Get the free How to avoid credit card surcharge feesfinder.com

Show details

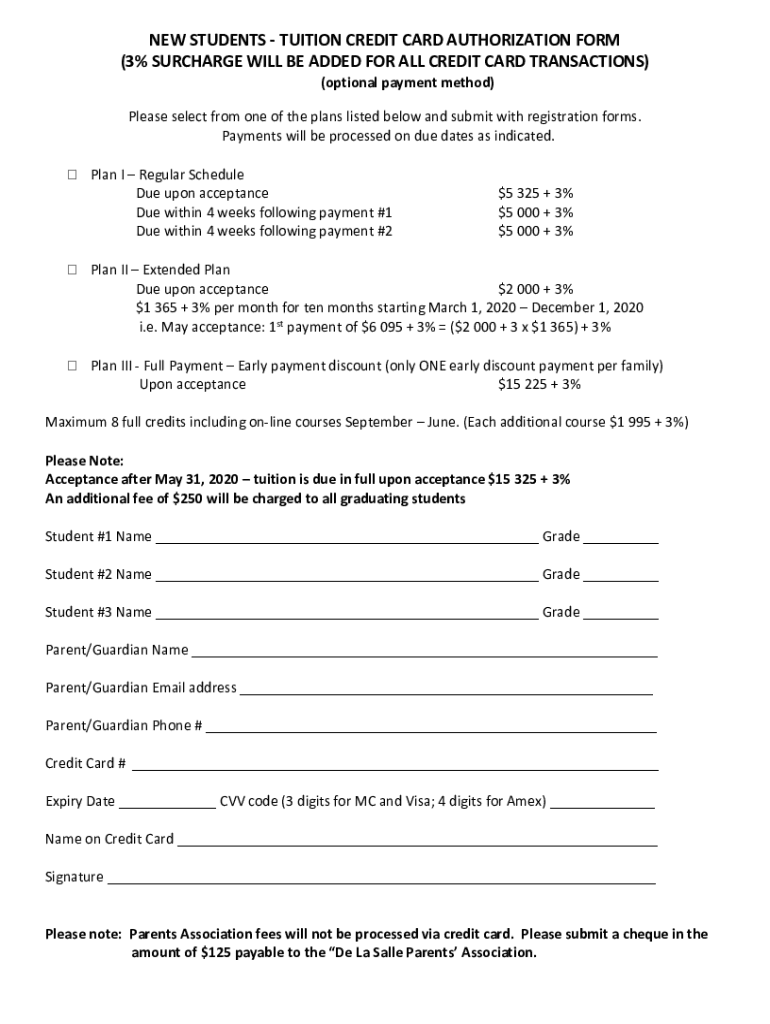

NEW STUDENTS TUITION CREDIT CARD AUTHORIZATION FORM (3% SURCHARGE WILL BE ADDED FOR ALL CREDIT CARD TRANSACTIONS) (optional payment method)Please select from one of the plans listed below and submit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how to avoid credit

Edit your how to avoid credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to avoid credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit how to avoid credit online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit how to avoid credit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how to avoid credit

How to fill out how to avoid credit

01

To fill out how to avoid credit, follow these steps:

02

Start by reviewing your credit report. Get a copy of your credit report from all three major credit bureaus: TransUnion, Equifax, and Experian.

03

Analyze your credit report thoroughly. Look for any errors or discrepancies that may be affecting your credit score negatively.

04

Dispute any errors you find on your credit report. Contact the credit bureau and provide them with the necessary documentation to support your dispute.

05

Pay your bills on time. Late payments can significantly impact your credit score. Set up reminders or automatic payments to ensure you never miss a payment.

06

Keep your credit card balances low. Try to keep your credit utilization ratio below 30% to demonstrate responsible credit management.

07

Avoid opening unnecessary credit accounts. Each new credit application can result in a hard inquiry on your credit report, which can temporarily lower your credit score.

08

Maintain a good mix of credit. Having a mix of credit types (such as credit cards, loans, and a mortgage) can positively impact your credit score.

09

Avoid closing old credit accounts. Closing old accounts can reduce your overall credit history length and potentially harm your credit score.

10

Monitor your credit regularly. Stay vigilant and keep an eye on your credit report to identify any suspicious activity or signs of identity theft.

11

Consider seeking professional help if needed. If you're struggling with managing your credit or need assistance with credit repair, consult a reputable credit counseling agency or credit repair service.

Who needs how to avoid credit?

01

Anyone who wants to maintain a good credit score and avoid negative financial consequences needs to know how to avoid credit problems.

02

This information is especially relevant for individuals who have a history of poor credit management, those looking to improve their credit score, or individuals planning to apply for credit in the near future.

03

By understanding how to avoid credit problems, individuals can take proactive steps to protect their financial well-being and improve their chances of qualifying for favorable loan terms, lower interest rates, and credit card approvals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send how to avoid credit for eSignature?

Once your how to avoid credit is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find how to avoid credit?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the how to avoid credit in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I edit how to avoid credit on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute how to avoid credit from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is how to avoid credit?

How to avoid credit generally refers to strategies and practices that help individuals or businesses maintain good creditworthiness and prevent the accumulation of bad credit.

Who is required to file how to avoid credit?

Individuals and businesses seeking to improve or maintain their credit scores and those who are managing debts are typically the ones required to implement measures to avoid bad credit.

How to fill out how to avoid credit?

To fill out how to avoid credit, individuals should gather their financial information, assess their credit report, identify potential risks, and develop a plan that includes timely payments and responsible credit usage.

What is the purpose of how to avoid credit?

The purpose of how to avoid credit is to educate individuals and businesses on maintaining a positive credit score, preventing debt accumulation, and ensuring financial stability.

What information must be reported on how to avoid credit?

Information such as payment history, credit utilization ratio, types of credit accounts, and any negative marks or delinquencies must be monitored to avoid credit issues.

Fill out your how to avoid credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Avoid Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.