Get the free By Gould Family Trust

Show details

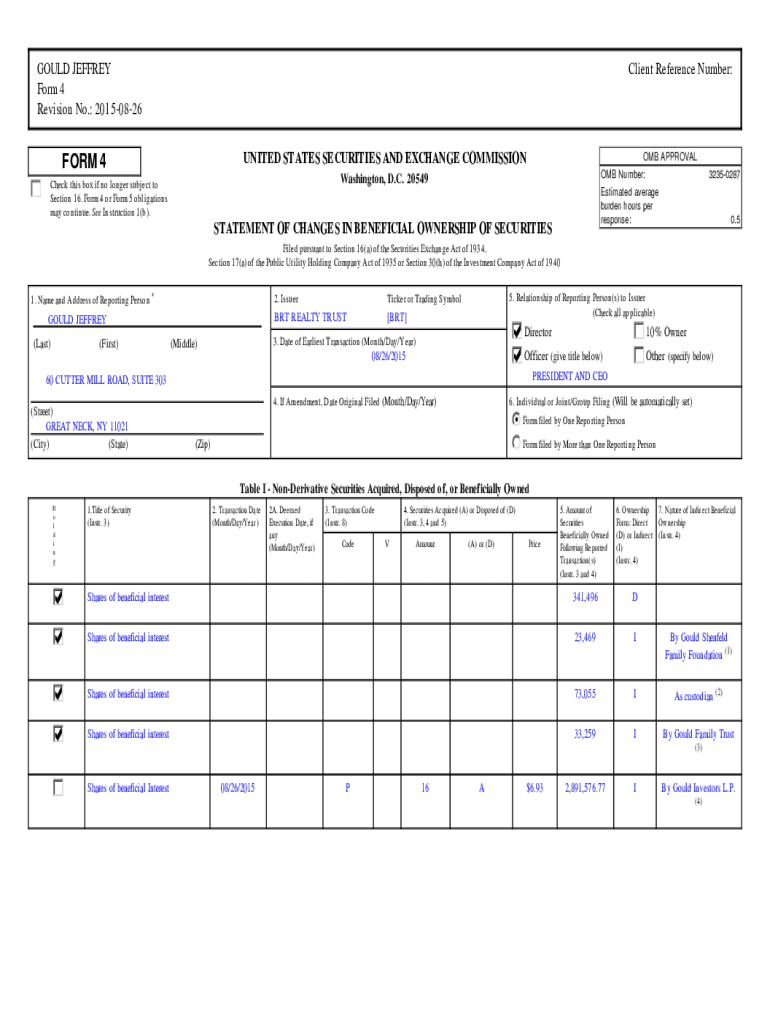

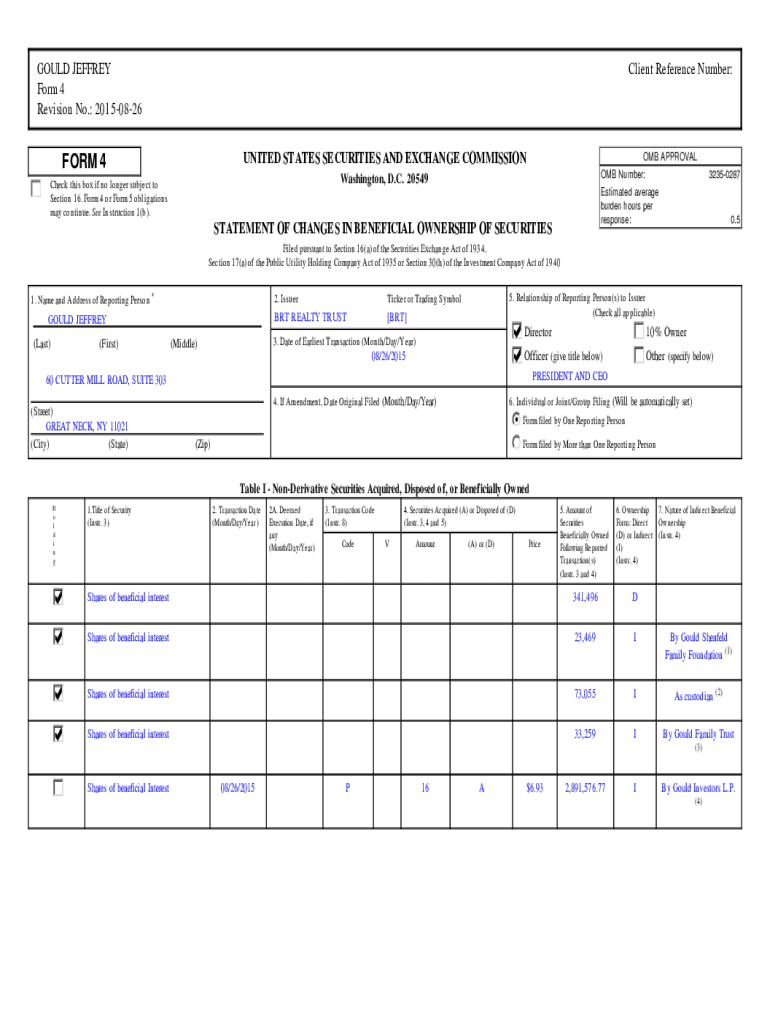

GOULD JEFFREY

Form 4

Revision No.: 20150826Client Reference Number:UNITED STATES SECURITIES AND EXCHANGE COMMISSIONER 4OMB APPROVAL

OMB Number:

Estimated average

burden hours per

response:Washington,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign by gould family trust

Edit your by gould family trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your by gould family trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing by gould family trust online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit by gould family trust. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out by gould family trust

How to fill out by gould family trust

01

To fill out the Gould Family Trust, follow these steps:

02

Start by obtaining the necessary forms. These can typically be found online or through a legal professional.

03

Familiarize yourself with the trust document and its requirements. Understand the purpose and provisions of the trust.

04

Gather all the required information, such as the names of all trust beneficiaries, assets to be transferred into the trust, and any specific instructions.

05

Consult with a qualified attorney to ensure you are completing the trust correctly and in accordance with your specific needs and goals.

06

Fill out the trust form accurately and completely, paying attention to all details and instructions.

07

Review the completed form for any errors or omissions before signing and dating it.

08

Once signed, make multiple copies of the trust document for record-keeping purposes.

09

Consider having the trust document notarized for additional validity and authenticity.

10

Keep the original trust document in a safe and secure location, such as a safe deposit box or with your attorney.

11

Review and update the trust as necessary to reflect any changes in your circumstances or wishes.

12

Remember, it is always best to consult with a legal professional to ensure the trust is properly filled out and meets your specific needs.

Who needs by gould family trust?

01

