Get the free AIM ISA Inheritance Tax portfolios explained: What are ...

Show details

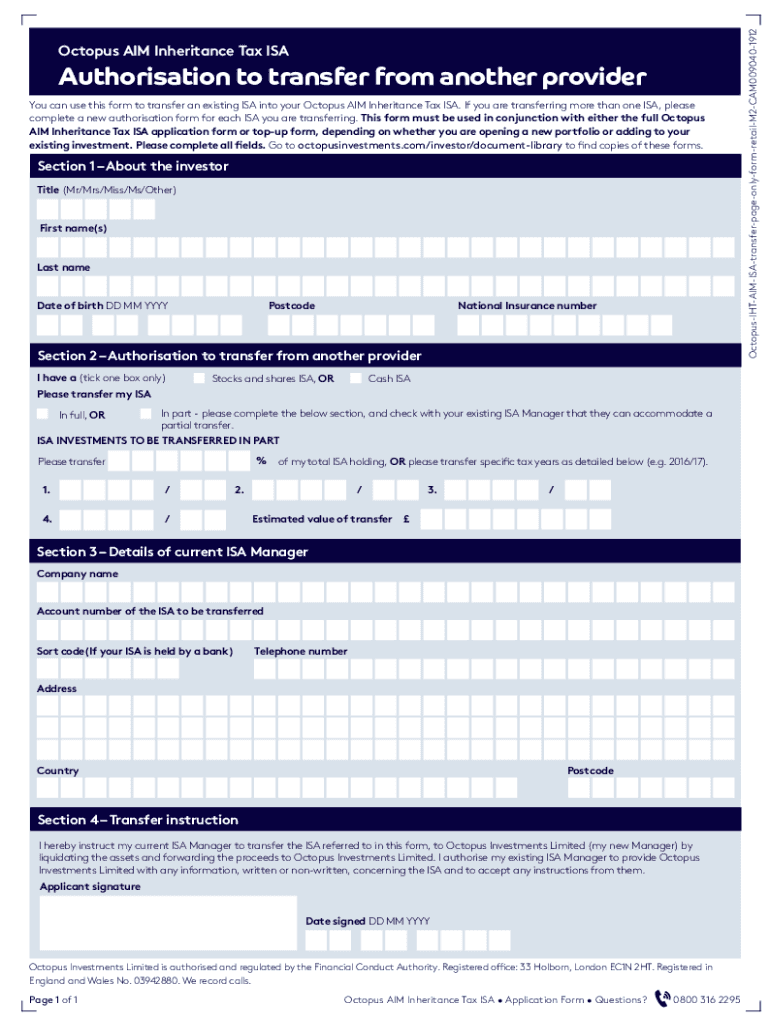

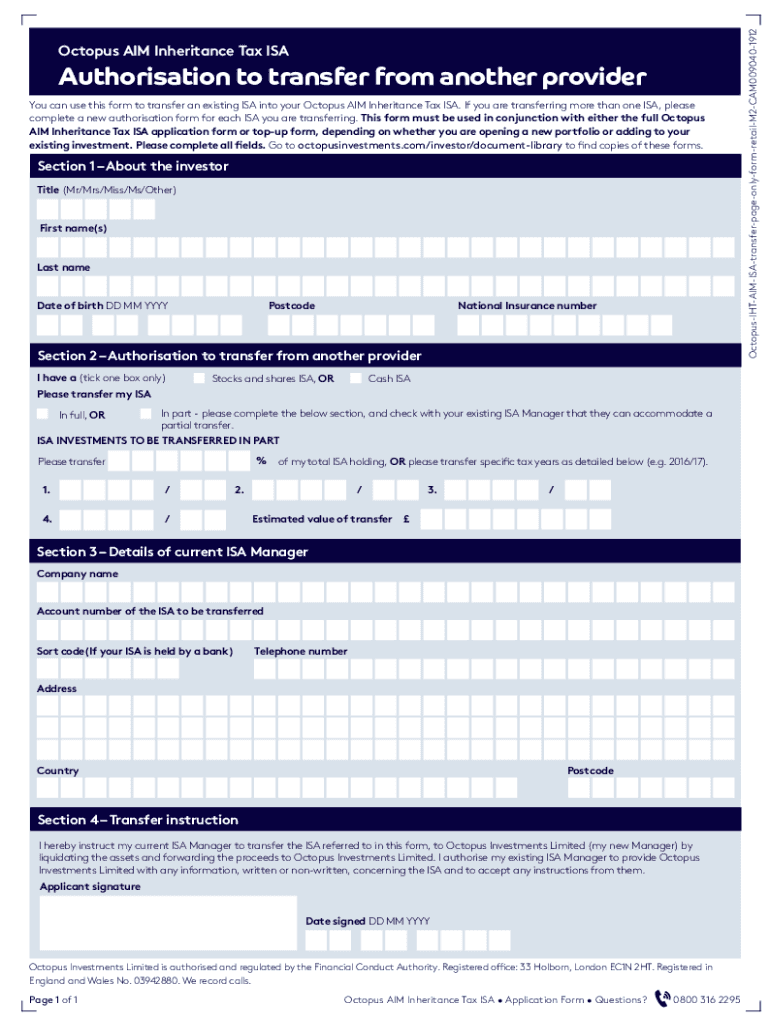

Authorization to transfer from another provider

You can use this form to transfer an existing ISA into your Octopus AIM Inheritance Tax ISA. If you are transferring more than one ISA, please

complete

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aim isa inheritance tax

Edit your aim isa inheritance tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aim isa inheritance tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing aim isa inheritance tax online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit aim isa inheritance tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aim isa inheritance tax

How to fill out aim isa inheritance tax

01

To fill out an AIM ISA inheritance tax form, follow these steps:

02

Gather all the necessary documentation, such as the deceased's will, death certificate, and any relevant financial records.

03

Determine if the deceased had an AIM ISA (Alternative Investment Market Individual Savings Account). This type of ISA allows individuals to invest in smaller, growing companies listed on the London Stock Exchange's AIM market.

04

Contact the ISA provider or financial institution managing the AIM ISA to inform them about the death and inquire about the necessary forms for inheritance tax purposes.

05

Complete the required forms provided by the ISA provider. This may include information about the deceased, the value of the AIM ISA, and details about any beneficiaries.

06

Provide any supporting documentation requested by the ISA provider, such as proof of the deceased's identity, proof of death, and proof of the value of the AIM ISA.

07

Submit the completed forms and supporting documentation to the ISA provider as instructed.

08

Await confirmation from the ISA provider regarding the inheritance tax process and any further steps or documentation required.

09

Consult with a professional tax advisor or solicitor if needed to ensure compliance with inheritance tax laws and to address any complex situations.

10

Keep copies of all submitted forms and documentation for your records.

Who needs aim isa inheritance tax?

01

