Get the free Nontaxable Corporate Reorganization - Merger

Show details

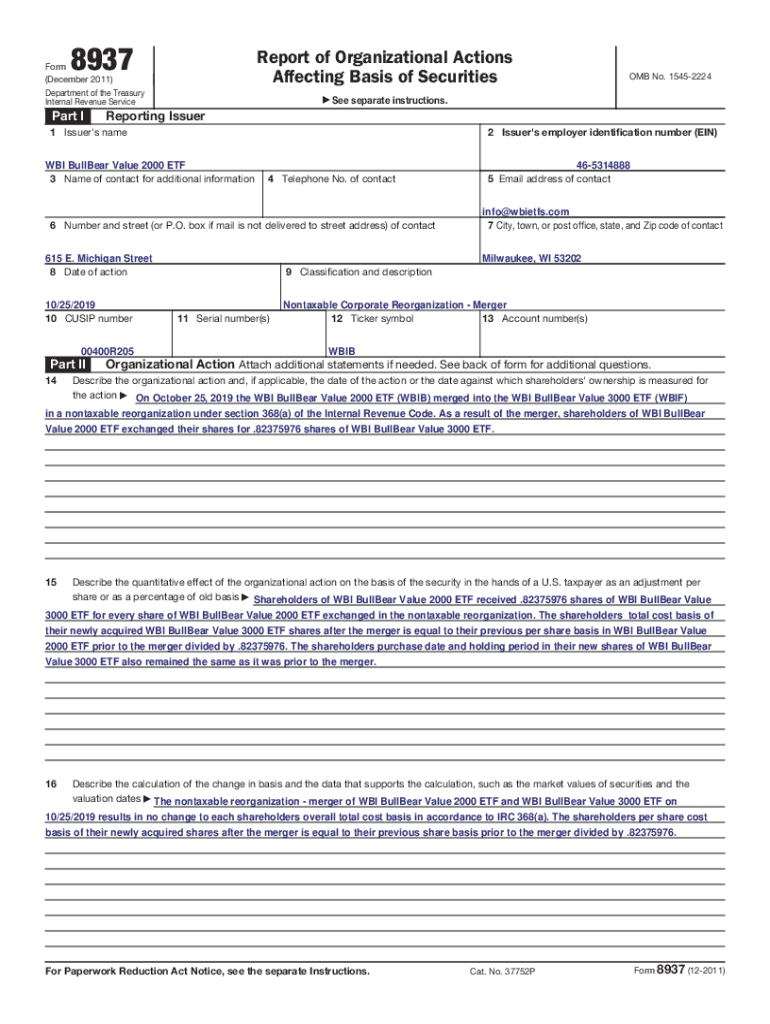

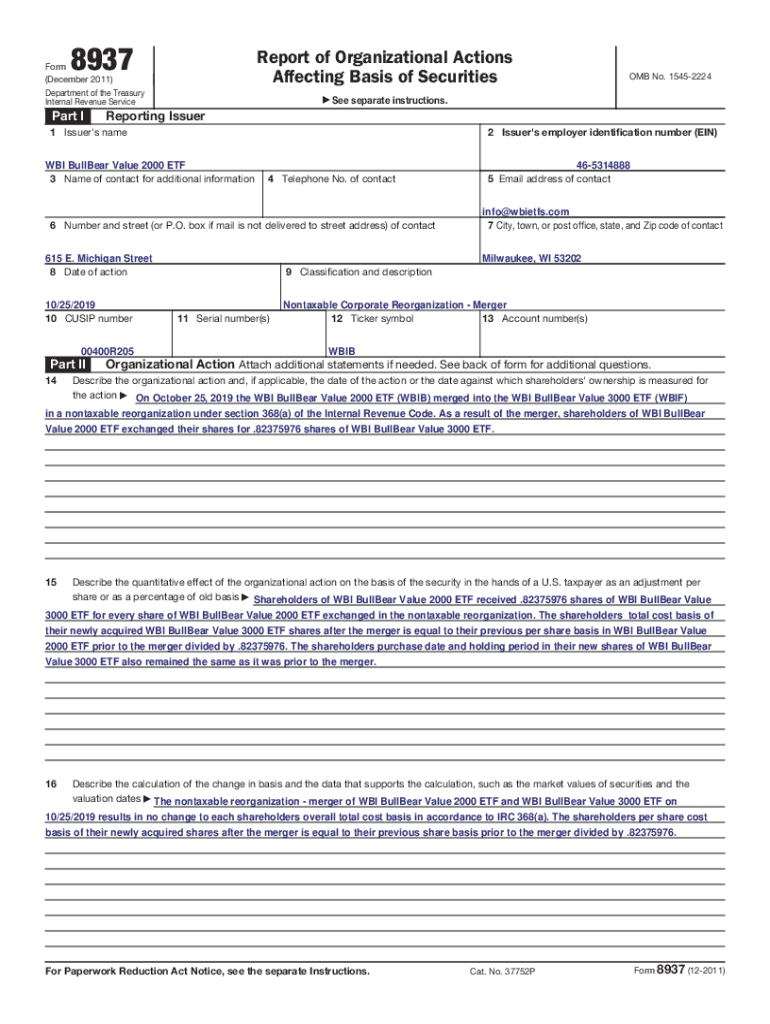

8937Report of Organizational Actions

Affecting Basis of SecuritiesForm

(December 2011)

Department of the Treasury

Internal Revenue Serviceman Ia See separate instructions. Reporting Issuer1 Issuer\'s

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nontaxable corporate reorganization

Edit your nontaxable corporate reorganization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nontaxable corporate reorganization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nontaxable corporate reorganization online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nontaxable corporate reorganization. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nontaxable corporate reorganization

How to fill out nontaxable corporate reorganization

01

Identify the type of corporate reorganization you are planning to undertake. This could include mergers, acquisitions, or spin-offs.

02

Consult legal and tax professionals to ensure compliance with relevant laws and regulations.

03

Gather all necessary documentation, including financial statements, corporate bylaws, and any relevant contracts or agreements.

04

Prepare the necessary tax forms required for the nontaxable corporate reorganization, such as Form 8832 or Form 8823.

05

Fill out the tax forms accurately and completely, providing all required information.

06

Review the completed forms for any errors or omissions and make necessary corrections.

07

Submit the filled forms to the appropriate tax authorities within the specified time frame.

08

Keep copies of all documents and forms for future reference and auditing purposes.

09

Monitor any updates or changes in tax laws or regulations that may affect the nontaxable corporate reorganization.

10

Stay in compliance with ongoing reporting and disclosure requirements after the reorganization is completed.

Who needs nontaxable corporate reorganization?

01

Companies or organizations that are planning to undergo significant structural changes, such as mergers, acquisitions, or spin-offs, may need to consider a nontaxable corporate reorganization.

02

Individuals or entities seeking to minimize tax implications and avoid taxable transactions may also benefit from utilizing a nontaxable corporate reorganization.

03

Businesses that want to consolidate or streamline their operations by merging with another company or separating certain business units may find nontaxable corporate reorganization advantageous.

