Get the free Keg Yield: Determining Profit From a 1/2 Barrel Keg Chart

Show details

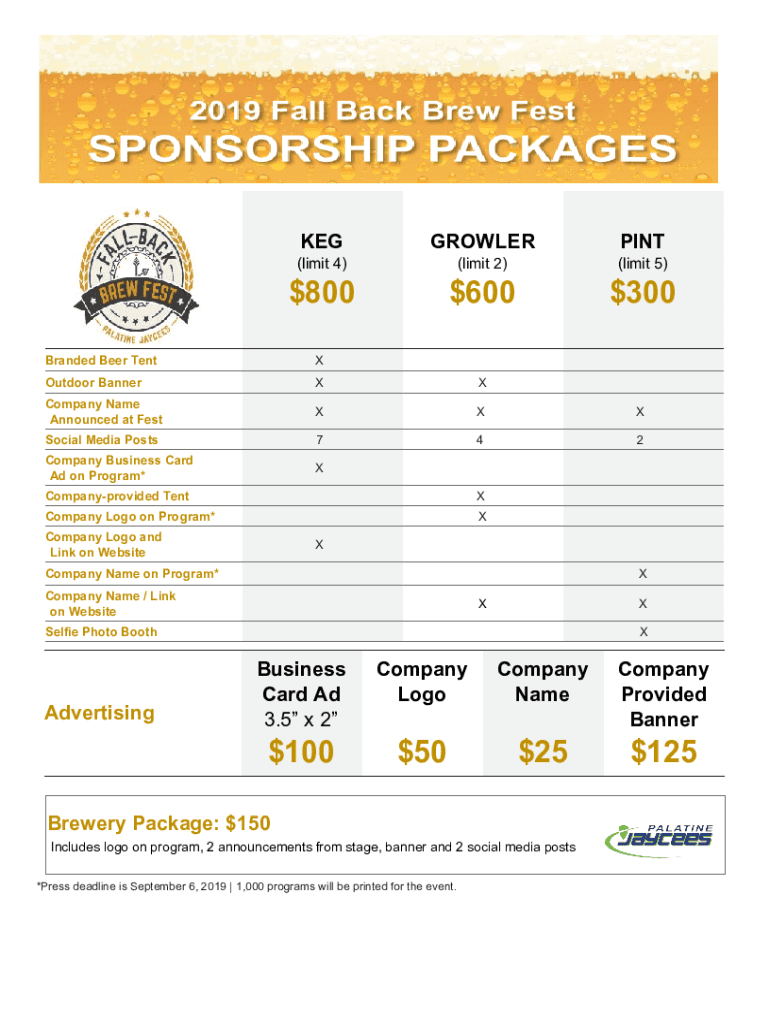

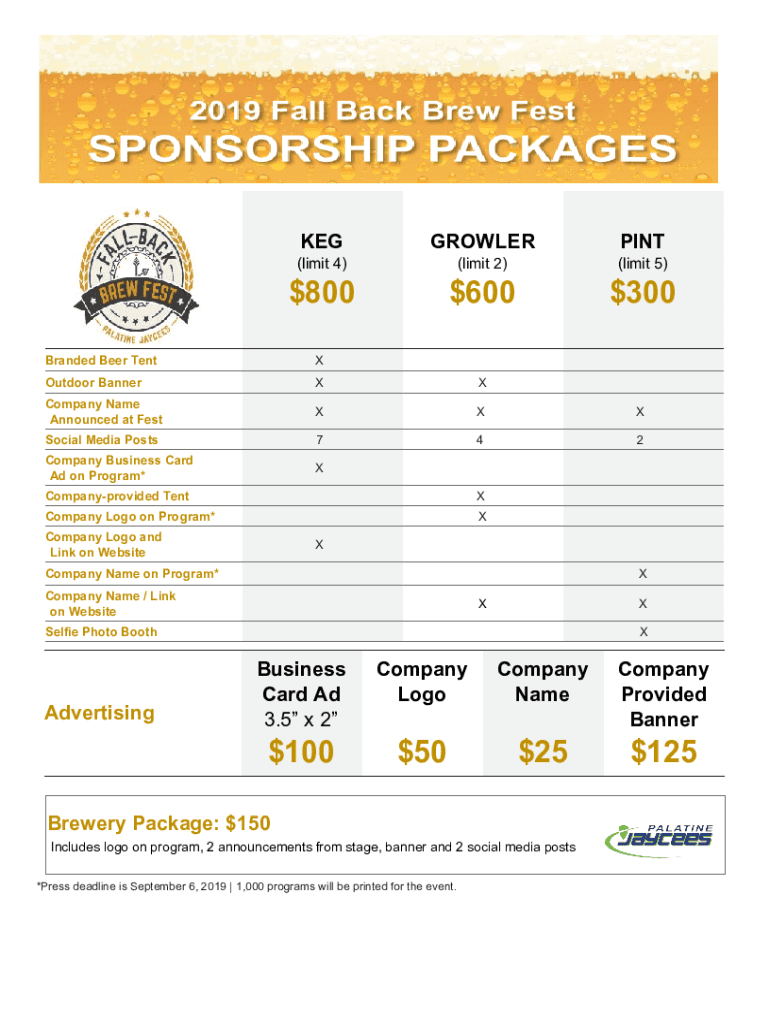

KEGGROWLERPINT(limit 4)(limit 2)(limit 5)$$$800600300Branded Beer TentXOutdoor BannerXXCompany Name

Announced at FestXXXSocial Media Posts742Company Business Card

Ad on Program×XCompanyprovided TentXCompany

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign keg yield determining profit

Edit your keg yield determining profit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your keg yield determining profit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit keg yield determining profit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit keg yield determining profit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out keg yield determining profit

How to fill out keg yield determining profit

01

To fill out keg yield determining profit, follow these steps:

02

Begin by determining the volume of beer you are pouring from the keg. This can be measured using a flow meter or by calculating the difference in weight before and after pouring.

03

Measure the cost of the keg of beer. This should include the purchase price of the keg and any additional costs such as delivery fees.

04

Calculate the yield percentage by dividing the volume of beer poured from the keg by the total volume of the keg.

05

Determine the cost per ounce of the beer by dividing the cost of the keg by the total number of ounces it yields.

06

Calculate the profit margin by subtracting the cost per ounce from the selling price per ounce.

07

Finally, assess the overall profitability by considering other factors such as overhead costs and customer demand.

Who needs keg yield determining profit?

01

