Get the free Know Your Client (KYC) Change Form - B2B Bank

Show details

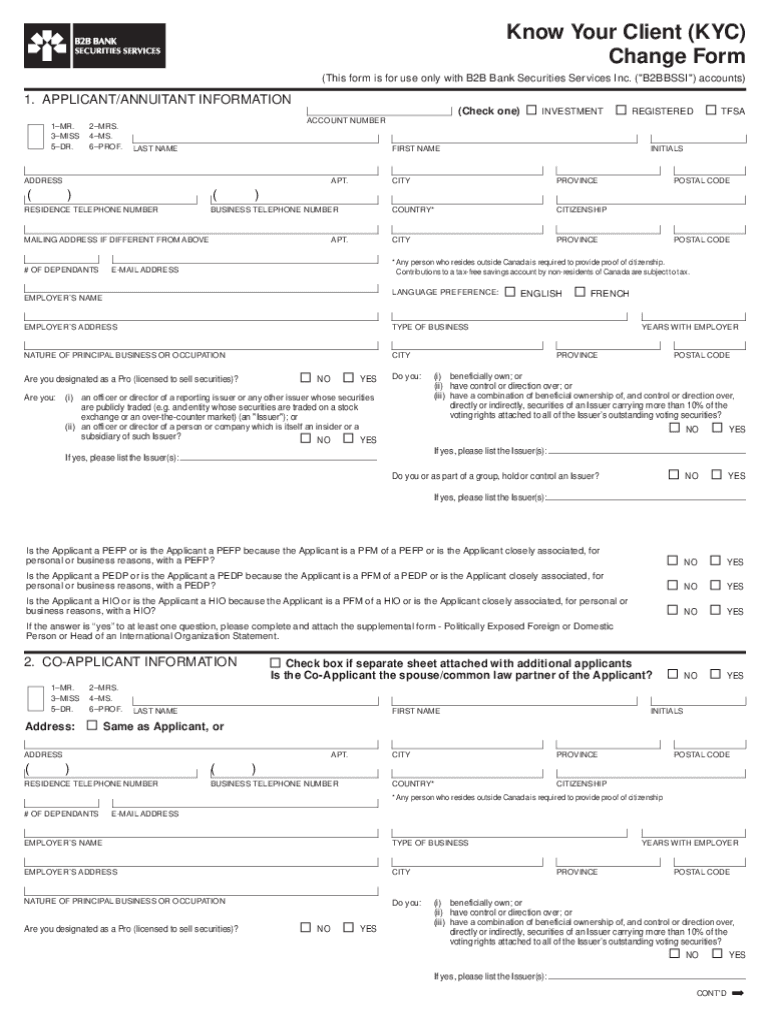

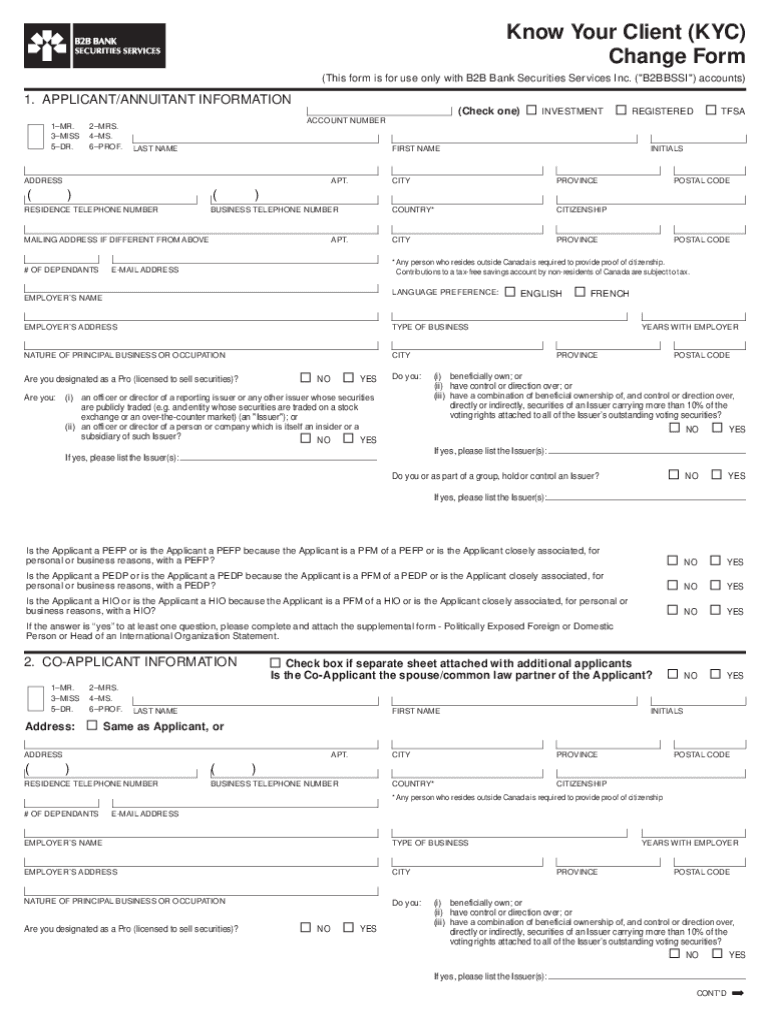

Import Dataset Footprint LETTER Sideshow Your Client (KYC) Change Form(This form is for use only with B2B Bank Securities Services Inc. (“B2BBSSI “) accounts)1. APPLICANT/ANNUITANT INFORMATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign know your client kyc

Edit your know your client kyc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your know your client kyc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing know your client kyc online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit know your client kyc. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out know your client kyc

How to fill out know your client kyc

01

Start by collecting all necessary information from the client, such as their full name, date of birth, address, contact details, and employment information.

02

Verify the client's identity by requesting valid identification documents, such as a passport or driver's license.

03

Conduct a risk assessment to determine the client's risk profile, which may involve evaluating factors such as their financial history, source of funds, and reason for using your services.

04

Ensure compliance with anti-money laundering (AML) regulations by thoroughly screening the client against various watchlists and conducting enhanced due diligence for high-risk individuals.

05

Document and record all information obtained from the client, maintaining confidentiality and adhering to data protection laws.

06

Regularly update and review the client's information to ensure its accuracy and relevance over time.

07

Implement proper security measures to safeguard the client's personal and financial information from unauthorized access or misuse.

08

Train your staff on KYC procedures to ensure consistent and thorough application of the process.

09

Consult legal and regulatory experts to stay up-to-date with evolving KYC regulations and best practices.

10

Continuously monitor changes in the client's behavior or transactions that may indicate potential risks or anomalies, taking appropriate measures as necessary.

Who needs know your client kyc?

01

Know Your Client (KYC) procedures are essential for financial institutions, such as banks, investment firms, insurance companies, and brokerage firms.

