Get the free Mutual Funds India Investment Plans Tax Saving Mutual ...

Show details

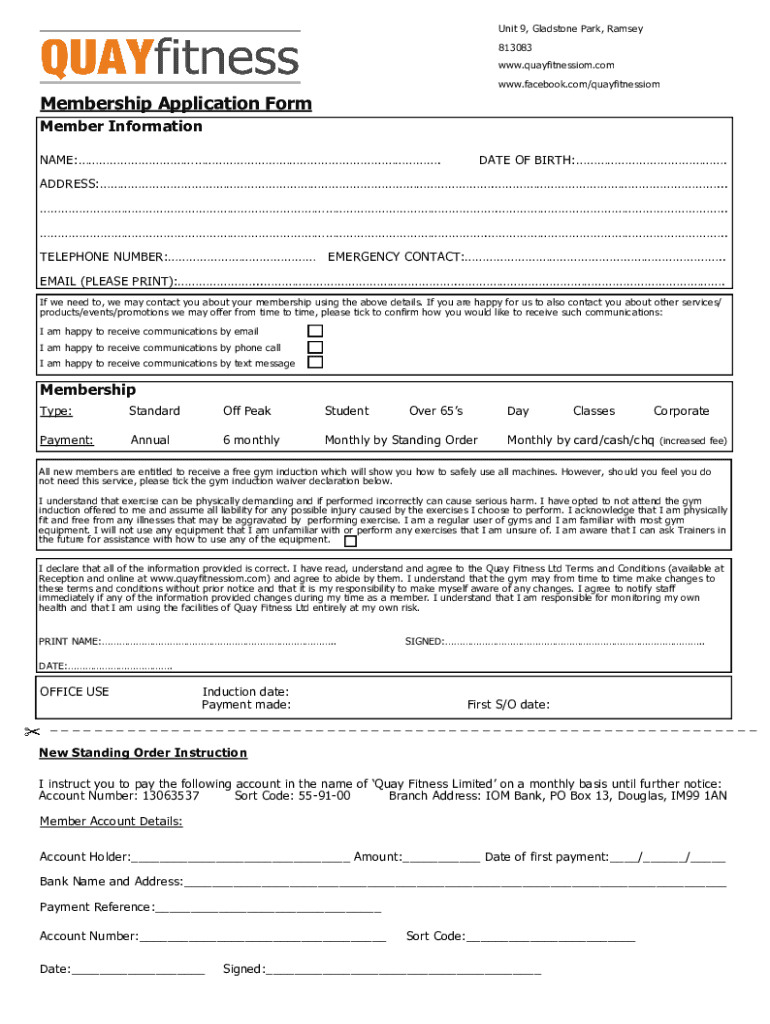

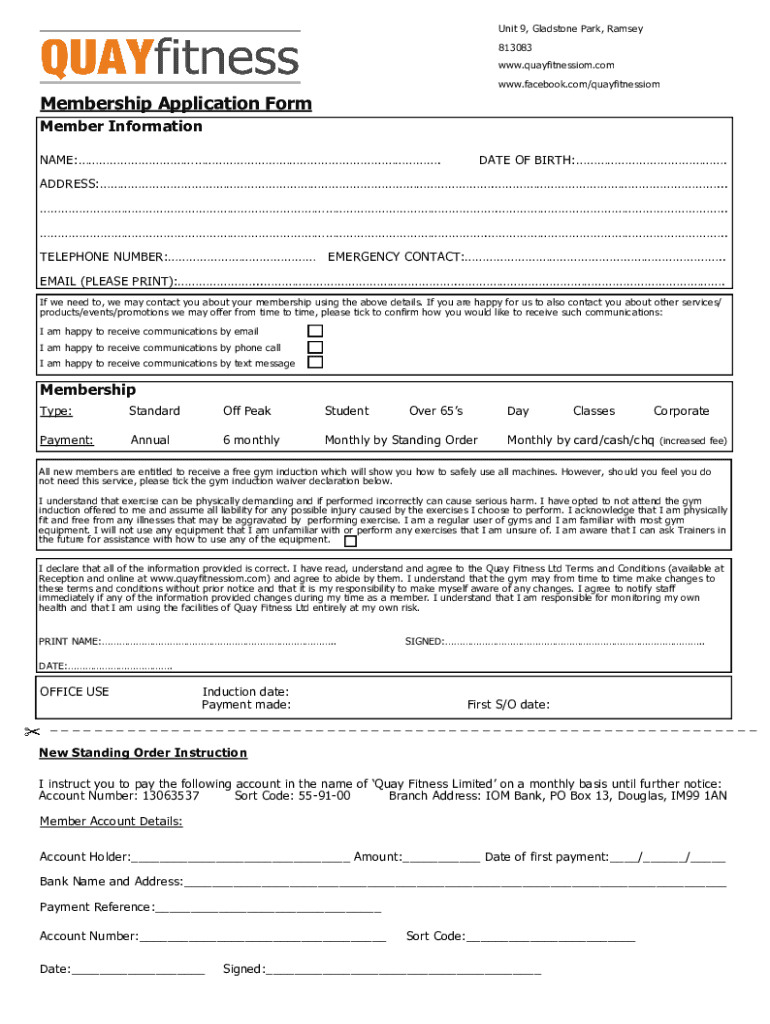

Unit 9, Gladstone Park, Ramsey 813083 www.quayfitnessiom.com www.facebook.com/quayfitnessiomMembership Application Form Member Information NAME:.DATE OF BIRTH:.ADDRESS:....

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mutual funds india investment

Edit your mutual funds india investment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mutual funds india investment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mutual funds india investment online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mutual funds india investment. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mutual funds india investment

How to fill out mutual funds india investment

01

To fill out mutual funds India investment, follow these steps:

02

Research and choose a mutual fund: Start by understanding the different types of mutual funds available in India and consider factors such as investment objectives, risk tolerance, and past performance.

03

Complete the necessary documentation: Fill out the mutual fund application form provided by the chosen fund house. You will need to provide details such as your personal information, bank account details, and investment amount.

04

KYC compliance: Ensure you are KYC (Know Your Customer) compliant by submitting the required documents like identity proof, address proof, and PAN card.

05

Select the investment mode: Choose between lump sum investment or systematic investment plan (SIP) based on your preferences and financial goals.

06

Submit the application: Attach the necessary documents, including a copy of your PAN card and any additional requirements specified by the fund house. Submit the filled-out application to the nearest branch office or through the online portal of the mutual fund provider.

07

Make the payment: If investing through a lump sum, make a cheque or demand draft payable to the respective mutual fund scheme. For SIP, set up an auto-debit mandate from your bank account.

08

Track your investments: Once your investment is made, keep track of its performance and periodically review your investment strategy.

09

Stay updated: Stay updated with the latest information about the mutual fund industry, market trends, and any changes in regulations that may impact your investment.

10

Note: It is recommended to consult a financial advisor before making any investment decisions.

Who needs mutual funds india investment?

01

Mutual funds India investment is suitable for the following individuals:

02

Individuals looking for professional fund management: Mutual funds are managed by experienced professionals who actively monitor the market and make investment decisions on behalf of investors.

03

Investors with different risk profiles: Mutual funds offer a wide range of investment options, from low-risk debt funds to high-risk equity funds, catering to investors with different risk appetites.

04