Keg yield determining profit is useful for businesses in the hospitality industry, such as bars, pubs, restaurants, and breweries. It helps these businesses understand the profitability of their kegged beer offerings and make informed decisions about pricing, inventory management, and cost control.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in keg yield determining profit without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your keg yield determining profit, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit keg yield determining profit on an iOS device?

You certainly can. You can quickly edit, distribute, and sign keg yield determining profit on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete keg yield determining profit on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your keg yield determining profit from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is keg yield determining profit?

Keg yield determining profit refers to the calculation used to assess the profit derived from the sale of kegs, taking into account factors like production costs, sales price, and wastage.

Who is required to file keg yield determining profit?

Businesses involved in the production or sale of beverages in kegs, such as breweries and distributors, are typically required to file keg yield determining profit.

How to fill out keg yield determining profit?

To fill out keg yield determining profit, gather financial data about production costs, sales data, and any other relevant information, and input it into the designated forms, ensuring accuracy.

What is the purpose of keg yield determining profit?

The purpose of keg yield determining profit is to provide a clear assessment of profitability for keg sales, helping businesses make informed financial decisions.

What information must be reported on keg yield determining profit?

The report must include details on production costs, total sales volumes, prices per keg, and any losses due to wastage or returns.

Fill out your keg yield determining profit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Keg Yield Determining Profit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.