Get the free Tax Collector RFP 1214 Design Build of New Tax Collector Office - hillstax

Show details

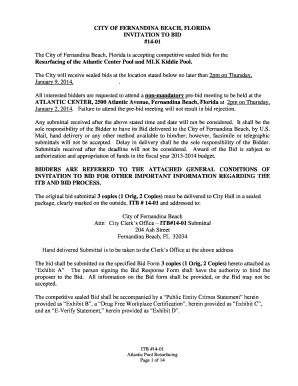

+ Hillsborough County Tax Collectors Office Requests for Proposals For Proposal No. 1214 for DesignBuild of New Tax Collector Office Contact Person Preston Trig Director of Administration and Special

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax collector rfp 1214

Edit your tax collector rfp 1214 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax collector rfp 1214 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax collector rfp 1214 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax collector rfp 1214. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax collector rfp 1214

How to fill out tax collector rfp 1214?

01

Start by carefully reading the entire request for proposal (RFP) document to ensure you understand all the requirements and instructions.

02

Gather all the necessary information and documents required for the RFP, such as your organization's credentials, financial statements, previous experience, and any other supporting documentation requested.

03

Familiarize yourself with the evaluation criteria specified in the RFP and ensure that your proposal addresses each criterion effectively.

04

Begin your response by providing a clear and concise introduction that outlines your understanding of the project and your organization's qualifications.

05

Respond to each section and subsection of the RFP in the order presented, addressing each requirement with specific and relevant information.

06

Ensure that your proposal is well-structured and organized, using headings, subheadings, and bullet points where appropriate to enhance readability.

07

Pay close attention to any word limits or page restrictions specified in the RFP and ensure that your response adheres to these guidelines.

08

Proofread your proposal thoroughly to eliminate any spelling or grammatical errors and ensure the overall clarity and coherence of your response.

09

Submit your completed proposal before the specified deadline, following any submission guidelines or procedures outlined in the RFP.

Who needs tax collector rfp 1214?

01

Municipalities or local governments seeking to contract a tax collector to manage and collect their taxes.

02

Tax collection agencies or organizations looking to submit a proposal to provide tax collection services for a specific jurisdiction.

03

Private firms specializing in tax collection services and wishing to bid for government contracts in this field.

04

Any entity or individual interested in understanding the requirements and procedures involved in filling out a tax collector RFP for educational or informational purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax collector rfp 1214 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including tax collector rfp 1214, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I sign the tax collector rfp 1214 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your tax collector rfp 1214.

How can I fill out tax collector rfp 1214 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your tax collector rfp 1214, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is tax collector rfp 1214?

Tax collector rfp 1214 is a request for proposal issued by the tax collector for specific services or projects.

Who is required to file tax collector rfp 1214?

Any individual or organization that meets the criteria set by the tax collector and wishes to bid for the project or services mentioned in the RFP.

How to fill out tax collector rfp 1214?

To fill out tax collector RFP 1214, you need to carefully read and follow the instructions provided in the document, complete all required sections, and submit it by the specified deadline.

What is the purpose of tax collector rfp 1214?

The purpose of tax collector RFP 1214 is to solicit competitive bids from qualified vendors or contractors for specific services or projects.

What information must be reported on tax collector rfp 1214?

The information that must be reported on tax collector rfp 1214 typically includes project specifications, requirements, deadlines, evaluation criteria, and submission instructions.

Fill out your tax collector rfp 1214 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Collector Rfp 1214 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.