Get the free Understanding Tax Lien Certificate Redemption PeriodsThe Basics of Tax Lien Investin...

Show details

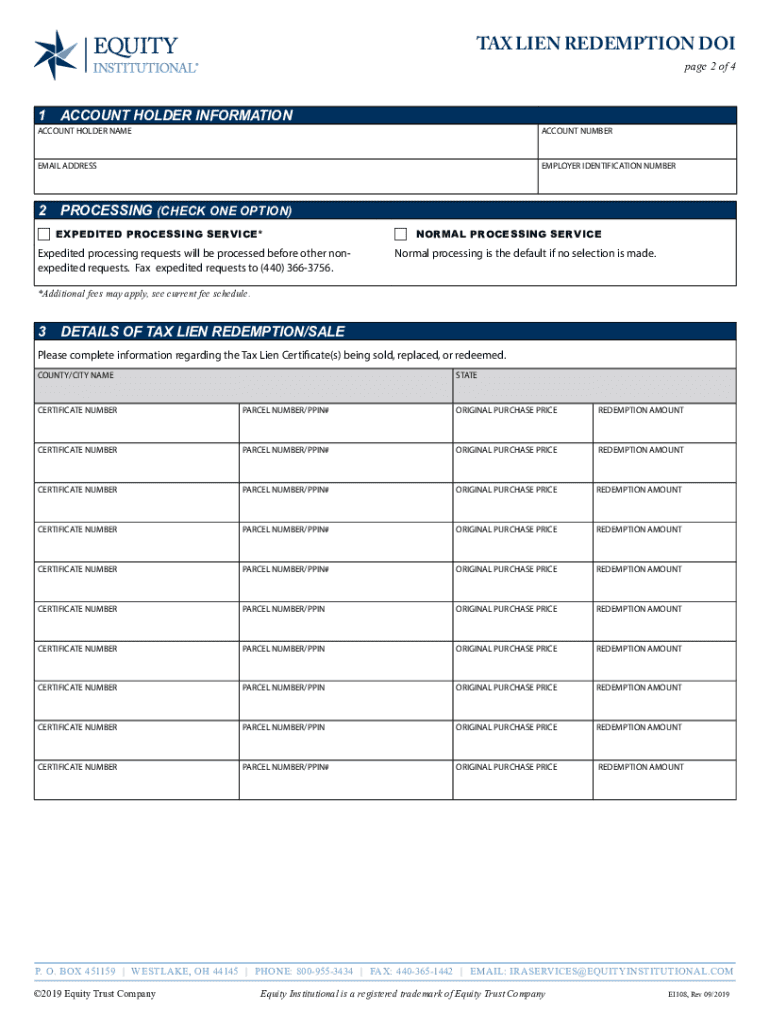

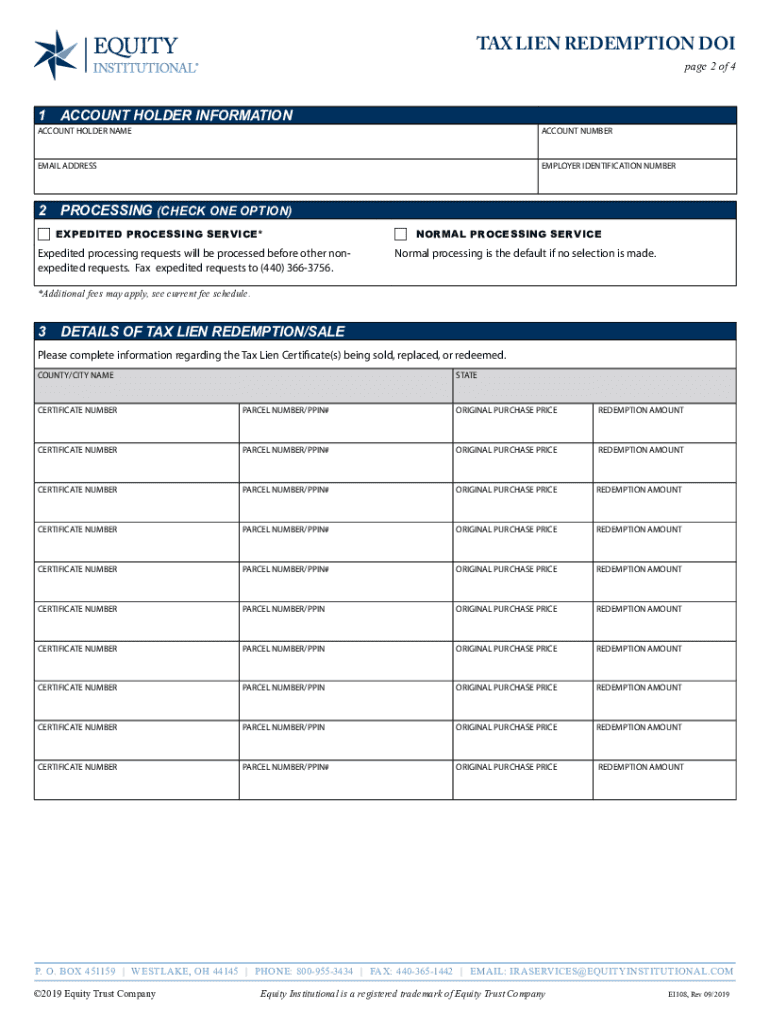

TAX LIEN REDEMPTION

DIRECTION OF INVESTMENTWHEN TO USE THIS FORMIMPORTANT! To initiate a redemption of a tax lien or certificate held

within the IRA or to initiate a replacement of a tax lien to

a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign understanding tax lien certificate

Edit your understanding tax lien certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding tax lien certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing understanding tax lien certificate online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit understanding tax lien certificate. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out understanding tax lien certificate

How to fill out understanding tax lien certificate

01

Research and understand the concept of tax lien certificates.

02

Determine which properties you are interested in acquiring tax lien certificates for.

03

Contact the county or municipality where the properties are located to inquire about their tax lien certificate sales process.

04

Obtain the necessary forms or applications for participating in the tax lien certificate sales.

05

Fill out the required information on the forms, including your personal details and the specific properties you are interested in.

06

Double-check all the information you have provided to ensure accuracy.

07

Submit the completed forms along with any required fees or documentation to the appropriate authority.

08

Follow any additional instructions or guidelines provided by the county or municipality to complete the process.

09

Attend any scheduled tax lien certificate auctions or sales events if required.

10

If successful in acquiring tax lien certificates, make sure to fulfill all obligations and requirements associated with them.

Who needs understanding tax lien certificate?

01

Real estate investors who want to profit from investing in tax lien certificates.

02

Individuals or businesses looking for alternative investment opportunities with potentially high returns.

03

People who are interested in acquiring real estate properties at a lower cost through tax lien certificate redemption or foreclosure.

04

Individuals who want to learn more about the tax lien system and its implications for property ownership and taxation.

05

