GA Application for Occupational Tax Calendar Year - Henry County 2013 free printable template

Show details

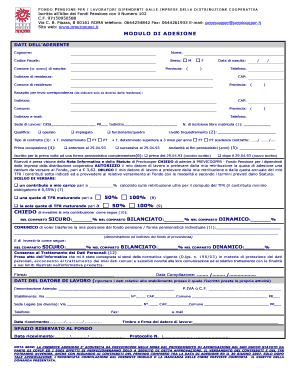

HENRY COUNTY OCCUPATIONAL TAX DIVISION 140 HENRY PARKWAY McDonough, GA. 30253 PHONE 7702888180 FAX 7702888190 APPLICATION FOR OCCUPATIONAL TAX CALENDAR YEAR APPLICATION VOID AFTER 60 DAYS TYPE OF

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign GA Application for Occupational Tax Calendar Year

Edit your GA Application for Occupational Tax Calendar Year form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GA Application for Occupational Tax Calendar Year form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing GA Application for Occupational Tax Calendar Year online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit GA Application for Occupational Tax Calendar Year. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA Application for Occupational Tax Calendar Year - Henry County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out GA Application for Occupational Tax Calendar Year

How to fill out GA Application for Occupational Tax Calendar Year

01

Obtain the GA Application for Occupational Tax Calendar Year form from the appropriate local government website or office.

02

Fill in the business name and address in the designated fields.

03

Provide the owner's name and contact information.

04

Select the type of business from the available categories.

05

Indicate the number of employees, if applicable.

06

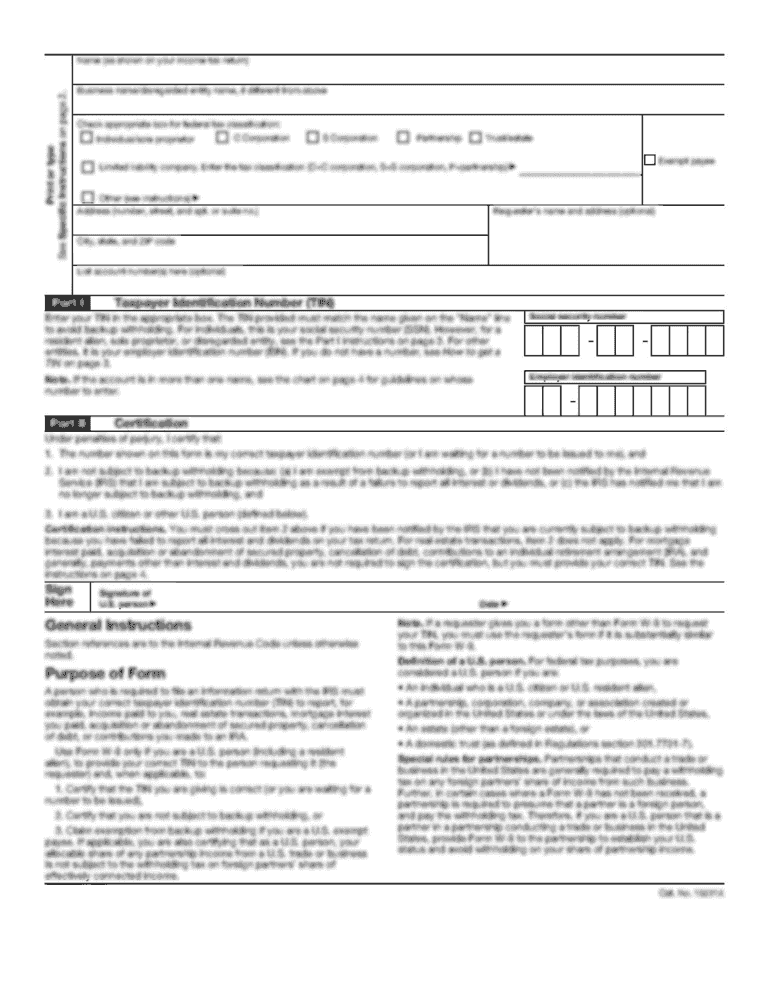

Include the relevant tax identification number or Social Security number.

07

Calculate the applicable occupational tax amount based on your business type and size.

08

Review the application for accuracy and completeness.

09

Sign and date the application where indicated.

10

Submit the completed form along with any required payment to the local tax office.

Who needs GA Application for Occupational Tax Calendar Year?

01

Any individual or business entity that operates within a municipality and is subject to occupational taxes.

02

Businesses that require a license to operate in a specific locality.

03

Self-employed individuals providing services or products within the city limits.

Fill

form

: Try Risk Free

People Also Ask about

How much is a business license in Henry County?

Business licenses are a minimum of $30 annually. Please contact the Commissioner of Revenue for more details.

What is the property tax rate in Henry County GA?

Henry County collects, on average, 1.07% of a property's assessed fair market value as property tax. Henry County has one of the highest median property taxes in the United States, and is ranked 547th of the 3143 counties in order of median property taxes.

What is the ad valorem tax in Henry County GA?

Newly purchased vehicles are subject to Title Ad Valorem Tax that is a one time fee imposed on a motor vehicle title transfer based upon the fair market value of the vehicle at the rate of 6.6%. If a passing emissions test has been performed within the last 12 months, you will not need a new inspection.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my GA Application for Occupational Tax Calendar Year in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your GA Application for Occupational Tax Calendar Year and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit GA Application for Occupational Tax Calendar Year on an iOS device?

Create, edit, and share GA Application for Occupational Tax Calendar Year from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete GA Application for Occupational Tax Calendar Year on an Android device?

On Android, use the pdfFiller mobile app to finish your GA Application for Occupational Tax Calendar Year. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is GA Application for Occupational Tax Calendar Year?

The GA Application for Occupational Tax Calendar Year is a form that businesses and individuals must complete to report and pay occupational taxes, which are taxes imposed on businesses for conducting operations within a particular jurisdiction in Georgia.

Who is required to file GA Application for Occupational Tax Calendar Year?

All businesses and individuals engaged in a profession, trade, or vocation within Georgia that are subject to occupational taxes are required to file the GA Application for Occupational Tax Calendar Year.

How to fill out GA Application for Occupational Tax Calendar Year?

To fill out the GA Application for Occupational Tax Calendar Year, provide the necessary business information, including the business name, address, type of business, and any other required details. Signature and date may also be required to validate the application.

What is the purpose of GA Application for Occupational Tax Calendar Year?

The purpose of the GA Application for Occupational Tax Calendar Year is to collect the information necessary for local governments to assess and collect occupational taxes imposed on businesses and individuals operating within their jurisdictions.

What information must be reported on GA Application for Occupational Tax Calendar Year?

The information that must be reported on the GA Application for Occupational Tax Calendar Year includes the applicant's name, business entity type, location, nature of the business, estimated gross receipts, and any applicable fees or penalties.

Fill out your GA Application for Occupational Tax Calendar Year online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA Application For Occupational Tax Calendar Year is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.