Get the free Private Placements - Traditional

Show details

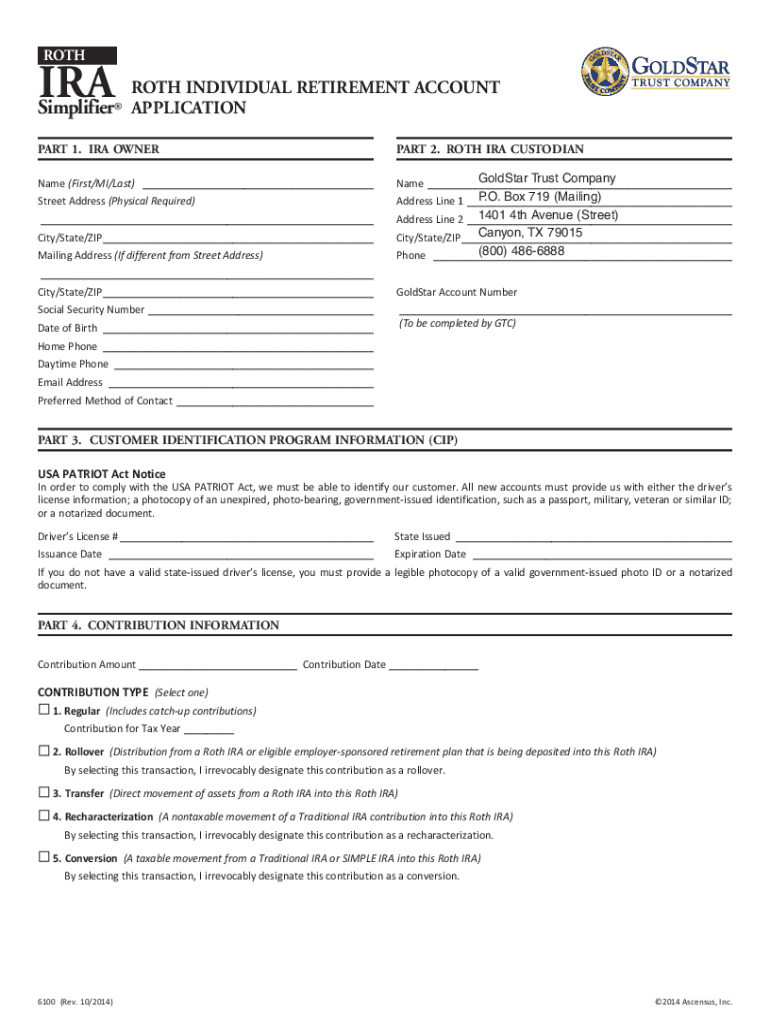

ROTH IRA Private PlacementsSelfDirected IRA GuideROTHIRAROTH INDIVIDUAL RETIREMENT ACCOUNTSimplifier APPLICATION PART 1. IRA COUNTERPART 2. ROTH IRA CUSTODIANName (First/MI/Last) Gold Star Trust Company

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private placements - traditional

Edit your private placements - traditional form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private placements - traditional form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing private placements - traditional online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit private placements - traditional. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out private placements - traditional

How to fill out private placements - traditional

01

To fill out private placements - traditional, follow these steps:

02

Research the specific requirements and regulations for private placements in your jurisdiction.

03

Determine the purpose and goals of the private placement, such as raising capital for a specific project or expanding the business.

04

Prepare the necessary legal documents, including a private placement memorandum (PPM) and subscription agreement.

05

Clearly define the terms and conditions of the private placement, including the offering amount, price per share, and any potential risks involved.

06

Identify and target potential investors who may be interested in participating in the private placement.

07

Promote and market the private placement to the identified investors, providing them with relevant information and disclosures.

08

Receive subscription agreements and investment commitments from interested investors.

09

Conduct the necessary due diligence on the investors to ensure they meet the regulatory requirements for participating in private placements.

10

Finalize the transaction by executing the necessary legal agreements, issuing shares or securities to the investors, and transferring the funds raised.

11

Comply with any ongoing reporting and disclosure requirements as required by the regulatory authorities.

Who needs private placements - traditional?

01

Private placements - traditional are typically suitable for:

02

Start-up companies or early-stage businesses looking to raise capital for expansion or product development.

03

Established businesses undergoing a major expansion, acquisition, or restructuring.

04

Real estate developers and property investment companies seeking funding for development projects.

05

High-net-worth individuals or sophisticated investors looking for investment opportunities outside of traditional public markets.

06

Companies that do not meet the requirements for a public offering or prefer to maintain privacy and control over their fundraising activities.

07

Institutional investors such as private equity firms or venture capital funds that specialize in investing in private placements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the private placements - traditional form on my smartphone?

Use the pdfFiller mobile app to complete and sign private placements - traditional on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete private placements - traditional on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your private placements - traditional. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete private placements - traditional on an Android device?

On Android, use the pdfFiller mobile app to finish your private placements - traditional. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is private placements - traditional?

Traditional private placements refer to the selling of securities directly to a small group of investors, often institutions or accredited individuals, without a public offering.

Who is required to file private placements - traditional?

Companies offering traditional private placements are required to file with the relevant regulatory authorities, such as the SEC in the United States, including details about the offering and its compliance.

How to fill out private placements - traditional?

To fill out private placements, the issuing company must prepare a Form D and provide information regarding the offering, including the type of securities being sold, the total amount, and the number of investors.

What is the purpose of private placements - traditional?

The purpose of traditional private placements is to raise capital for business operations, development projects, or expansion without the extensive regulatory requirements of a public offering.

What information must be reported on private placements - traditional?

Information such as the issuer's details, amount of securities offered, use of proceeds, and information on the purchasers must be reported on private placements.

Fill out your private placements - traditional online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Placements - Traditional is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.