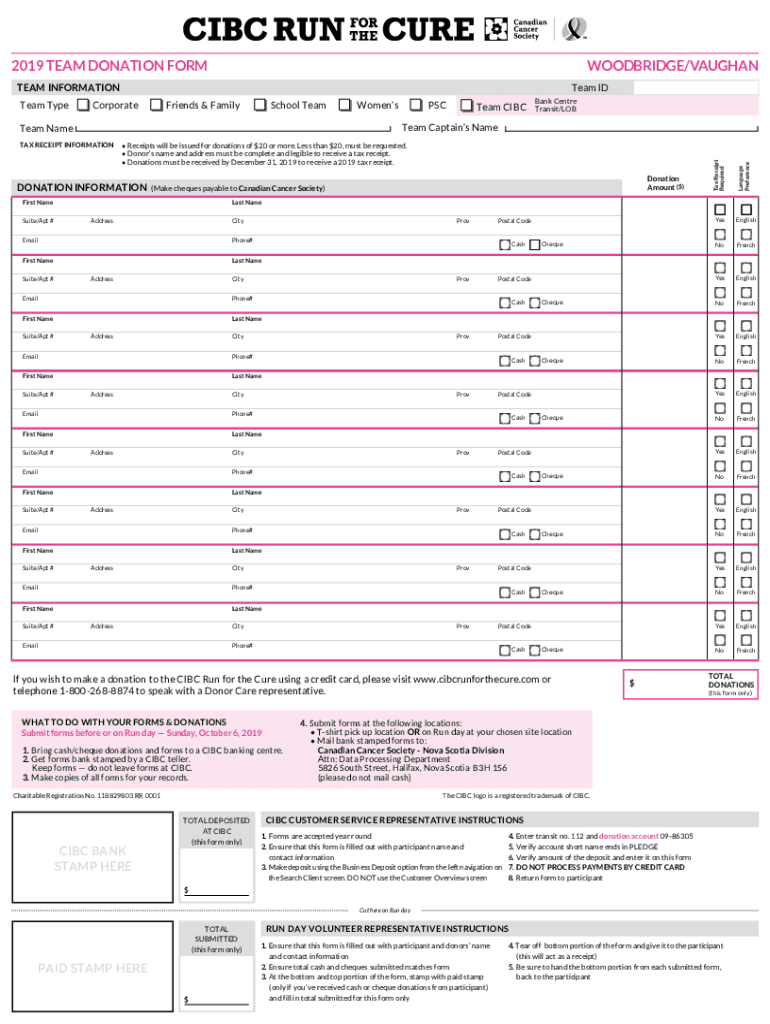

Get the free Donations must be received by December 31, 2019 to receive a 2019 tax receipt

