Get the free Buy To Let Mortgage Form - POSITIVE LENDING

Show details

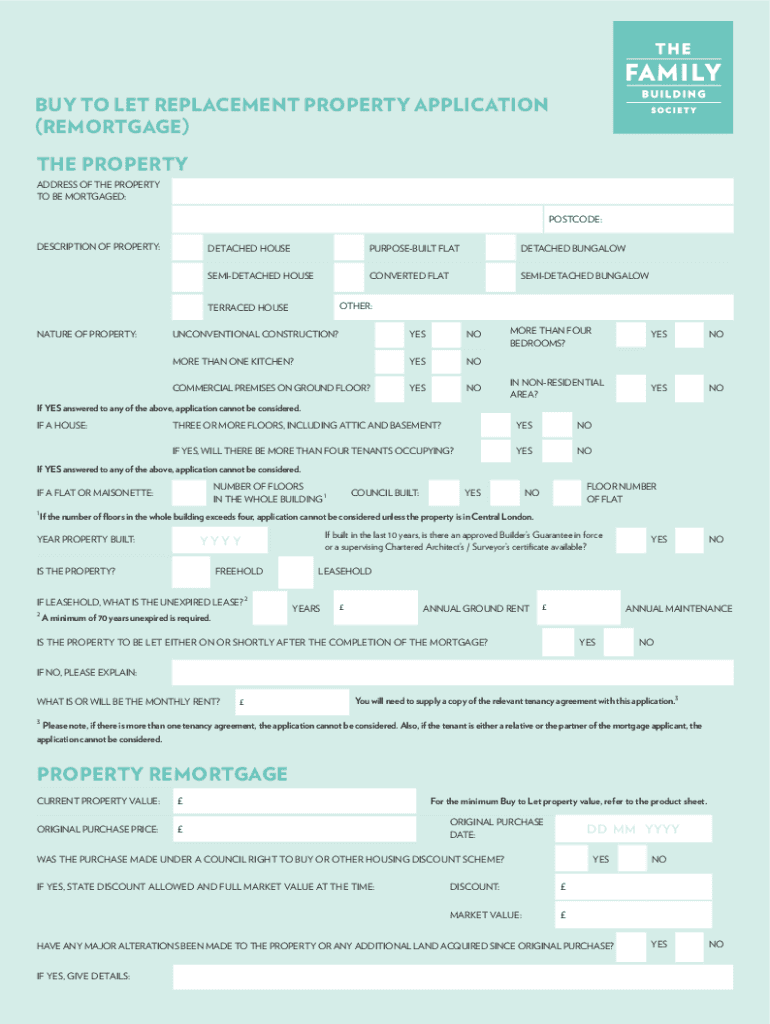

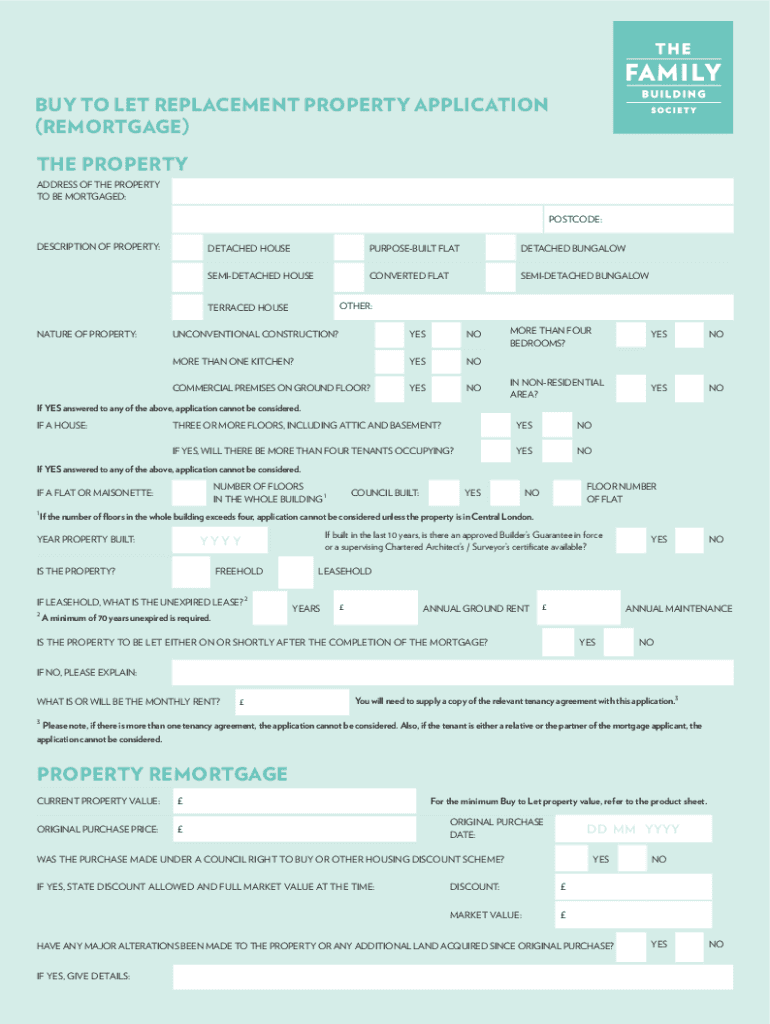

BUY TO LET REPLACEMENT PROPERTY APPLICATION

(REMORTGAGE)

THE PROPERTY

ADDRESS OF THE PROPERTY

TO BE MORTGAGED:

POSTCODE:

DESCRIPTION OF PROPERTY:DETACHED HOUSEPURPOSEBUILT FLATDETACHED BUNGALOWSEMIDETACHED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign buy to let mortgage

Edit your buy to let mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your buy to let mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit buy to let mortgage online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit buy to let mortgage. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out buy to let mortgage

How to fill out buy to let mortgage

01

To fill out a buy to let mortgage, follow these steps:

02

Research lenders: Find out which banks and financial institutions offer buy to let mortgages.

03

Compare rates: Compare interest rates and fees offered by different lenders to get the best deal.

04

Check eligibility: Ensure you meet the eligibility criteria set by the lender, such as minimum income requirements, credit score, and property type.

05

Gather documentation: Prepare the necessary documents, including proof of income, bank statements, ID proof, and property details.

06

Consult a mortgage advisor: Seek professional advice to understand the application process and get guidance on selecting the right mortgage product.

07

Complete the application: Fill out the application form with accurate information and submit it along with the required documents.

08

Undergo a valuation: The lender may conduct a valuation of the property to assess its market value and suitability for a buy to let mortgage.

09

Await approval: The lender will review your application, assess your financial stability, and make a decision on whether to approve the mortgage.

10

Complete legal formalities: Once approved, you will need to engage solicitors or conveyancers to handle the legal aspects of the mortgage, such as property searches and title transfer.

11

Finalize the mortgage: Sign the necessary documents, including the mortgage deed, and arrange for the transfer of funds to complete the purchase.

12

Remember to consider your financial situation and carefully calculate your affordability before taking on a buy to let mortgage.

Who needs buy to let mortgage?

01