04

Startups or small businesses looking to attract investors or raise capital through a reorganization may choose to pursue a nontaxable corporate reorganization to maintain favorable tax treatment.

05

Companies involved in cross-border transactions or international expansion may also consider nontaxable corporate reorganization to manage and optimize their tax liabilities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit nontaxable corporate reorganization from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your nontaxable corporate reorganization into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I sign the nontaxable corporate reorganization electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your nontaxable corporate reorganization in minutes.

How do I fill out the nontaxable corporate reorganization form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign nontaxable corporate reorganization and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is nontaxable corporate reorganization?

Nontaxable corporate reorganization refers to specific types of business restructurings that allow companies to reorganize their corporate structures without incurring immediate tax liabilities. This typically includes mergers, consolidations, and certain transfers of assets.

Who is required to file nontaxable corporate reorganization?

Corporations involved in a nontaxable reorganization must file the necessary forms, including filings for both the acquiring and target companies involved in the transaction.

How to fill out nontaxable corporate reorganization?

To fill out nontaxable corporate reorganization forms, corporations need to provide detailed information about the transaction, including the type of reorganization, the parties involved, and any stock or assets exchanged.

What is the purpose of nontaxable corporate reorganization?

The primary purpose of nontaxable corporate reorganization is to facilitate business consolidations and restructuring without triggering immediate tax consequences, thus enabling companies to focus on integration and future growth.

What information must be reported on nontaxable corporate reorganization?

Companies must report details such as the nature of the reorganization, identification of the parties, fair market values of the assets exchanged, and any stock involved in the transaction.

Fill out your nontaxable corporate reorganization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nontaxable Corporate Reorganization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.