Get the free Mutual Funds India - Quant Fund, Quant Investments, Quant AMC

Show details

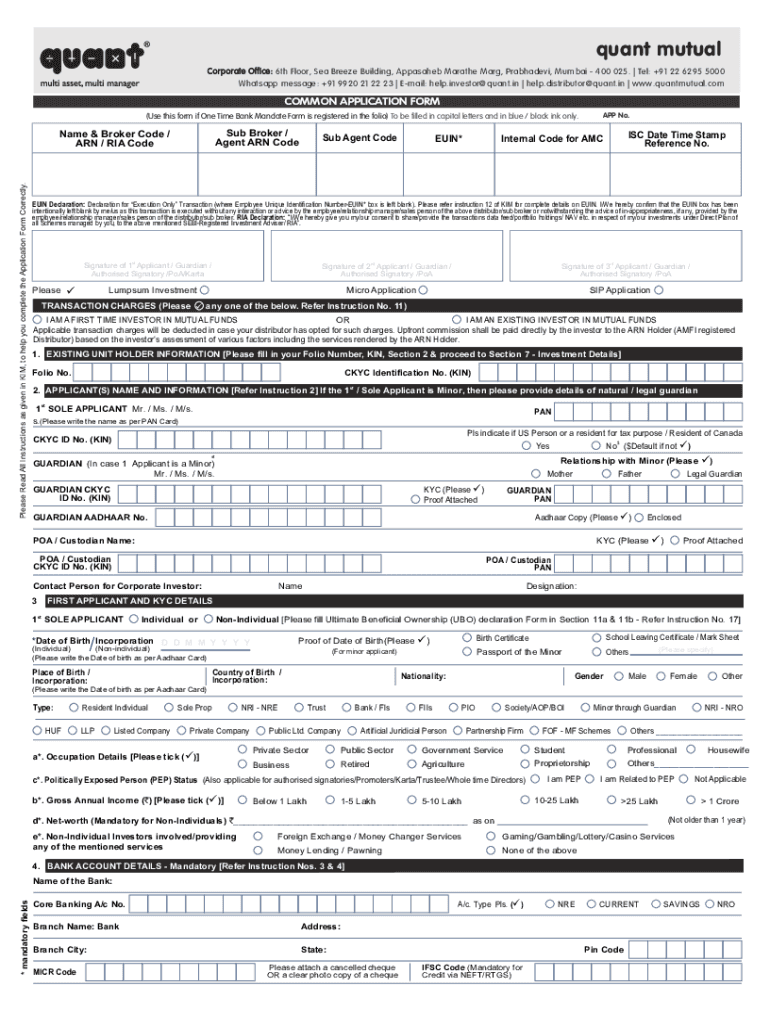

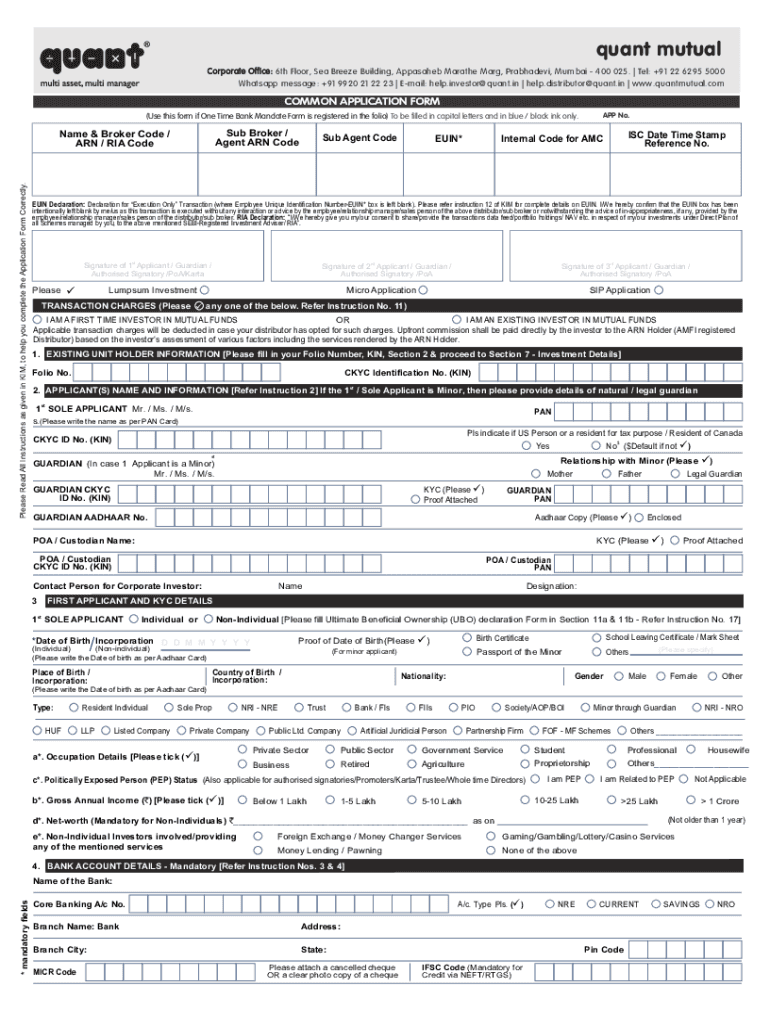

Quaint mutual Corporate Office: 6th Floor, Sea Breeze Building, Appasaheb Marathi Mary, Prabhavati, Mumbai 400 025. Tel: +91 22 6295 5000 WhatsApp message: +91 9920 21 22 23 Email: help. Investor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mutual funds india

Edit your mutual funds india form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mutual funds india form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mutual funds india online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mutual funds india. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mutual funds india

How to fill out mutual funds india

01

To fill out mutual funds in India, follow these steps:

02

Research various mutual fund options available in India.

03

Determine your investment goals and risk tolerance.

04

Choose a mutual fund that aligns with your investment objectives.

05

Obtain the application form from the mutual fund company or download it from their website.

06

Fill out the application form with accurate personal and financial information.

07

Attach the necessary supporting documents, such as PAN card, address proof, and identity proof.

08

Specify the investment amount and the mode of payment.

09

Review the filled-out application form and supporting documents for accuracy.

10

Submit the completed application form along with the required documents to the mutual fund company.

11

Keep a copy of the filled-out form and documents for your reference.

12

Wait for the acknowledgment receipt or confirmation from the mutual fund company.

13

Monitor your mutual fund investments regularly and make any necessary adjustments.

Who needs mutual funds india?

01

Anyone who wants to invest in a diversified portfolio of securities and assets can benefit from mutual funds in India.

02

Mutual funds offer an opportunity for individuals, families, and organizations to participate in the financial markets without the need for extensive knowledge or expertise.

03

People who want to achieve long-term financial goals, such as retirement planning, wealth creation, or funding higher education, can find mutual funds useful.

