Get the free Employee Giving Guide: Tips and Best Practices in the ...Employee Giving CampaignAla...

Show details

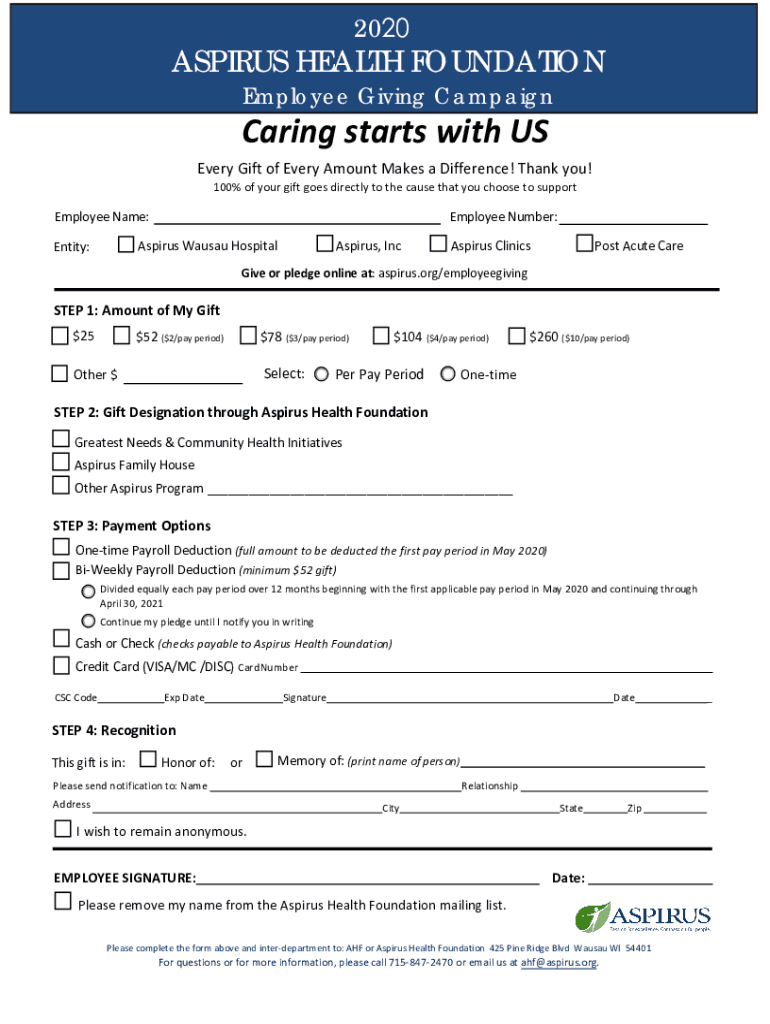

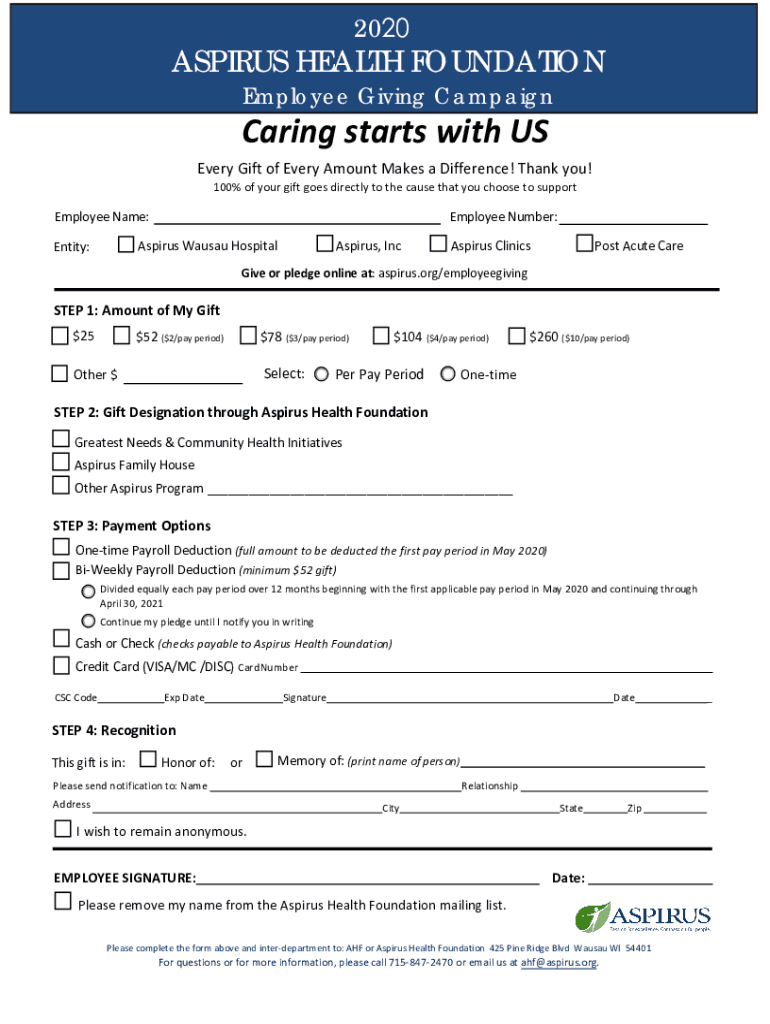

2020ASPIRUS HEALTH FOUNDATION

Employee Giving Campaigning starts with USE very Gift of Every Amount Makes a Difference! Thank you!

100% of your gift goes directly to the cause that you choose to supportEmployee

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employee giving guide tips

Edit your employee giving guide tips form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee giving guide tips form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employee giving guide tips online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit employee giving guide tips. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employee giving guide tips

How to fill out employee giving guide tips

01

Start by reviewing the employee giving guide tips provided by your organization.

02

Familiarize yourself with the various ways you can contribute, be it through payroll deductions, one-time donations, or volunteering.

03

Consider your personal values and interests when selecting the causes or organizations you want to support.

04

Determine the amount of money or time you are willing to commit to employee giving.

05

Read the instructions carefully to understand how to complete the donation or volunteer forms.

06

Fill out the employee giving guide tips form accurately, providing all the required information.

07

If you have any questions or need assistance, reach out to the designated contact person or department.

08

Submit the completed employee giving guide tips form and keep a copy for your records.

09

Review your contribution details to ensure they match your intentions.

10

Consider setting a reminder to review and update your employee giving preferences annually.

Who needs employee giving guide tips?

01

Employees who want to make a positive difference through charitable giving.

02

Organizations that promote employee giving programs and want to provide guidance.

03