Individuals with long-term financial goals: Mutual funds are ideal for individuals looking to achieve long-term financial goals such as retirement planning, children's education, or buying a house.

05

Investors seeking diversification: Mutual funds pool money from multiple investors and invest in a diversified portfolio of assets. This helps in reducing the risk associated with investing in a single stock or bond.

06

Individuals lacking expertise and time for investment: Mutual funds provide an easy and convenient way for individuals to invest in various asset classes without requiring expertise or spending significant time on portfolio management.

07

Investors looking for liquidity: Mutual funds allow investors to redeem their units based on the prevailing Net Asset Value (NAV) and thus provide liquidity compared to other investments such as fixed deposits or real estate.

08

Individuals seeking tax efficiency: Certain mutual funds like Equity Linked Savings Schemes (ELSS) offer tax benefits under Section 80C of the Income Tax Act, making them attractive for individuals looking to reduce their tax liability.

09

Note: It is important to assess your financial goals, risk tolerance, and investment horizon before investing in mutual funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify mutual funds india investment without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including mutual funds india investment. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I get mutual funds india investment?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific mutual funds india investment and other forms. Find the template you want and tweak it with powerful editing tools.

Can I edit mutual funds india investment on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share mutual funds india investment on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is mutual funds india investment?

Mutual funds in India are investment vehicles that pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities managed by professional fund managers.

Who is required to file mutual funds india investment?

Individuals and entities investing in mutual funds who have taxable income are required to file their mutual fund investments for tax purposes.

How to fill out mutual funds india investment?

To fill out mutual fund investments, investors must provide information such as their personal details, investment amount, and select the type of mutual fund, and submit the application to the fund house or online platform.

What is the purpose of mutual funds india investment?

The purpose of mutual fund investments is to allow investors to grow their wealth by gaining exposure to a diversified portfolio managed by professionals, while also providing liquidity and convenience.

What information must be reported on mutual funds india investment?

Investors must report details such as the amount invested, the capital gains or losses from the investment, and any income derived from the mutual fund, like dividends or interest.

Fill out your mutual funds india investment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mutual Funds India Investment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.