Show details

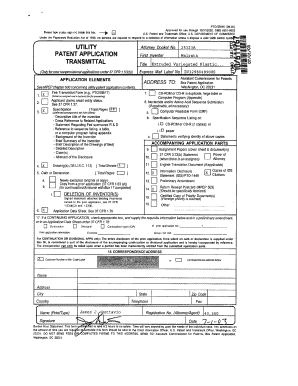

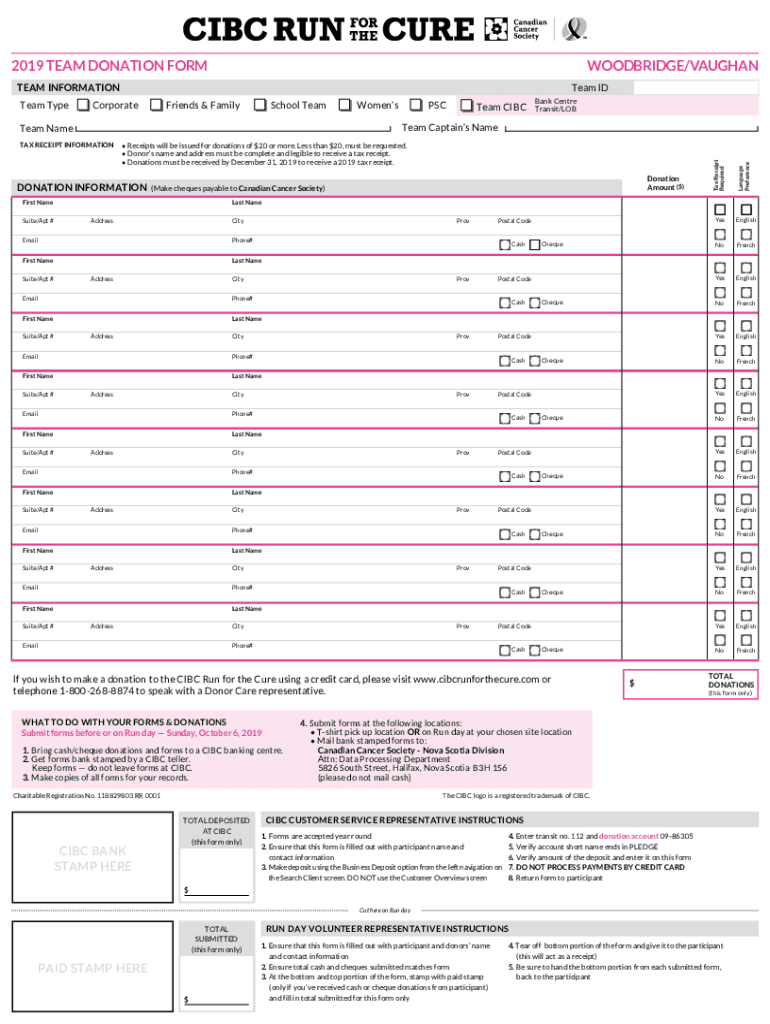

2019 TEAM DONATION FORMWOODBRIDGE/VAUGHANTEAM INFORMATION Friends & FamilyCorporateSchool Team Receipts will be issued for donations of $20 or more. Less than $20, must be requested. Donors name and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donations must be received

Edit your donations must be received form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donations must be received form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing donations must be received online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit donations must be received. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donations must be received

How to fill out donations must be received

01

To fill out donations must be received, follow these steps:

02

Start by gathering all the necessary information about the donations being received, such as the type, quantity, and condition of the items.

03

Create a donation receipt form or use a pre-designed template. Include fields for the donor's name, contact information, and donation details.

04

Clearly label each donation item with any pertinent information, such as its value or expiration date.

05

Arrange a designated drop-off or pick-up location for the donations. Make sure it is easily accessible and secure.

06

Inform potential donors about the donation process. This can be done through various channels such as social media, email newsletters, or direct mail.

07

When a donation is received, check its condition and verify that it aligns with your organization's acceptance guidelines.

08

Record the donation details in your database or tracking system. Make sure to include information about the donor, the items donated, and any special instructions or restrictions.

09

Issue a donation receipt to the donor. This document serves as a confirmation of their donation and can be used for tax purposes.

10

Properly store the received donations in a secure and organized manner. This will ensure that they are easily accessible when needed.

11

Express gratitude to the donors. Sending a thank-you note or email is a simple yet meaningful way to show appreciation for their generosity.

Who needs donations must be received?

01

Donations must be received by various individuals, organizations, and charities in need. These can include:

02

- Non-profit organizations that rely on donations to fund their operations and provide services to the community.

03

- Food banks or shelters that distribute food and supplies to those facing hunger or homelessness.

04

- Schools or educational institutions that require donations for scholarships, books, or equipment.

05

- Hospitals or medical facilities that may accept donations of medical supplies, equipment, or funds for research.

06

- Animal shelters or rescue organizations that need donations to care for and find homes for abandoned or mistreated animals.

07

- Disaster relief agencies that rely on donations to assist those affected by natural disasters or emergencies.

08

- Community programs or initiatives that aim to support underprivileged individuals or families.

09

Overall, anyone or any organization that has a need and relies on the generosity of others can benefit from receiving donations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my donations must be received in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your donations must be received and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an electronic signature for signing my donations must be received in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your donations must be received directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit donations must be received on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign donations must be received on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is donations must be received?

Donations must be received is a requirement for organizations to report all donations received during a specific period for transparency and compliance with tax regulations.

Who is required to file donations must be received?

Non-profit organizations, charities, and other entities that receive donations and are subject to tax regulations are required to file donations must be received.

How to fill out donations must be received?

To fill out donations must be received, organizations must provide details such as the amount of each donation, the date received, donor information, and any relevant documentation or receipts.

What is the purpose of donations must be received?

The purpose of donations must be received is to ensure accountability and transparency in financial reporting, and to comply with legal obligations for tax-exempt organizations.

What information must be reported on donations must be received?

Information that must be reported includes the donor's name, the amount of the donation, the date of the donation, and the purpose of the donation if applicable.

Fill out your donations must be received online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donations Must Be Received is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.