Pershing LLC FRM-IRA-DB 2007-2025 free printable template

Show details

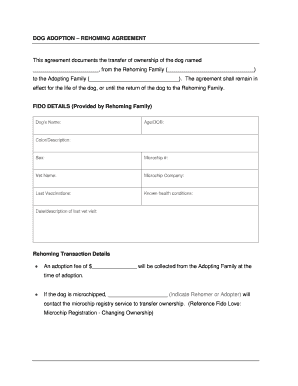

DESIGNATION OF BENEFICIARY I. PARTICIPANT INFORMATION NAME: STREET ADDRESS: TELEPHONE NUMBER: MARITAL STATUS: SINGLE CITY: SOCIAL SECURITY NUMBER: MARRIED (NOTE: Spousal consent may be required. See

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pershing designation form

Edit your pershing beneficiary form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your beneficiary frmira pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit beneficiary frmira template online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit beneficiary frmira fill form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out beneficiary frmira make form

How to fill out Pershing LLC FRM-IRA-DB

01

Download the FRM-IRA-DB form from the Pershing LLC website.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide details about your IRA account, such as the account number and type of IRA.

04

Indicate the beneficiaries of your IRA by providing their names and contact information.

05

Review the completed form for accuracy.

06

Sign and date the form.

07

Submit the form to the designated address or email provided by Pershing LLC.

Who needs Pershing LLC FRM-IRA-DB?

01

Individuals who wish to open or manage an IRA account with Pershing LLC.

02

Clients who are required to update their beneficiary designations.

03

Investors looking to roll over funds from another retirement account into a Pershing LLC IRA.

Fill

pershing beneficiary edit

: Try Risk Free

People Also Ask about beneficiary frmira printable

What is an entity as a beneficiary?

A beneficiary is the person or entity that you legally designate to receive the benefits from your financial products. For life insurance coverage, that is the death benefit your policy will pay if you die. For retirement or investment accounts, that is the balance of your assets in those accounts.

Who uses Pershing?

Pershing serves institutional-oriented broker-dealers, investment banks and other capital markets firms, and hedge funds and other alternative investment managers.

What does it mean if the beneficiary is an entity?

Entity Beneficiary means any partnership, trust, corporation, limited liability company or firm, or any combination thereof, that is not a Designated Beneficiary or an EligibleDesignated Beneficiary but designated by a Participant to receive benefits under the Plan as of the date of death of the Participant.

What is a designated beneficiary mean?

Beneficiary designations allow you to transfer assets directly to individuals, regardless of the terms of your will. Beneficiary designations are often made when a financial account, retirement account, or life insurance policy is established. But, these designations should be reviewed periodically.

What is Pershing brokerage account?

Pershing LLC is a subsidiary of the Bank of New York Mellon with over 60 years' experience in providing investment products and services. CommSec has partnered with Pershing LLC to provide our customers with access to trading on US and non-US markets through CommSec International.

What are the two types of IRA accounts?

Key Takeaways The key difference between Roth and traditional IRAs lies in the timing of their tax advantages. With traditional IRAs, you deduct contributions now and pay taxes on withdrawals later, while Roth IRAs allow you to pay taxes on contributions now and get tax-free withdrawals later.

What are the types of beneficiaries?

Primary and contingent beneficiaries There are two types of beneficiaries: primary and contingent. A primary beneficiary is the person (or persons) first in line to receive the death benefit from your life insurance policy — typically your spouse, children or other family members.

What is a Pershing IRA?

Pershing is a one-stop source for a range of individual retirement solutions—along with a wealth of tools and resources to help advisors grow their retirement business. Choose from Traditional, Roth, and Rollover individual retirement accounts (IRAs) that feature convenient account services and distribution options.

Can you have 4 primary beneficiaries?

Key Takeaways. A primary beneficiary is a person or entity named to receive the benefit of a will, trust, insurance policy, or investment account. More than one primary beneficiary can be named, with the grantor able to direct particular percentages to each.

What are the 3 types of IRA?

There are several types of IRAs available: Traditional IRA. Contributions typically are tax-deductible. Roth IRA. Contributions are made with after-tax funds and are not tax-deductible, but earnings and withdrawals are tax-free. SEP IRA. SIMPLE IRA.

What is a trust or entity beneficiary?

What Is a Beneficiary of Trust? A beneficiary of trust is the individual or group of individuals for whom a trust is created. The trust creator or grantor designates beneficiaries and a trustee, who has a fiduciary duty to manage trust assets in the best interests of beneficiaries as outlined in the trust agreement.

What is the difference between a beneficiary and a designated beneficiary?

A beneficiary is any individual or entity who receives some portion of an inherited estate. A designated beneficiary refers to a specific person or entity who has been named and documented by the owner of the estate before their death.

What are the four types of beneficiaries?

Listing the beneficiaries of your wealth is the important first step in your estate plan. Generally, there are four classes of beneficiaries to consider: you and your spouse, friends and family, charity, and the government.

What are the 3 types of beneficiaries?

Your beneficiary can be a person, a charity, a trust, or your estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in beneficiary frmira download without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing beneficiary frmira sample and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit pershing beneficiary fill on an iOS device?

Use the pdfFiller mobile app to create, edit, and share pershing beneficiary trial from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete beneficiary frmira fillable on an Android device?

Use the pdfFiller mobile app to complete your beneficiary frmira on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is Pershing LLC FRM-IRA-DB?

Pershing LLC FRM-IRA-DB is a form used for the reporting of IRA and DB (Defined Benefit) plan information associated with accounts held at Pershing LLC.

Who is required to file Pershing LLC FRM-IRA-DB?

Entities that manage or administer Individual Retirement Accounts (IRAs) and Defined Benefit plans held at Pershing LLC are required to file the FRM-IRA-DB.

How to fill out Pershing LLC FRM-IRA-DB?

To fill out the Pershing LLC FRM-IRA-DB form, follow the provided instructions, ensuring that all required fields are accurately completed with the relevant financial and account holder information.

What is the purpose of Pershing LLC FRM-IRA-DB?

The purpose of the Pershing LLC FRM-IRA-DB is to facilitate compliance with regulatory requirements by collecting and reporting necessary information on IRA and Defined Benefit accounts.

What information must be reported on Pershing LLC FRM-IRA-DB?

The information that must be reported includes account holder details, account balances, transaction data, and any applicable tax-related information pertaining to the IRA or DB plan.

Fill out your beneficiary frmira form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pershing Beneficiary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.