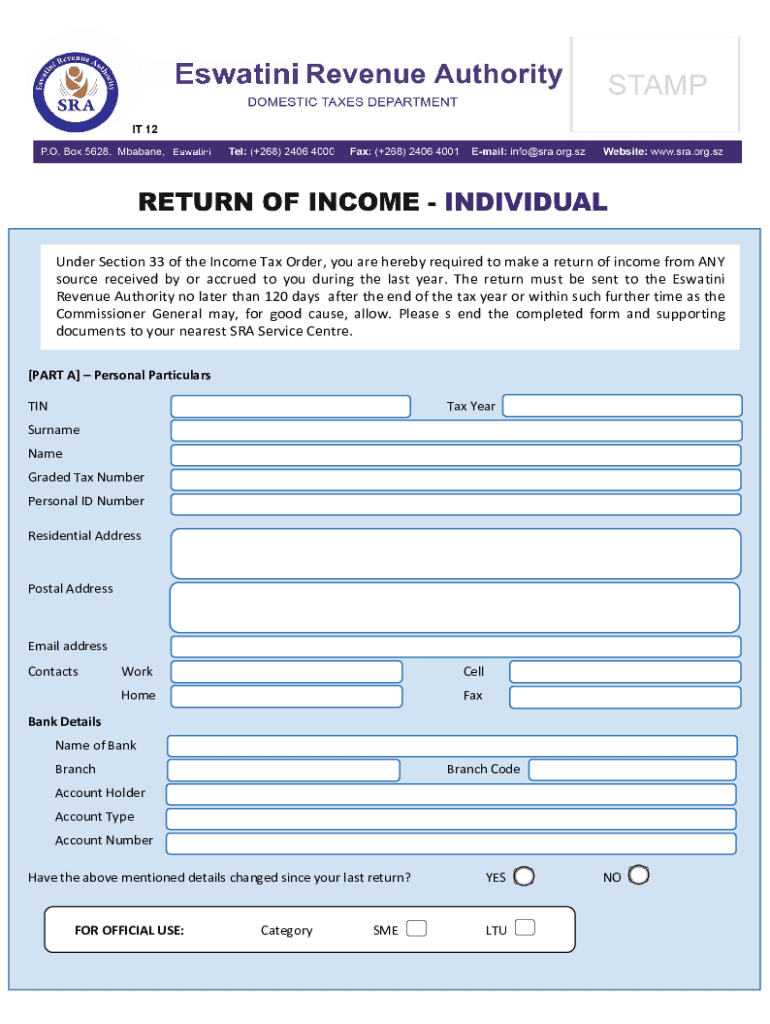

SWAT i NI SWAT i under Section 33 of the Income Tax Order, you are hereby required to make a return of income from ANY source received by or accrued to you during the last year. The return must be

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estimated taxes for individualsinternal

Edit your estimated taxes for individualsinternal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estimated taxes for individualsinternal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing estimated taxes for individualsinternal online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit estimated taxes for individualsinternal. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estimated taxes for individualsinternal

How to fill out estimated taxes for individualsinternal

01

To fill out estimated taxes for individuals, follow these steps:

02

Determine your filing status: Decide whether you are single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

03

Estimate your total income: Add up all sources of income, including wages, self-employment income, interest, dividends, and any other taxable income.

04

Calculate your deductions: Consider any deductions you qualify for, such as student loan interest, self-employment tax, business expenses, and itemized deductions.

05

Calculate your credits: Determine any tax credits you are eligible for, such as the Earned Income Credit, Child Tax Credit, or Education Credits.

06

Determine your estimated tax liability: Use the current year's tax tables or tax rates to calculate the amount of tax you owe on your estimated income.

07

Subtract any withholding or estimated tax payments already made: If you have made any tax payments throughout the year, subtract them from your estimated tax liability.

08

File Form 1040-ES: Use Form 1040-ES to report your estimated tax payments and calculate any penalties or interest you owe for underpayment.

09

Make quarterly estimated tax payments: Pay your estimated taxes in four equal installments throughout the year, typically due on April 15th, June 15th, September 15th, and January 15th of the following year.

10

Keep records: Maintain detailed records of all your estimated tax payments and calculations for future reference or to support any deductions or credits claimed on your tax return.

11

Review and adjust: Regularly review your estimated tax payments to ensure they accurately reflect your current income and tax situation. Adjust your payments as necessary to avoid underpayment penalties.

Who needs estimated taxes for individualsinternal?

01

Estimated taxes for individuals are generally needed by self-employed individuals, freelancers, independent contractors, and people who receive income not subject to withholding. It is also necessary for individuals who expect to owe at least $1,000 in tax after subtracting withholding and refundable credits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send estimated taxes for individualsinternal for eSignature?

Once you are ready to share your estimated taxes for individualsinternal, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I execute estimated taxes for individualsinternal online?

With pdfFiller, you may easily complete and sign estimated taxes for individualsinternal online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I edit estimated taxes for individualsinternal on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign estimated taxes for individualsinternal on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is estimated taxes for individualsinternal?

Estimated taxes for individuals refer to the payments made to the IRS on a quarterly basis by individuals who do not have enough withholding from their paychecks throughout the year to cover their tax obligations.

Who is required to file estimated taxes for individualsinternal?

Individuals are required to file estimated taxes if they expect to owe at least $1,000 in tax for the year after subtracting withholding and refundable credits, or if they expect their withholding and credits to be less than 90% of the tax for the current year.

How to fill out estimated taxes for individualsinternal?

To fill out estimated taxes, individuals should use IRS Form 1040-ES, which includes a worksheet to estimate tax liability based on expected income, deductions, and credits. The form also provides payment vouchers to send with each quarterly payment.

What is the purpose of estimated taxes for individualsinternal?

The purpose of estimated taxes is to allow taxpayers to pay tax on income that is not subject to withholding, ensuring that they meet their tax liabilities throughout the year rather than paying a lump sum when filing their annual tax return.

What information must be reported on estimated taxes for individualsinternal?

Individuals must report their expected income, deductions, and credits for the year, as well as the total amount of estimated tax they expect to owe and any prior year's overpayment that they wish to apply to the current year's estimated tax.

Fill out your estimated taxes for individualsinternal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estimated Taxes For Individualsinternal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.