Get the free Motor Vehicle Fuel Tax: Motor Fuel Tax Report, Fiscal Year to Date ... - tax ohio

Show details

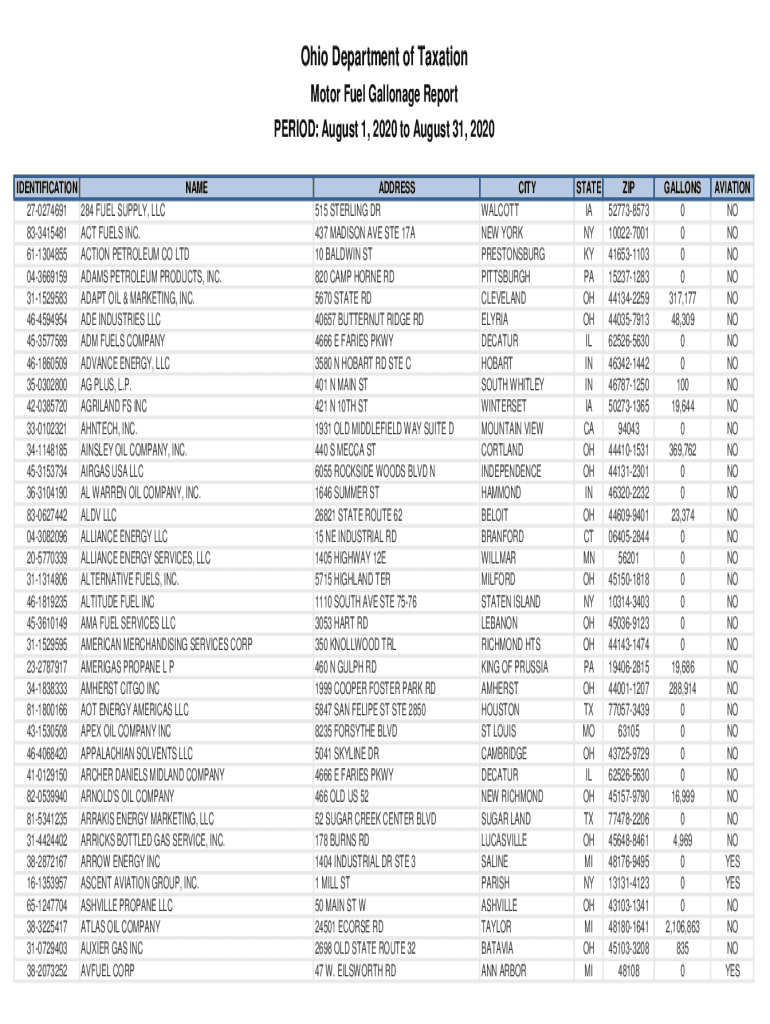

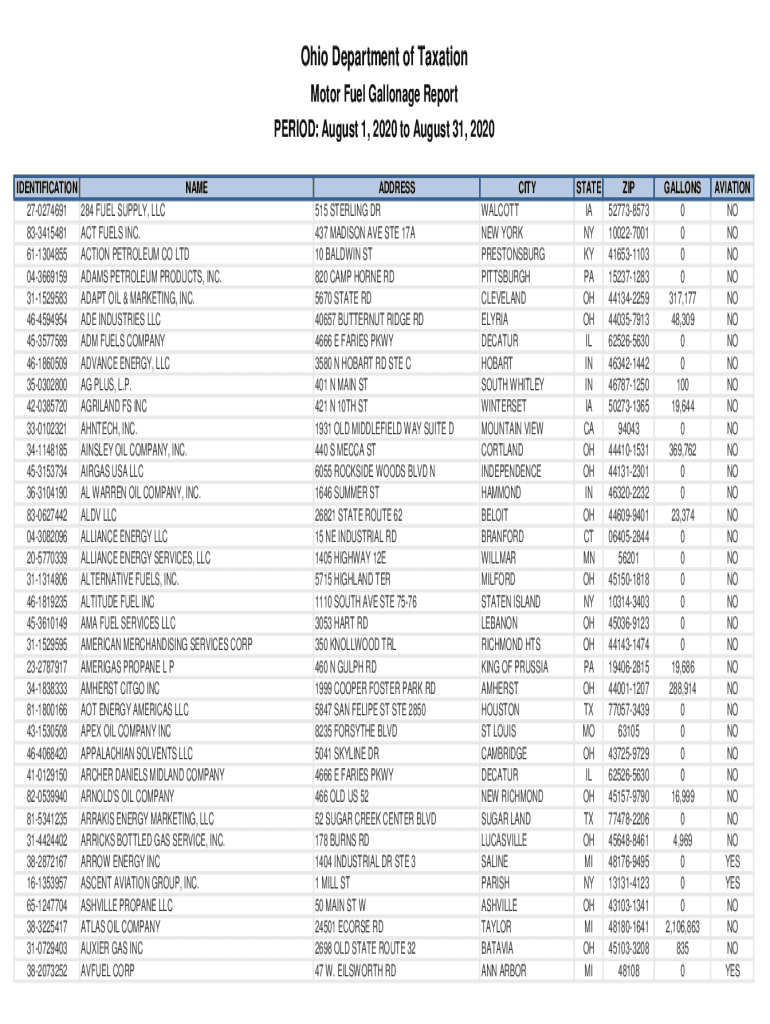

Ohio Department of Taxation

Motor Fuel Gallon age Report

PERIOD: August 1, 2020, to August 31, 2020,

IDENTIFICATION

270274691

833415481

611304855

043669159

311529583

464594954

453577589

461860509

350302800

420385720

330102321

341148185

453153734

363104190

830627442

043082096

205770339

311314806

461819235

453610149

311529595

232787917

341838333

811800166

431530508

464068420

410129150

820539940

815341235

314424402

382872167

161353957

651247704

383225417

310729403

382073252NAME

284

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motor vehicle fuel tax

Edit your motor vehicle fuel tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motor vehicle fuel tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit motor vehicle fuel tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit motor vehicle fuel tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out motor vehicle fuel tax

How to fill out motor vehicle fuel tax

01

To fill out the motor vehicle fuel tax form, follow these steps:

02

Obtain the motor vehicle fuel tax form from the appropriate government agency or website.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide information about your motor vehicle, such as the make, model, and registration number.

05

Calculate the total amount of fuel consumed by the vehicle during the reporting period.

06

Determine the fuel tax rate applicable to your vehicle based on its type and usage.

07

Multiply the fuel consumption by the tax rate to calculate the total fuel tax owed.

08

Enter the calculated fuel tax amount in the designated section of the form.

09

Review the form for accuracy and completeness.

10

Sign and date the form.

11

Submit the completed form along with any required supporting documents to the appropriate authority.

12

Ensure timely payment of the fuel tax if required.

Who needs motor vehicle fuel tax?

01

Motor vehicle fuel tax is needed by individuals or businesses who operate motor vehicles that run on taxable fuel.

