Get the free Step 2: Insurance cover

Show details

INESSENTIAL SUPER 1 July 2019Insurance cancellation form Please complete these instructions in BLACK INK using CAPITAL LETTERS and 3 boxes where provided. Step 1: Member details Account number Title

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign step 2 insurance cover

Edit your step 2 insurance cover form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your step 2 insurance cover form via URL. You can also download, print, or export forms to your preferred cloud storage service.

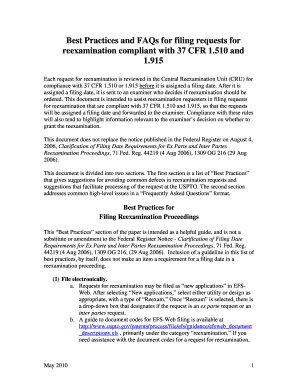

Editing step 2 insurance cover online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit step 2 insurance cover. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out step 2 insurance cover

How to fill out step 2 insurance cover

01

To fill out step 2 insurance cover, follow these steps:

02

Begin by gathering all necessary information, including your personal details, employment information, and any previous insurance coverage.

03

Read through the insurance form carefully, paying attention to each section and the information required.

04

Start with the first section, usually addressing your personal information. Fill in your full name, address, contact details, and date of birth.

05

Move on to the employment section, providing details about your current job or occupation.

06

If you have any previous insurance coverage, disclose this information in the relevant section. Include details of the insurer and the policy information.

07

Review your responses thoroughly to ensure accuracy and correctness.

08

Sign and date the insurance form as required.

09

Make a copy of the completed form for your records, if necessary.

10

Submit the filled-out form to the appropriate insurance provider through the preferred method, such as mail, email, or online submission.

11

Follow up with the insurance provider if you do not receive any confirmation within a reasonable time frame.

Who needs step 2 insurance cover?

01

Step 2 insurance cover is typically required by individuals who have completed step 1 insurance cover and have been deemed eligible for further coverage.

02

It is designed for those who wish to enhance their insurance protection beyond the basic level provided by step 1.

03

Common parties who may need step 2 insurance cover include:

04

- Individuals seeking additional financial coverage for specific risks or events

05

- Employees who want to supplement their employer-provided insurance benefits

06

- Entrepreneurs or self-employed individuals who need comprehensive coverage

07

- Anyone who wants to tailor their insurance policy to better suit their individual needs and circumstances.

08

It is advisable to consult with an insurance professional or provider to determine if step 2 insurance cover is suitable for your specific requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send step 2 insurance cover for eSignature?

Once your step 2 insurance cover is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get step 2 insurance cover?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific step 2 insurance cover and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in step 2 insurance cover?

The editing procedure is simple with pdfFiller. Open your step 2 insurance cover in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

What is step 2 insurance cover?

Step 2 insurance cover refers to a specific level of insurance coverage that provides additional protection beyond basic insurance. It typically includes coverage for various risks that are not covered by standard policies.

Who is required to file step 2 insurance cover?

Businesses and individuals who meet certain criteria set by insurance regulations are required to file step 2 insurance cover. This often includes those engaged in specific industries or who possess particular assets.

How to fill out step 2 insurance cover?

To fill out step 2 insurance cover, one should obtain the appropriate application form, gather necessary documentation, provide accurate information regarding coverage needs, and submit the completed form to the insurance provider.

What is the purpose of step 2 insurance cover?

The purpose of step 2 insurance cover is to provide enhanced protection for policyholders against a broader range of risks, ensuring financial security in the event of unforeseen incidents.

What information must be reported on step 2 insurance cover?

Information that must be reported includes personal or business details, types of coverage required, descriptions of assets or activities to be insured, and any previous claims history.

Fill out your step 2 insurance cover online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Step 2 Insurance Cover is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.