Individuals who are unsure about how to effectively contribute to employee giving campaigns.

04

People who value corporate social responsibility and want to participate in philanthropic activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get employee giving guide tips?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific employee giving guide tips and other forms. Find the template you need and change it using powerful tools.

How do I execute employee giving guide tips online?

With pdfFiller, you may easily complete and sign employee giving guide tips online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make changes in employee giving guide tips?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your employee giving guide tips and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is employee giving guide tips?

Employee giving guide tips refer to suggestions and best practices provided to employees to facilitate and encourage charitable giving and donations, often through workplace giving programs.

Who is required to file employee giving guide tips?

Typically, employers who have workplace giving programs are required to file employee giving guide tips, especially if they offer payroll deduction options for charitable contributions.

How to fill out employee giving guide tips?

To fill out employee giving guide tips, employees need to provide information such as their personal details, the organization they wish to support, the amount to be donated, and any necessary payment authorization.

What is the purpose of employee giving guide tips?

The purpose of employee giving guide tips is to promote and streamline the process of charitable donations made by employees and to enhance participation in community and charitable initiatives.

What information must be reported on employee giving guide tips?

The information that must be reported typically includes the donor's name, the recipient organization, donation amount, and any other relevant details necessary for tax reporting.

Fill out your employee giving guide tips online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Giving Guide Tips is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.