Get the free MONEY MARKET OBLIGATIONS TRUST Form N-Q Filed 2013-02-25

Show details

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2013-02-25 Period of Report: 2012-12-31

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign money market obligations trust

Edit your money market obligations trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your money market obligations trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing money market obligations trust online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit money market obligations trust. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out money market obligations trust

How to fill out money market obligations trust?

01

Obtain the necessary forms: Start by acquiring the required paperwork for the money market obligations trust. These forms can typically be obtained from the financial institution or trust company managing the trust.

02

Provide personal information: Fill out the forms with your personal information, including your full name, address, contact information, and social security number. This information is necessary for identification and compliance purposes.

03

Specify the terms of the trust: Clearly state the terms and conditions of the trust, including the duration, investment objectives, and any specific instructions or restrictions you have for managing the trust's assets.

04

Appoint a trustee: Designate a trustee who will be responsible for managing the trust's assets and ensuring that the trust's objectives are met. This can be yourself, a family member, or a professional trustee.

05

Determine the beneficiaries: Identify the individuals or organizations who will benefit from the trust's assets. Specify their names and relationship to you, as well as any conditions for distribution.

06

Fund the trust: Transfer the desired assets into the trust, whether it's cash, securities, or other investments. Follow the instructions provided by the trust company or financial institution to ensure a smooth transfer.

07

Review and finalize: Carefully review all the information provided on the forms, making sure there are no errors or omissions. Sign and date the forms, and submit them to the trust company or financial institution for processing.

Who needs money market obligations trust?

01

High net worth individuals: Those with significant assets may opt for a money market obligations trust to diversify their investments, maximize returns, and preserve capital.

02

Estate planning purposes: Money market obligations trusts can be used as part of an estate plan to provide for the financial security of loved ones or charitable organizations after the grantor's passing.

03

Business owners: Business owners looking to protect and manage surplus funds or assets may find a money market obligations trust beneficial for their financial strategy.

04

Charitable organizations: Non-profit entities may establish money market obligations trusts to generate income for their operations or to support specific causes.

05

Individuals with specific investment objectives: Investors seeking stable income and capital preservation may choose money market obligations trusts as part of their overall investment portfolio.

In summary, filling out a money market obligations trust involves obtaining the necessary forms, providing personal information, specifying the trust's terms, appointing a trustee, determining the beneficiaries, funding the trust, and reviewing and finalizing the paperwork. Money market obligations trusts are commonly utilized by high net worth individuals, for estate planning purposes, by business owners, charitable organizations, and individuals with specific investment objectives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is money market obligations trust?

Money market obligations trust is a type of investment vehicle that pools funds from investors and invests in short-term, low-risk securities such as Treasury bills and commercial paper.

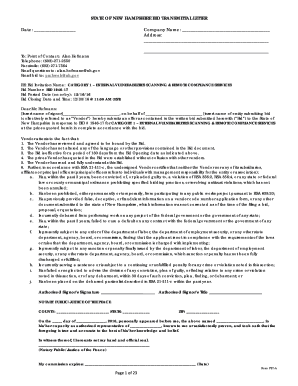

Who is required to file money market obligations trust?

Financial institutions and funds that operate money market obligations trust are required to file with the appropriate regulatory authorities.

How to fill out money market obligations trust?

To fill out a money market obligations trust, detailed information on the investments made, income generated, expenses incurred, and any changes in the trust structure must be reported.

What is the purpose of money market obligations trust?

The purpose of money market obligations trust is to provide investors with a low-risk option for investing in short-term securities while earning a competitive return.

What information must be reported on money market obligations trust?

Information such as the total value of the trust, investment holdings, income earned, expenses incurred, and any changes in the trust structure must be reported on money market obligations trust.

How do I execute money market obligations trust online?

pdfFiller has made it easy to fill out and sign money market obligations trust. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit money market obligations trust straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing money market obligations trust.

How do I complete money market obligations trust on an Android device?

On Android, use the pdfFiller mobile app to finish your money market obligations trust. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your money market obligations trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Money Market Obligations Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.