Buy to let mortgages are suitable for individuals or investors who want to purchase property specifically for the purpose of renting it out to tenants.

02

Typically, the following groups of people may consider getting a buy to let mortgage:

03

- Experienced landlords who already own multiple properties and want to expand their portfolio.

04

- First-time landlords who are looking to invest in property and generate rental income as a long-term investment.

05

- Individuals who inherit a property and decide to rent it out instead of occupying it themselves.

06

- Investors who want to take advantage of potential capital appreciation in the property market and earn rental income at the same time.

07

However, it's important to note that buy to let mortgages come with specific risks and responsibilities, so it's crucial to thoroughly research and assess your financial capabilities before making a decision.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send buy to let mortgage to be eSigned by others?

When your buy to let mortgage is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get buy to let mortgage?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific buy to let mortgage and other forms. Find the template you need and change it using powerful tools.

How do I complete buy to let mortgage on an Android device?

Use the pdfFiller mobile app and complete your buy to let mortgage and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is buy to let mortgage?

A buy to let mortgage is a type of property loan specifically designed for individuals who wish to purchase property for rental purposes.

Who is required to file buy to let mortgage?

Individuals or entities that purchase property with the intention of letting it out are required to file for a buy to let mortgage.

How to fill out buy to let mortgage?

To fill out a buy to let mortgage application, you typically provide personal details, financial information, property details, and your rental income expectations.

What is the purpose of buy to let mortgage?

The purpose of a buy to let mortgage is to enable property investors to finance the purchase of a property for rental income.

What information must be reported on buy to let mortgage?

Information that must be reported includes personal identification, income details, employment status, property valuation, and projected rental income.

Fill out your buy to let mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Buy To Let Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.