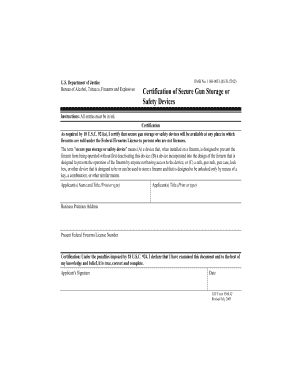

Get the free mack littleton planned giving form.docx

Show details

My

demo

ck tosh Ac an

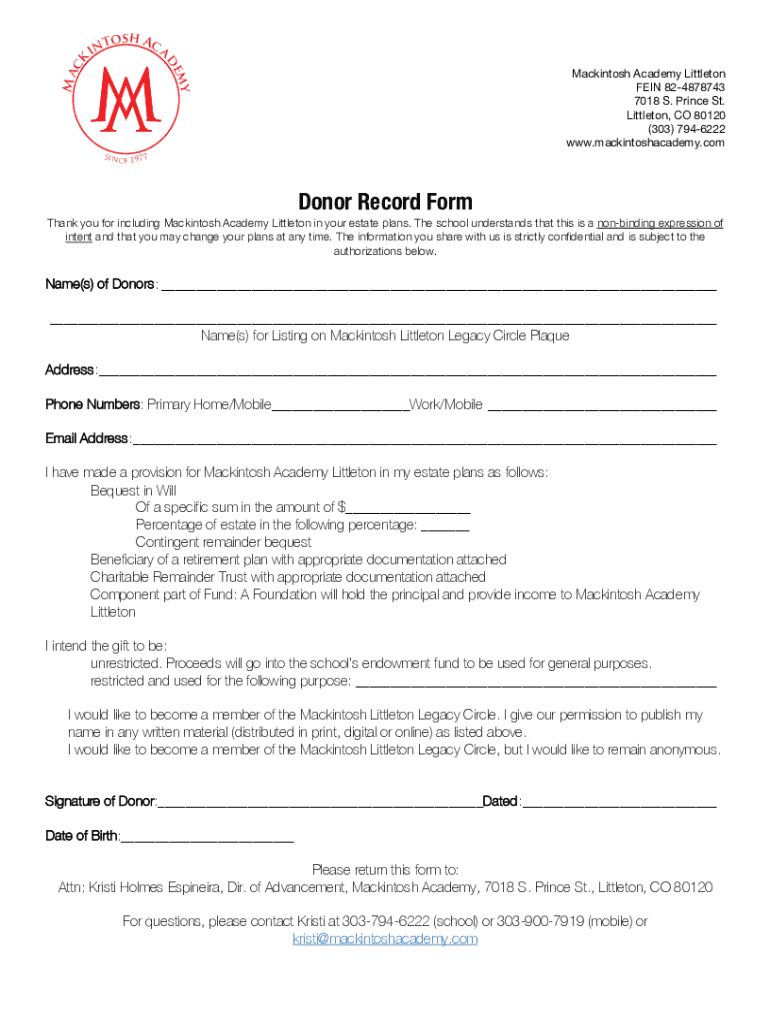

INS in slicker Academy Littleton

VEIN 824878743

7018 S. Prince St.

Littleton, CO 80120

(303) 7946222

www.mackintoshacademy.come 1977Donor Record Form

Thank you for including

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mack littleton planned giving

Edit your mack littleton planned giving form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mack littleton planned giving form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mack littleton planned giving online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mack littleton planned giving. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mack littleton planned giving

How to fill out mack littleton planned giving

01

To fill out Mack Littleton Planned Giving, follow these steps:

02

Obtain the necessary forms: You can usually find the forms on the Mack Littleton website or by contacting their planned giving department directly.

03

Review the forms: Take the time to read through the forms and understand the information they require.

04

Gather the required information: Make sure you have all the necessary information on hand, such as your personal details, assets, and desired beneficiaries.

05

Complete the forms: Fill out all the required information accurately and legibly. Double-check for any errors before submitting.

06

Seek professional advice: Consider consulting with a financial advisor or attorney who specializes in planned giving to ensure you understand the implications and benefits of your decisions.

07

Submit the forms: Once you have completed the forms and reviewed them thoroughly, submit them to the Mack Littleton planned giving department.

08

Follow up: If necessary, follow up with the department to ensure they have received your forms and to inquire about any additional steps or information needed.

09

Maintain a copy: Keep a copy of the filled-out forms for your records and reference.

Who needs mack littleton planned giving?

01

Mack Littleton Planned Giving is beneficial for individuals who:

02

- Wish to make a charitable contribution to Mack Littleton and support their mission and initiatives.

03

- Want to leave a lasting legacy by donating assets or funds to a cause they believe in.

04

- Desire to have a planned approach to charitable giving, ensuring their contributions are distributed according to their wishes.

05

- Are looking for potential tax benefits or estate planning advantages that come with planned giving.

06

- Have significant assets or wealth that they want to leverage for philanthropic purposes.

07

- Are interested in creating a charitable remainder trust, charitable lead trust, or other planned giving vehicles to maximize the impact of their contributions.

08

Overall, anyone who wants to make a meaningful and lasting charitable impact through Mack Littleton can benefit from their planned giving program.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mack littleton planned giving in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your mack littleton planned giving along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Where do I find mack littleton planned giving?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the mack littleton planned giving in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I edit mack littleton planned giving on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing mack littleton planned giving.

What is mack littleton planned giving?

Mack Littleton Planned Giving refers to a structured process in which individuals can make charitable contributions through various financial and estate planning methods, often benefiting nonprofit organizations or causes of their choice.

Who is required to file mack littleton planned giving?

Individuals who wish to document their planned gifts for tax purposes or those who are donating through a trust, will, or other legal instrument may need to file Mack Littleton Planned Giving.

How to fill out mack littleton planned giving?

To fill out Mack Littleton Planned Giving, individuals should gather relevant financial information, specify the intended charitable recipient, and complete any required forms that detail the planned gift's structure and intent.

What is the purpose of mack littleton planned giving?

The purpose of Mack Littleton Planned Giving is to enable donors to leave a lasting impact on their chosen charities while optimizing their tax benefits and ensuring that their philanthropic goals are met.

What information must be reported on mack littleton planned giving?

Information that must be reported includes donor details, description of the planned gift, valuation of the gift, intended use by the charity, and any relevant legal documentation.

Fill out your mack littleton planned giving online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mack Littleton Planned Giving is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.