04

Investors who prefer professional management of their funds and the ability to choose from a wide range of investment options can opt for mutual funds.

05

Whether you are a beginner or an experienced investor, mutual funds provide a convenient and flexible way to invest in India's equity markets, debt instruments, and other assets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit mutual funds india in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your mutual funds india, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit mutual funds india on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit mutual funds india.

How do I edit mutual funds india on an Android device?

You can make any changes to PDF files, like mutual funds india, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is mutual funds india?

Mutual funds in India are investment programs funded by shareholders that trade in diversified holdings and are professionally managed. They pool money from multiple investors to invest in securities like stocks, bonds, and money market instruments.

Who is required to file mutual funds india?

Individuals and entities that have made investments in mutual funds are typically required to file relevant tax returns and disclosures related to their mutual fund gains.

How to fill out mutual funds india?

To fill out mutual fund forms in India, investors need to provide details such as their name, PAN (Permanent Account Number), investment amount, scheme name, and other personal information as required in the application form.

What is the purpose of mutual funds india?

The primary purpose of mutual funds in India is to provide a structured investment vehicle for individual investors that allows them to participate in the equity and debt markets with professional management.

What information must be reported on mutual funds india?

Investors must report details such as the amount invested, gains or losses incurred, dividend received, and overall portfolio value during tax filing to comply with regulatory requirements.

Fill out your mutual funds india online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mutual Funds India is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.