NJ FB-0504 2023-2025 free printable template

Show details

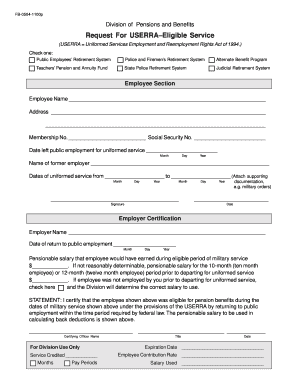

State of New Jersey Department of the Treasury FB05041218pDIVISION OF PENSIONS & BENEFITS Purchase SECTION P.O. Box 295, Trenton, NJ 086250295REQUEST FOR USERRAELIGIBLE SERVICE (Uniformed Services

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit . Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ FB-0504 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out

How to fill out NJ FB-0504

01

Begin by downloading the NJ FB-0504 form from the official New Jersey tax website.

02

Fill in your personal information, including name, address, and Social Security number.

03

Indicate your filing status, whether it's single, married, etc.

04

Provide details about your income sources and amounts for the relevant tax year.

05

List any deductions or credits you are eligible for, following the instructions provided on the form.

06

Review the filled form to ensure all information is accurate and complete.

07

Sign and date the form before submission.

08

Submit the completed form to the appropriate New Jersey tax authority by mail or electronically, as instructed.

Who needs NJ FB-0504?

01

Individuals or businesses in New Jersey who are required to report certain financial information to the state.

02

Taxpayers who are claiming specific deductions or credits that require the use of the NJ FB-0504 form.

Fill

form

: Try Risk Free

People Also Ask about

Who is eligible for pers NJ?

At least 25 years of service required. Annual Benefit = Years of Service ÷ 55 X Final Average (3 yrs.) Salary. No minimum age; however, if under age of 55, the benefit is reduced 3 percent per year (1/4 of 1 percent per month) for each year under age 55.

How long do you have to work for the state of NJ to get a pension?

available to members who have 25 years or more of service credit. The amount of your annual pension will be equal to 65 percent of your Final Compensation plus 1 percent for each year of service over 25 years but not to exceed 30 years. The maximum allowance is therefore 70 percent of your Final Compensation.

What happens to my NJ pension if I leave my job?

If you terminate covered employment before retire- ment, you may withdraw all your contributions less any outstanding loan or other obligations (plus a small amount of interest for PERS or TPAF members with at least three years of service).

Do NJ state employees get a pension?

Public Employee Retirement System (PERS) The Public Employees' Retirement System is open to state, county, municipal, authority, and school board employees who are precluded from any other NJ state pension system (e.g., Teachers, Police and Fire, State Police, Judicial).

What are the requirements for NJ state pension?

20 years of service credit at age 60 or older; • 25 years of service credit at age 55 or older; or • 35 years of service credit at age 55 or older.

What is pers nj?

Public Employee Retirement System (PERS) The Public Employees' Retirement System is open to state, county, municipal, authority, and school board employees who are precluded from any other NJ state pension system (e.g., Teachers, Police and Fire, State Police, Judicial).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send to be eSigned by others?

Once your is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute online?

Filling out and eSigning is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How can I fill out on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your . You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is NJ FB-0504?

NJ FB-0504 is a tax form used by employers in New Jersey to report certain employee benefits and tax withheld for workers.

Who is required to file NJ FB-0504?

Employers who provide taxable fringe benefits to employees are required to file NJ FB-0504.

How to fill out NJ FB-0504?

To fill out NJ FB-0504, employers must provide details about the employee benefits offered, calculate the total taxable benefits, and ensure that accurate withholding amounts are recorded.

What is the purpose of NJ FB-0504?

The purpose of NJ FB-0504 is to ensure proper taxation and reporting of employee fringe benefits provided by employers in New Jersey.

What information must be reported on NJ FB-0504?

The NJ FB-0504 must report the types and value of fringe benefits provided, the number of employees, and the tax amounts withheld for those benefits.

Fill out your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.