The Gould Family Trust can be beneficial for individuals or families who wish to establish a legal mechanism for managing and distributing their assets. This trust can help provide for the financial well-being of family members, protect assets from creditors or lawsuits, minimize estate taxes, and provide instructions for the distribution of assets upon the grantor's death. People with considerable assets, complex family situations, or specific wishes for their estate plan can benefit from setting up a family trust like the Gould Family Trust.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit by gould family trust online?

The editing procedure is simple with pdfFiller. Open your by gould family trust in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I sign the by gould family trust electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your by gould family trust in minutes.

How do I fill out by gould family trust using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign by gould family trust and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is by gould family trust?

The By Gould Family Trust is a legal arrangement where the Gould family places assets into a trust to manage and protect their wealth for their beneficiaries.

Who is required to file by gould family trust?

Typically, the trustee of the By Gould Family Trust is required to file any necessary tax returns related to the trust.

How to fill out by gould family trust?

To fill out the By Gould Family Trust, one must complete the trust document specifying the assets, beneficiaries, and the terms under which the trust operates, often with legal guidance.

What is the purpose of by gould family trust?

The purpose of the By Gould Family Trust is to manage family assets efficiently, provide for beneficiaries, and potentially reduce estate taxes.

What information must be reported on by gould family trust?

Information typically reported includes details of the trust assets, income generated, distributions made to beneficiaries, and any relevant tax liabilities.

Fill out your by gould family trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

By Gould Family Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.