People who are beneficiaries of an AIM ISA may need to be aware of the inheritance tax implications.

02

Individuals who have invested in AIM ISAs and have accumulated wealth that may be subject to inheritance tax should also be aware of the rules and regulations related to AIM ISA inheritance tax.

03

Executors of an estate may also need to deal with the AIM ISA inheritance tax if it is part of the deceased's assets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my aim isa inheritance tax in Gmail?

aim isa inheritance tax and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I fill out aim isa inheritance tax on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your aim isa inheritance tax from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I edit aim isa inheritance tax on an Android device?

You can make any changes to PDF files, like aim isa inheritance tax, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is aim isa inheritance tax?

The AIM ISA Inheritance Tax (IHT) is a tax relief scheme in the UK that allows investors in companies listed on the Alternative Investment Market (AIM) to pass on their investments free from IHT, provided that certain conditions are met.

Who is required to file aim isa inheritance tax?

Individuals who have passed away and left assets that include investments in AIM-listed companies may require the filing of IHT, especially if the value of their estate exceeds the IHT threshold.

How to fill out aim isa inheritance tax?

To fill out the aim ISA inheritance tax, you need to complete the appropriate IHT forms (such as IHT205 or IHT400) providing details of the estate, including assets, debts, and any reliefs or exemptions applicable.

What is the purpose of aim isa inheritance tax?

The purpose of the AIM ISA inheritance tax is to incentivize investment in smaller companies by providing a tax relief that enables investors to pass on their investments without incurring IHT.

What information must be reported on aim isa inheritance tax?

Information that must be reported includes the deceased's personal details, details of all assets and liabilities, any special reliefs claimed, and specifically, the value of AIM investments.

Fill out your aim isa inheritance tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aim Isa Inheritance Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.