Get the free KYC/AML Policy Know Your Customer, Anti-Money Laundering ...

Show details

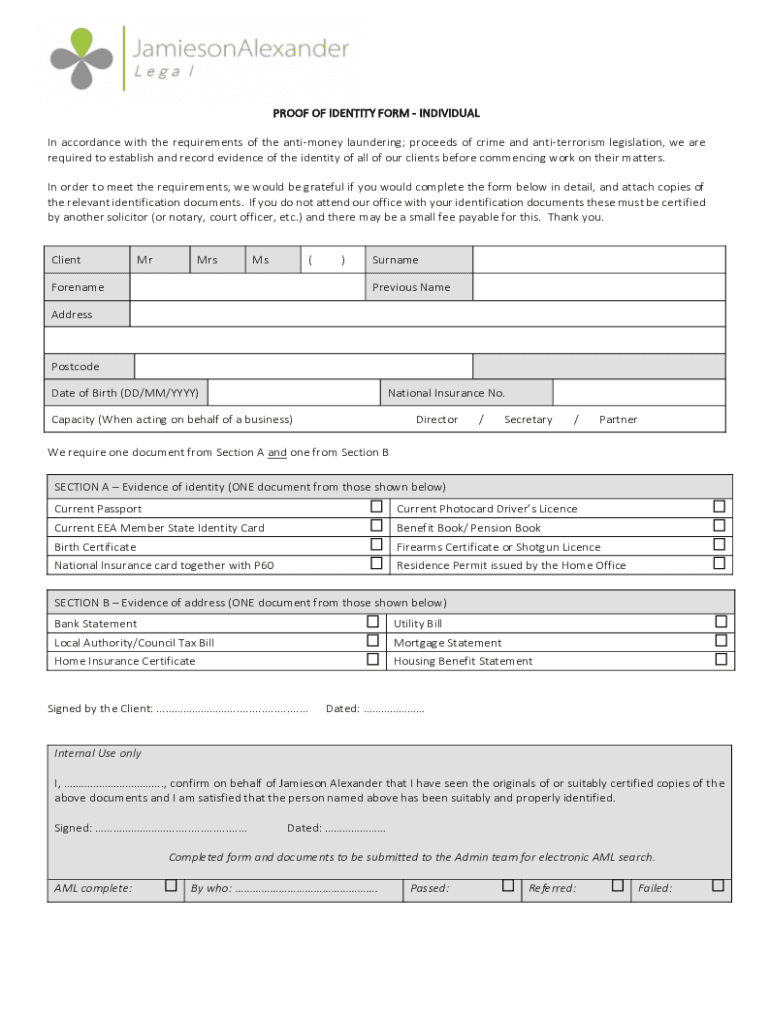

PROOF OF IDENTITY FORM INDIVIDUAL In accordance with the requirements of the antimony laundering; proceeds of crime and antiterrorist legislation, we are required to establish and record evidence

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kycaml policy know your

Edit your kycaml policy know your form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kycaml policy know your form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kycaml policy know your online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit kycaml policy know your. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out kycaml policy know your

How to fill out kycaml policy know your

01

To fill out KYC/AML policy (Know Your Customer/Anti-Money Laundering), follow these steps:

02

Gather required documents: Collect identification proof such as passport, driver's license, or national ID, and address proof like utility bills, bank statements, or lease agreements.

03

Verify customer identity: Validate the provided identification documents by cross-checking them with reliable sources. Ensure the documents are genuine and current.

04

Conduct risk assessment: Evaluate the customer's risk level based on factors like their background, transaction history, and the nature of their business activities.

05

Record information: Record all the relevant details about the customer, including their name, date of birth, address, contact information, and any other additional data required by regulatory bodies.

06

Implement identity verification measures: Utilize verification methods like face-to-face interactions, digital identity verification services, or document validation systems to authenticate the customer's identity.

07

Monitor transactions: Regularly monitor and analyze the customer's transaction patterns and behavior to identify any suspicious activities or signs of money laundering.

08

Educate employees: Train your staff members to identify potential risks and suspicious activities that might arise during the customer onboarding process.

09

Regularly update the policy: Keep your KYC/AML policy up to date with the evolving regulations and changes in the risk landscape to ensure compliance and effectiveness.

10

Seek legal advice if needed: Consult legal professionals to ensure your KYC/AML policy adheres to all applicable laws and regulations.

Who needs kycaml policy know your?

01

KYC/AML policy (Know Your Customer/Anti-Money Laundering) is necessary for various entities and industries, including but not limited to:

02

- Banks and financial institutions

03

- Insurance companies

04

- Cryptocurrency exchanges

05

- Fintech startups

06

- Money service businesses

07

- Real estate agencies

08

- Law firms

09

- Gaming and gambling platforms

10

- Non-profit organizations

11

- Trading platforms

12

Essentially, any organization that deals with financial transactions or has potential exposure to money laundering risks should implement KYC/AML policy to mitigate regulatory non-compliance and safeguard against illicit activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute kycaml policy know your online?

pdfFiller makes it easy to finish and sign kycaml policy know your online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit kycaml policy know your online?

With pdfFiller, it's easy to make changes. Open your kycaml policy know your in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out kycaml policy know your on an Android device?

Use the pdfFiller mobile app and complete your kycaml policy know your and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is kycaml policy know your?

The kycaml policy, or Know Your Customer Anti-Money Laundering policy, is a set of procedures and regulations implemented by businesses to verify the identity of their clients and assess potential risks for illegal activities.

Who is required to file kycaml policy know your?

Businesses in regulated sectors such as financial services, banking, insurance, and any other sectors that deal with customer funds are required to file the kycaml policy.

How to fill out kycaml policy know your?

To fill out the kycaml policy, one must gather customer identification information, verify the identity through reliable documents, assess the risk level, and document all details according to the regulatory requirements.

What is the purpose of kycaml policy know your?

The purpose of the kycaml policy is to prevent money laundering, terrorist financing, and other financial crimes by ensuring businesses understand their customers and their financial dealings.

What information must be reported on kycaml policy know your?

Reported information includes customer identity details, source of funds, nature of business, and any risk assessments related to the customer's activities.

Fill out your kycaml policy know your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kycaml Policy Know Your is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.