Homeowners who want to understand the potential risks and consequences of having a tax lien placed on their property.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute understanding tax lien certificate online?

pdfFiller makes it easy to finish and sign understanding tax lien certificate online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make edits in understanding tax lien certificate without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your understanding tax lien certificate, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out understanding tax lien certificate on an Android device?

Use the pdfFiller mobile app and complete your understanding tax lien certificate and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is understanding tax lien certificate?

A tax lien certificate is a legal document issued by a government authority that indicates a property has had unpaid taxes, and it grants the holder the right to claim the amount owed plus interest. Understanding this certificate involves knowing how it affects property ownership and the tax collection process.

Who is required to file understanding tax lien certificate?

Individuals or entities who purchase tax lien certificates at a tax lien auction are typically required to file them. This may include investors, financial institutions, or any party interested in acquiring the tax lien rights.

How to fill out understanding tax lien certificate?

To fill out a tax lien certificate, you need to provide details such as the property owner's name, property address, amount of taxes owed, date of the lien, and your contact information as the lien holder. Ensure all fields are completed accurately and double-check for any specific local requirements.

What is the purpose of understanding tax lien certificate?

The purpose of a tax lien certificate is to secure the government's right to collect unpaid property taxes and to provide a mechanism for interested buyers to invest in tax liens. It also serves as a method for local governments to recoup lost tax revenue.

What information must be reported on understanding tax lien certificate?

Information that must be reported includes the property owner's name, property description, parcel number, amount of tax owed, interest rate, and the date the lien was filed. Some jurisdictions may have additional reporting requirements.

Fill out your understanding tax lien certificate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Understanding Tax Lien Certificate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.