02

Other industries, such as online gaming, cryptocurrency exchanges, real estate, and legal services, may also have compliance obligations to conduct KYC due diligence on their customers.

03

In general, any business or organization that is at risk of being involved in money laundering, fraud, or other financial crimes should implement KYC measures to mitigate those risks and maintain regulatory compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send know your client kyc for eSignature?

Once you are ready to share your know your client kyc, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit know your client kyc online?

The editing procedure is simple with pdfFiller. Open your know your client kyc in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete know your client kyc on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your know your client kyc. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is know your client kyc?

Know Your Client (KYC) is a process used by financial institutions and other regulated companies to verify the identity of their clients to prevent fraud, money laundering, and other illicit activities.

Who is required to file know your client kyc?

Entities such as banks, investment firms, insurance companies, and other financial services providers are required to implement KYC procedures as part of their compliance with anti-money laundering (AML) regulations.

How to fill out know your client kyc?

To fill out KYC forms, clients must provide personal information such as full name, date of birth, address, identification documents (like a passport or driver's license), and any relevant financial information, usually in accordance with the requesting institution's guidelines.

What is the purpose of know your client kyc?

The purpose of KYC is to ensure that institutions know their clients, which helps prevent identity theft, financial fraud, money laundering, and terrorism financing, thereby safeguarding the financial system.

What information must be reported on know your client kyc?

KYC reporting typically includes personal identification details, proof of address, date of birth, source of income or wealth, and information about the client's business activities, if applicable.

Fill out your know your client kyc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Know Your Client Kyc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.