02

This includes owners or operators of cars, trucks, buses, motorcycles, boats, or any other vehicle using taxable fuel.

03

The tax is imposed to help fund transportation infrastructure and maintain roads, highways, and related services.

04

The specific requirements for motor vehicle fuel tax may vary by jurisdiction, so it is important to consult the regulations and guidelines of the relevant authority.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send motor vehicle fuel tax for eSignature?

When you're ready to share your motor vehicle fuel tax, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out the motor vehicle fuel tax form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign motor vehicle fuel tax. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete motor vehicle fuel tax on an Android device?

Complete motor vehicle fuel tax and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is motor vehicle fuel tax?

Motor vehicle fuel tax is a tax imposed on the sale and use of fuel for motor vehicles, typically used to fund the construction and maintenance of road infrastructure.

Who is required to file motor vehicle fuel tax?

Generally, fuel distributors, suppliers, and retailers who sell motor vehicle fuel are required to file motor vehicle fuel tax returns.

How to fill out motor vehicle fuel tax?

To fill out the motor vehicle fuel tax, one must complete the appropriate tax return form, listing the total gallons sold, taxes collected, and any exemptions claimed, and then submit it to the relevant tax authority.

What is the purpose of motor vehicle fuel tax?

The purpose of motor vehicle fuel tax is to generate revenue that supports the development and maintenance of transportation infrastructure, including roads and bridges.

What information must be reported on motor vehicle fuel tax?

Information that must be reported includes the total gallons of fuel sold, the tax rate applied, the total tax collected, any exemptions, and details about the seller and buyer.

Fill out your motor vehicle fuel tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motor Vehicle Fuel Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.